Cryptocurrency trading

Trade on popular cryptocurrencies with leverage, from Bitcoin and Ethereum to Dogecoin and Solana, on our award-winning spread betting and CFD platform1. With tight spreads, lightning-fast execution2 and dedicated customer support 24/5.

Search instruments:

More than a cryptocurrency trading platform

Precision pricing

We aggregate pricing from 18 different feeds to get you a more accurate price.

Minimal slippage

With fully automated, lightning-fast execution in 0.004 seconds2.

No partial fills

And no dealer intervention, regardless of your trading size.

Dedicated customer service

Experienced support 24/5, whenever you're trading.

Take a view across our full range, top or emerging cryptocurrencies with a single trade.

Tax-free spread betting

Pay no capital gains tax on profits from cryptocurrency spread bets3.

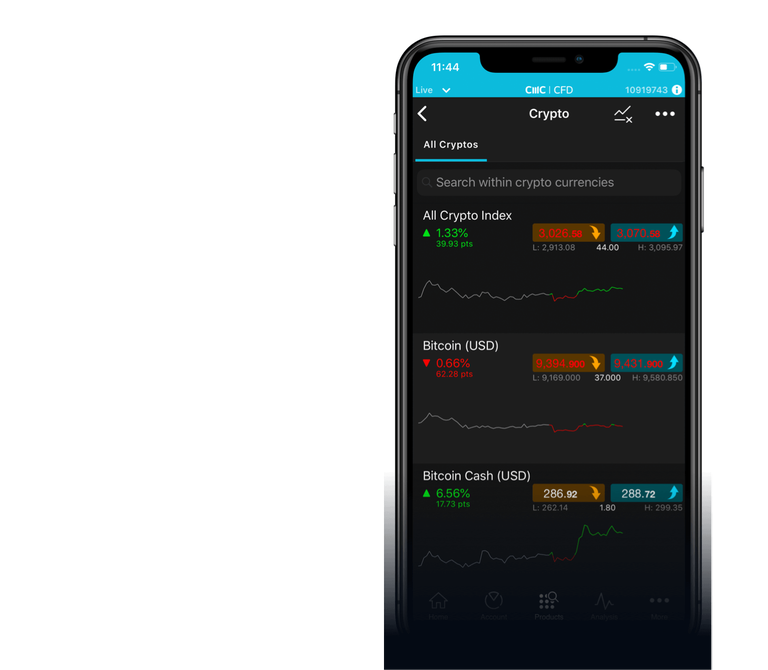

40 major and alt coins

Get exposure to volatility on favourites like Bitcoin and Ethereum, as well as alt coins like Polygon with spreads from as low as 0.65 points.

Other popular cryptocurrencies

Pricing is indicative. Past performance is not a reliable indicator of future results.

See our cryptocurrency costs

Whatever you trade, costs matter. We’re committed to keeping our costs as competitive as possible, whether you trade on Bitcoin, Solana, Ethereum or our cryptocurrency indices.

