Index trading

Trade with leverage on over 80 cash and forward indices based on the FTSE and more, via our award-winning spread betting and CFD trading platform1. Enjoy tight spreads, lightning-fast execution2, and 24/5 support from our experienced customer service team.

Licensed and regulated in the EU

35 years' expertise

Search instruments:

More than just a trading platform

Your favourites in one place

Trade on indices based on the FTSE 100, plus dozens of other global markets.

Trade out of hours

Popular indices like the UK 100 and US 30 trade 24/5, so you don’t have to stop when the markets do.

No partial fills

All orders are fully executed without dealer intervention, regardless of your trading size.

Precision pricing

We combine multiple feeds from tier-one banks, to get you the most accurate bid/ask price.

Dedicated client service

Our experienced customer service team are online 24/5, whenever you need them.

Exclusive products

Get broader access to the market in a single position with our exclusive share baskets.

Trade on over 80 indices

Get exposure to global equity markets by spread betting or trading CFDs on indices based on the FTSE and more, as well as regional indices including Australia, Asia-Pacific, US and Europe.

Other popular instruments

Pricing is indicative. Past performance is not a reliable indicator of future results.

See our index costs

Whatever you trade, costs matter. We’re committed to keeping our costs as competitive and transparent as possible, whether you trade on UK, US, European, or Asian indices.

EXCLUSIVE TO CMC

Looking for an opportunity? We’ve analysed the trends driving the market and grouped shares into topical buckets like Driverless Cars or Renewable Energy, to allow you to trade across a trending theme with a single position.

