Compare our accounts

We offer a dedicated spread betting and CFD trading account, as well as a corporate account. See the table below to find out which account is best suited for you based on your trading requirements.

Spread betting

Spread betting is a tax-efficient1 way of speculating on the price movement of global financial instruments.

- 12,000+ instruments across indices, forex, shares, commodities, cryptos and more

- Trade with leverage from 3.3%*

- CMC web platform, iOS and Android app

- Tax-free profits1

CFD trading

CFDs are derivative product which enables you to trade on the price movement of underlying financial assets, with no stamp duty on profits1.

- 12,000+ instruments across indices, forex, shares, commodities, cryptos and more

- Trade with leverage from 3.3%*

- CMC web platform, iOS and Android app

- MT4 platform available

- Pay no stamp duty on CFD trading profits1

Corporate account

Our corporate account offers access to a CFD trading account for your business, to trade on the movements of underlying financial assets.

- 12,000+ instruments across indices, forex, shares, commodities, cryptos and more

- Trade with leverage from 3.3%*

- CMC web platform, iOS and Android app

- MT4 platform available

- 24/5 UK-based customer support

*Please note that leverage amplifies profits and losses equally.

Account comparison

Account features

Take a position on rising and falling markets

Yes

Yes

Yes

Stamp duty payable

No

No

No

Capital gains tax payable

No1

Yes

Yes

Minimum deposit

€0

€0

€0

Instruments available

12,000+

12,000+

12,000+

80+

80+

80+

300+

300+

300+

10,000+

10,000+

10,000+

1,000+

1,000+

1,000+

100+

100+

100+

40

40

40

34

34

34

50+

50+

50+

Maximum leverage (professional clients)

200:1

200:1

200:1

Maximum leverage (retail clients)

30:1

30:1

30:1

Trade size

€ per point

Number of units/Notional value

Number of units/Notional value

Fractional trade sizes

Yes

Yes

Yes

Costs

Spreads from

0.2 points

0.2 points

0.2 points

Commissions

No

Yes (shares and ETFs only)

Yes (shares and ETFs only)

Minimum commissions

No

Yes (shares and ETFs only)

Yes (shares and ETFs only)

Holding costs if held overnight

Yes

Yes

Yes

Market data fees

No

Yes

Yes

GSLO premium

Yes (100% refund if not triggered)

Yes (100% refund if not triggered)

Yes (100% refund if not triggered)

Account maintenance fees

No

No

No

Additional key features

Cash rebates

Yes (professional clients only)

Yes (professional clients only)

Yes (professional clients only)

Demo account

Yes

Yes

Yes

Negative balance protection

Yes

Yes

Yes

Order boundaries

Yes

Yes

Yes

Account netting

Yes

Yes

Yes

Accurately hedge a physical position

No

Yes

Yes

Price depth ladder

Yes

Yes

Yes

Account currency

GBP and EUR

EUR und USD

EUR und USD

Telephone trading

Yes

Yes

Yes

Support during market hours

Yes

Yes

Yes

Free with your account

Education, seminars & webinars

Yes

Yes

Yes

CMC market analyst 'Insights'

Yes

Yes

Yes

Market calendar

Yes

Yes

Yes

Reuters News2

Yes, Live account only

Yes, Live account only

Yes, Live account only

Morningstar quantitative equity research reports2

Yes, Live account only

Yes, Live account only

Yes, Live account only

Client sentiment

Yes

Yes

Yes

Pattern recognition scanner

Yes

Yes

Yes

Platform features

Order execution types

- Market, limit and stop entry orders (ability to set expiry)

- Guaranteed stop-loss orders

- Regular stop-loss orders

- Trailing stop-loss orders

- Take-profit orders

Advanced order management

- Trade from charts

- Boundary orders (to help prevent slippage)

- Enable/disable account netting (ability to go long and short on the same instrument at the same time)

- Tiered margins

- Trade using unrealised profit

- Custom stop order triggering (specify stops to trigger off buy, mid or sell price)

- Price depth for larger trade sizes

- One-click trading, partially close open trades

- Auto rollover forward positions (with reduced spread); and a range of default order setting options to make placing a trade as quick and as simple as possible