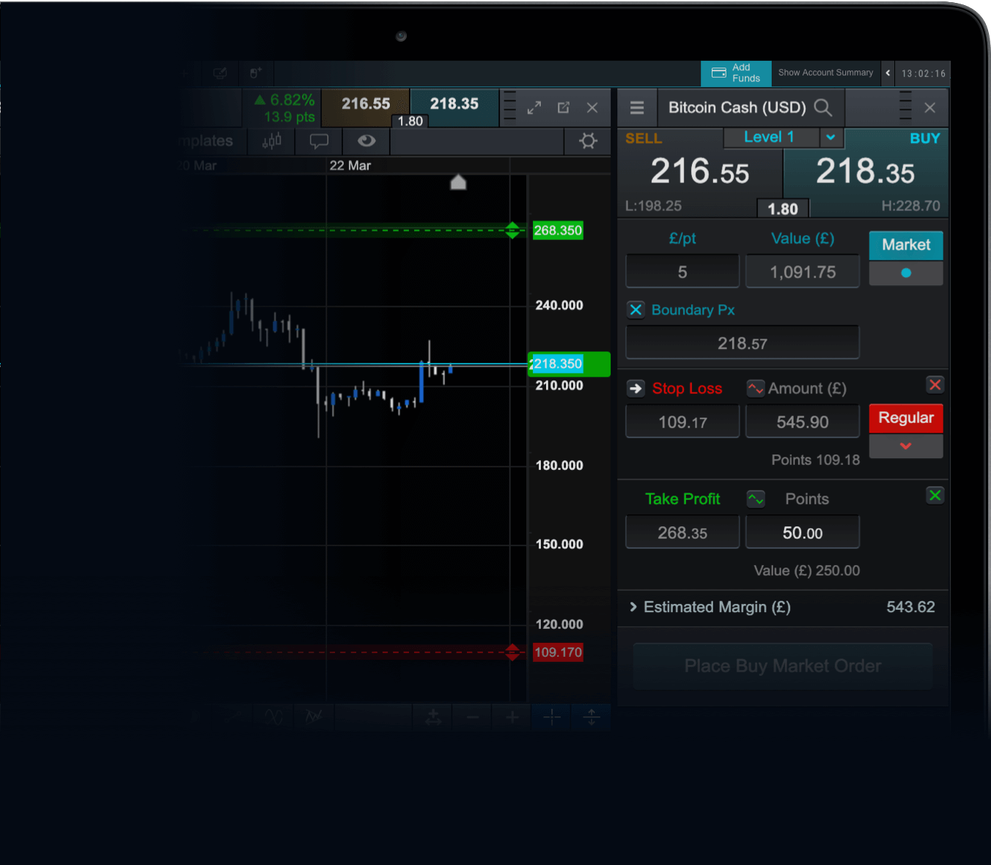

The platform built for crypto trading

Fast execution2, exclusive insights and accurate signals are vital to your success as a cryptocurrency trader. Our award-winning trading platform1 was built with the successful trader in mind.

Advanced order execution

We offer a range of advanced order types, including trailing and guaranteed stop losses, partial closure, market orders and boundary orders on every trade, so you have the flexibility to trade your way.

Client sentiment

Our client sentiment tool shows you where the market is bullish and where it’s bearish, based on real-time trades. Identify trends based on how that sentiment changes over time across our whole client base or just our top traders.

Award-winning app1

With full order ticket functionality, mobile-optimised charting and over 40 technical indicators and drawing tools.

Industry-leading charting1

Analyse the markets with our wide selection of over 115 indicators and drawing tools, 70 chart patterns and 12 chart types.

Increase your exposure to the cryptocurrency market

EXCLUSIVE TO CMC

Expecting big things from crypto? We’ve grouped different cryptocurrencies together in order to create three new crypto baskets, allowing you to trade on multiple cryptos with a single position.

Why experienced traders choose CMC

For over 35 years, we have been committed to developing the most intuitive and sophisticated trading platform for ambitious spread bet and CFD traders. This, combined with our competitive spreads, advanced trading tools and 24/5 customer support, makes CMC Markets the home for dedicated traders.

Competitive fees

Spread bet or trade CFDs on popular cryptos with our competitive spreads.

Award-winning broker

Our trading platform, charting tools, in-house analysts and more frequently receive awards from numerous independent bodies1.

24/5 customer support

Our dedicated support team are available around the clock, from Sunday night through to Friday evening. So whenever you are trading, we are here to help.

Authorised and regulated in the EU

CMC Markets Germany GmbH is regulated by the German Federal Finacial Supervisory Authority (BaFin) under registration number 154814.

World-class platform

Our powerful and intuitive platform boasts a huge range of charting features, tools, order settings and analysis functions, so you can always stay a step ahead.

Exclusive analyses

Our award-winning in-house analysts deliver daily market commentaries and insights on important market movements, straight to your device via push message.