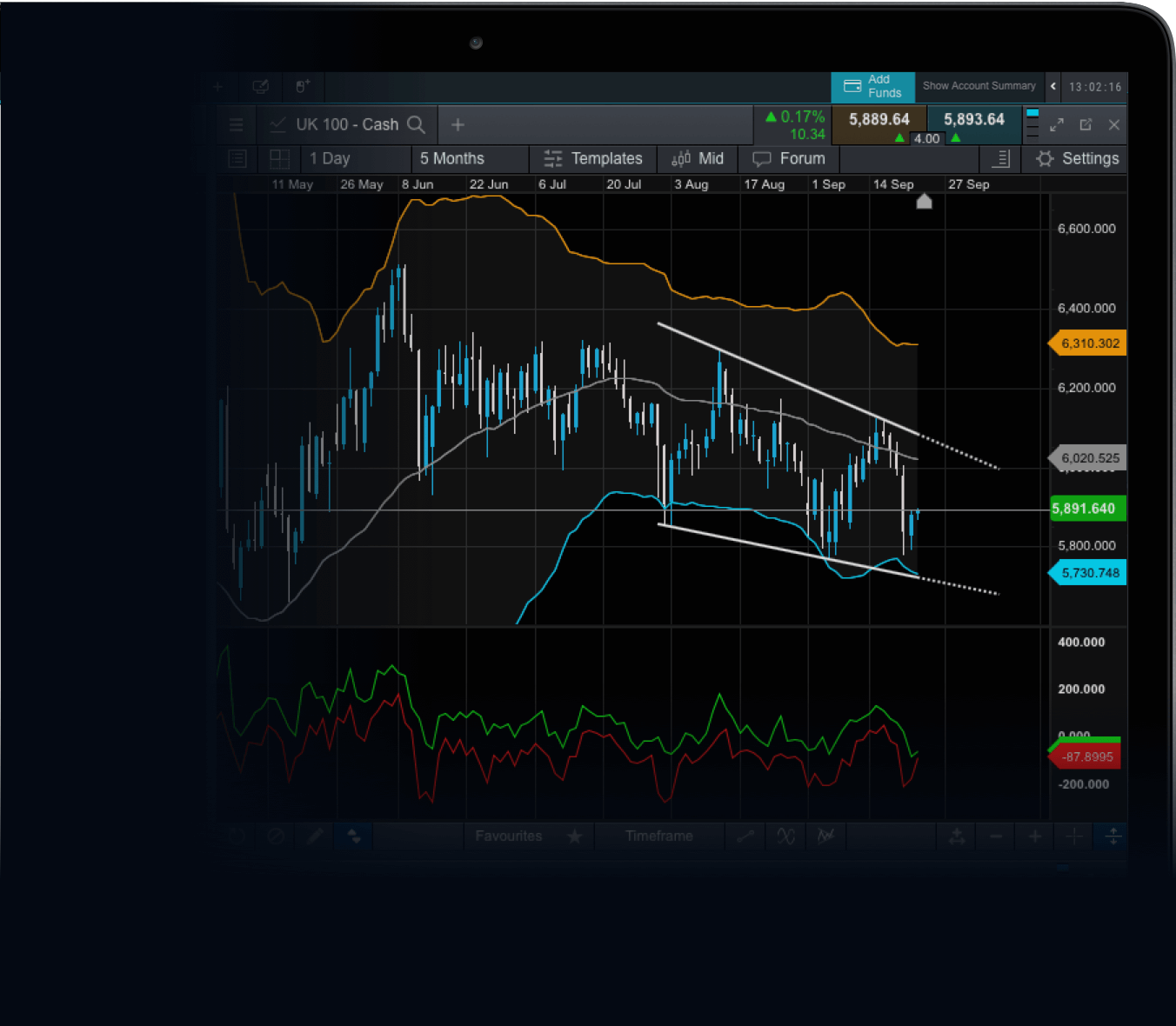

The platform built for index trading

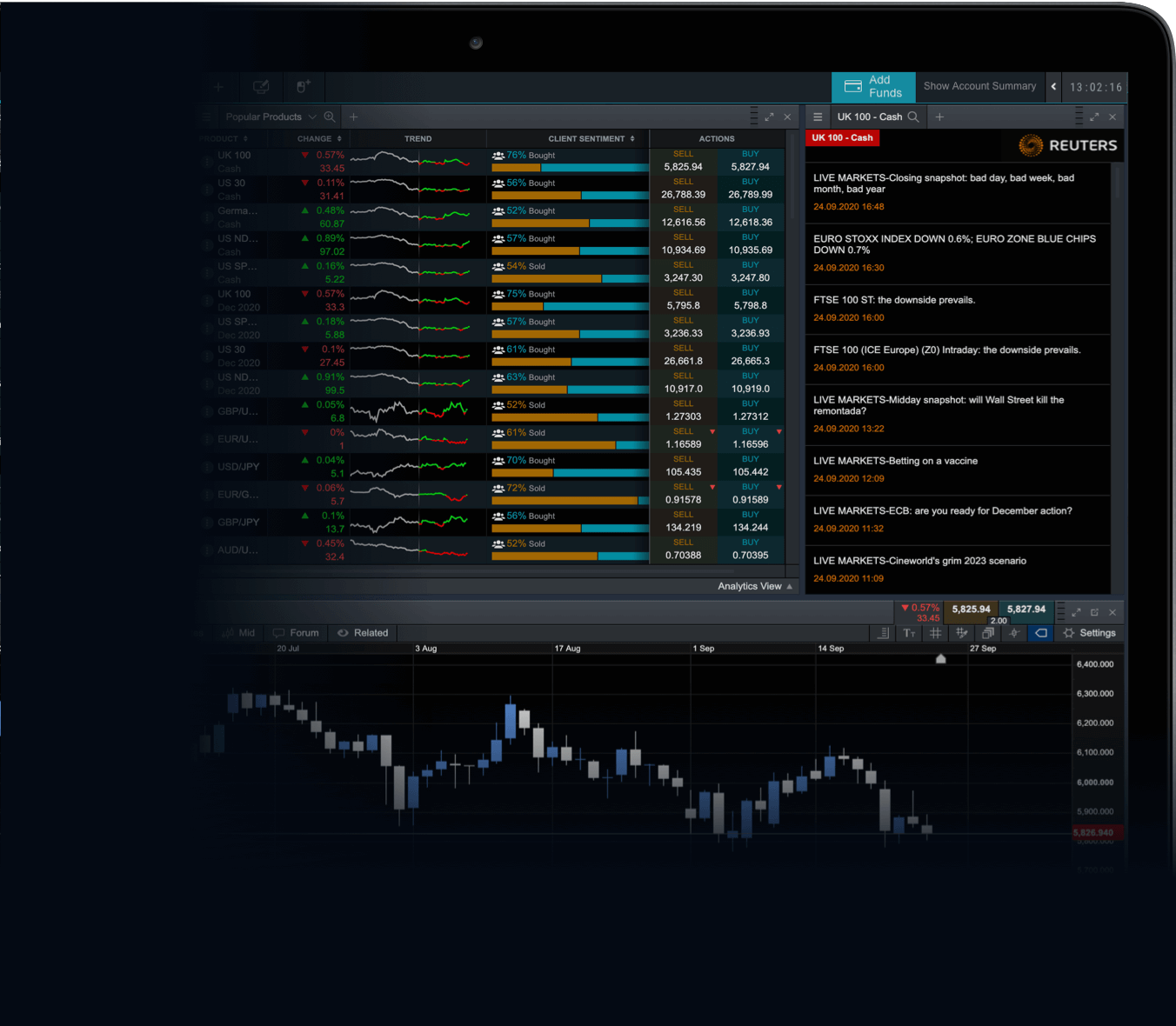

Fast execution2, exclusive insights and accurate signals are vital to your success as an index trader. Our award-winning trading platform1 was built with the successful trader in mind.