Account close-out methods

- Standard close-out

- Last in first out

- Largest position loss first

- Largest position margin first

Charting tools

- Free charting package with 80+ technical indicators and drawing tools

- Intervals from one second, multiple chart presets

- Autosave analysis

- Trade from charts

- Automatic pattern recognition

- Comparison charts, 10 chart types

- Chart forum and advanced mobile charts

Layout management

- Save up to five custom layouts

- Multiscreen support

- Small or large platform resolution

- Easily switch between multiple accounts (demo, live, CFD, spread betting)

- Autosave platform changes, easily load or change module instruments using our quick search options

- Snap modules to grid and fast platform navigation with our module-linking feature

Trading tools

- Comprehensive instrument overviews

- Market calendar

- Price alerts

- Client sentiment (minute by minute updates)

- Morningstar quantitative equity research reports2

- Reuters news2

- CMC market analysts' 'Insights' feature

- Statement centre

- Price ticker

- CMC TV

- CMC Twitter feed

Mobile trading

- Advanced mobile apps for iPhone

- iPad and Android (tablet and phone)

- Our apps include our complete range of order types

- Advanced charting

- Intelligent watchlists

- Client sentiment

- Market calendar

- Reuters news2

- CMC market analysts' 'Insights' feature

- Real-time alerts

- Customisable home screen and swipe login for quicker access to your account

Alerts available

- Price

- Order execution

- Market calendar & completed chart pattern

Spread betting

CFD trading

Corporate account

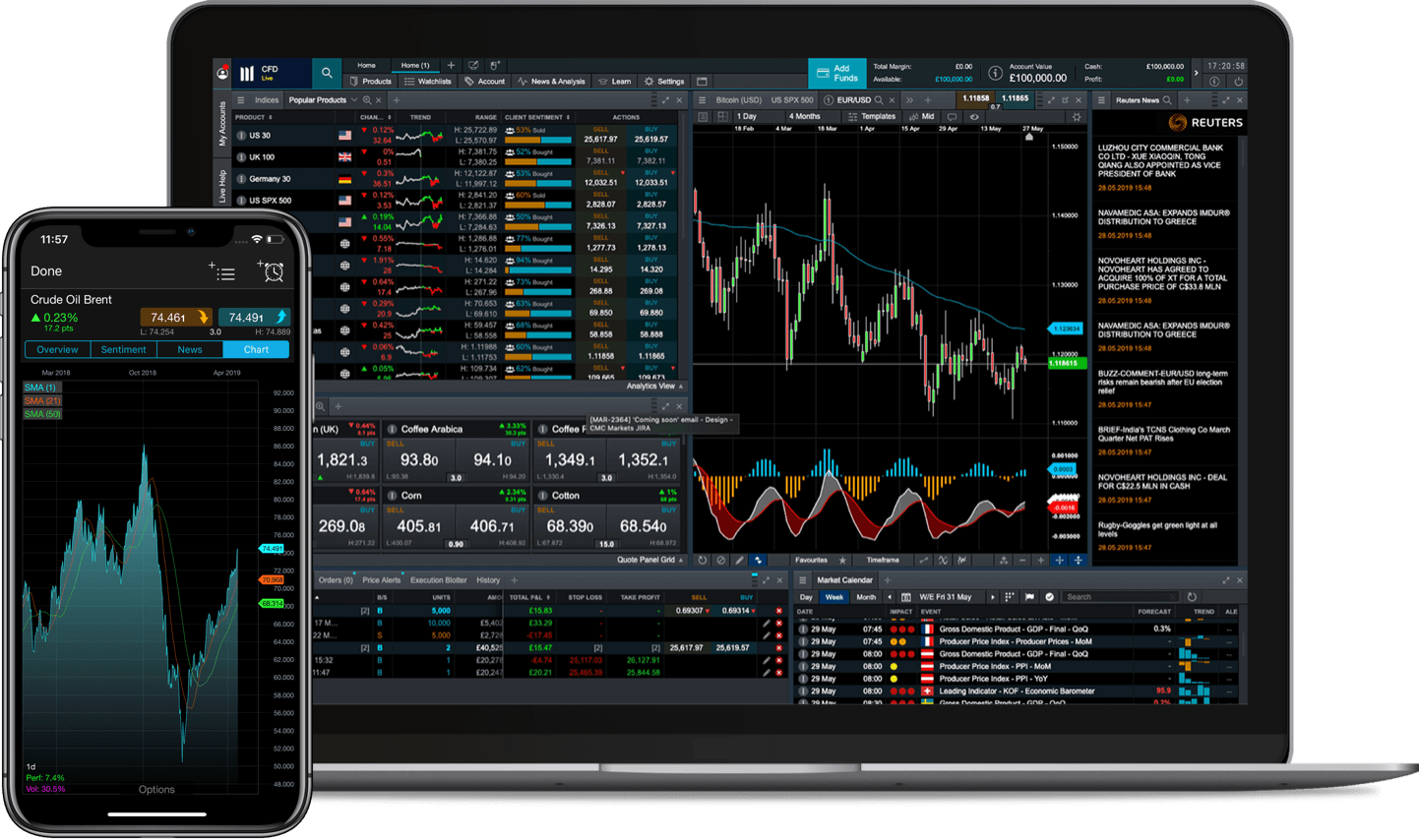

Powerful trading on the move

Packed with advanced features, yet intuitive and available to everyone; whatever the next step in your trading journey is, our platform is ready to help you get there.

FAQs

Account specifications FAQs

How many types of trading accounts are there?

We offer spread betting and CFD trading accounts in the UK and Ireland, available as a standard retail account for all traders. We also offer an Alpha account, which is tailored to premium retail clients; and a CMC Pro account, which is specifically for professional traders. We also offer an institutional account for businesses.

What is the difference between a spread betting and CFD trading account?

Spread betting and CFDs are derivative products that allow you to speculate on the price movements of financial assets without taking ownership. The main difference between the two accounts is how they are taxed. Learn more about each product in our spread betting versus CFDs guide. For more information, read our articles on spread betting explained and CFDs explained.

What is the maximum leverage I can trade with?

For retail clients, the maximum leverage you can currently trade with is 30:1 (or 3.3% margin) for our spread betting and CFD trading accounts. Read more about trading with leverage.

Can I open a demo account?

You can open a demo account with us, which enables you to practise trading with virtual funds starting at €10,000. Choose between a spread betting demo account or a CFD trading demo account.