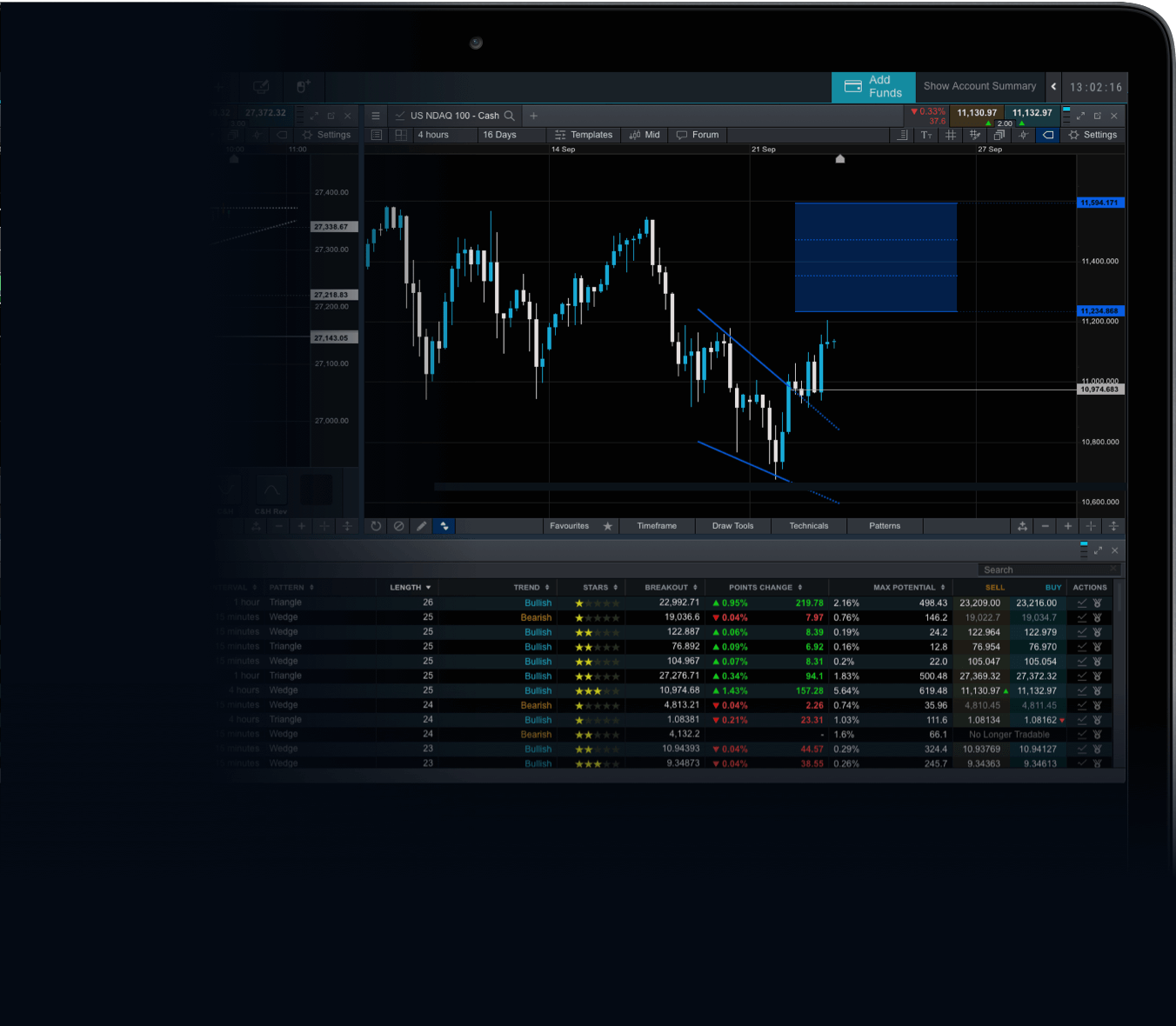

Pattern recognition scanner

We automatically scan over 120 of our most popular instruments every 15 minutes for emerging and completed chart patterns, such as wedges, channels and head & shoulders formations, and overlay them on to your charts to alert you to potential emerging trends.