What is the minimum deposit required to open an account?

There is no minimum deposit required to open an account with us. However, you won’t be able to place a trade until there are sufficient funds to cover your position. Learn how to fund your online account through our dedicated FAQs section.

What is included in a trading account?

When you open a spread betting or CFD trading account, you'll have access to a multitude of technical and fundamental analysis tools, as well as trading indicators, draw tools and other charting features. Please note that some of these are only available with a live account. Learn more about our platform by watching our trading tutorials.

Which markets can I trade?

You can spread bet or trade CFDs on more than 12,000 financial instruments with us, and speculate on the price movements of forex, indices, commodities, shares, share baskets, ETFs, cryptocurrencies, and treasuries. Browse our range of markets.

Which types of expenses are shown in my account?

When you open a trading account, you may incur expenses which include the following: spreads, share commissions (CFDs only), overnight holding costs, market data fees (CFDs only) and GSLO premiums. See our trading costs page for an overview of expenses.

What is the most popular type of trading account at CMC Markets?

Our most popular account type is a spread betting account for retail traders. Spread betting allows you to speculate on the financial markets tax-free1 in the UK and Ireland. Open a spread betting account to get started.

New to CMC Markets?

Is it free to open an account?

There's no cost when opening a live spread betting or CFD trading account. You can also view prices and use tools such as charts, Reuters news or Morningstar quantitative equity reports2, free of charge. However, you will need to deposit funds in your account to place a trade. Find out more about the costs of placing a trade.

Is CMC Markets regulated?

CMC Markets Germany GmbH is a company authorised and regulated by the German Federal Financial Supervisory Authority (BaFin). CMC Markets complies with the requirements of §84 of the German Securities Trading Act (WpHG) regarding client funds

How does CMC Markets protect my money?

CMC Markets Germany GmbH is a broker regulated by the German Federal Financial Supervisory Authority (BaFin). It holds funds of private clients separately from its own funds in separate bank accounts. In the unlikely event that CMC Markets Germany GmbH is unable to meet its financial obligations, the EdW would cover any claim for damages by claimants up to EUR 20,000, provided that certain criteria are met.

How does CMC Markets make money?

Our income primarily comes from our spreads, while other fees, such as overnight holding costs, make a minor contribution to our overall revenue. We never aim to profit from our clients' losses. Our aim is to build long-term relationships, by providing the best possible trading experience through our technology and customer service.

What markets can I trade with CMC?

With your CMC Markets account, you gain access to over 12,000 instruments via spread betting and CFD trading. For more information, view our range of markets.