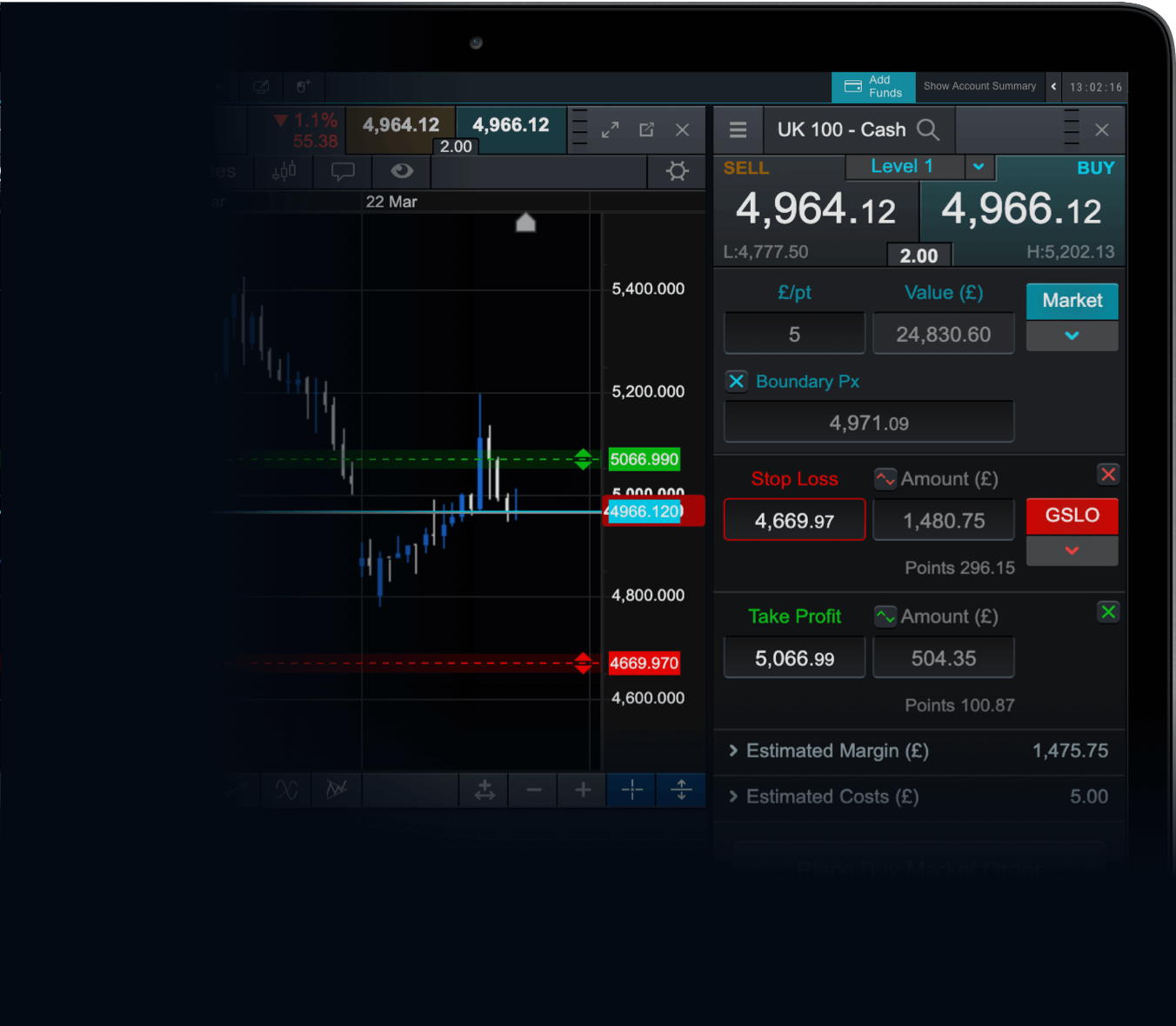

Advanced order execution

We offer a range of advanced order types, including trailing and guaranteed stop losses, partial closure, market orders and boundary orders on every trade, so you have the flexibility to trade your way.

Reuters news and analysis3

Industry-leading charting1

No. 1 Platform Technology (UK)

ForexBrokers.com

Industry Pioneer (Germany)

Focus Money, Test Edition 36/2022

Best CFD Provider (UK)

Online Money Awards

Best Spread Betting Provider (UK)

The City of London Wealth Management

News

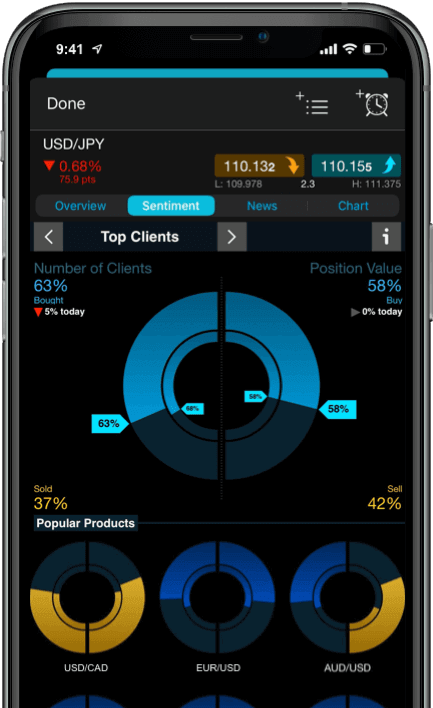

Innovative trading

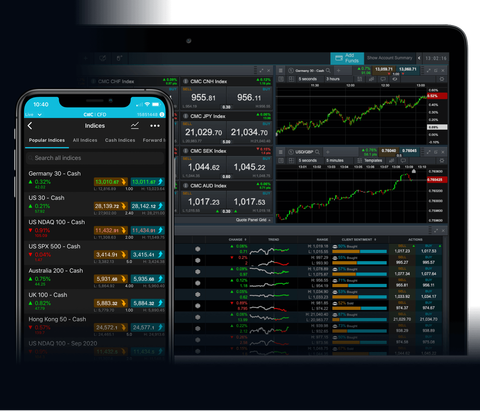

on the go

Trade like you’re on a desktop, on your mobile. Our award-winning mobile trading app1 allows you to seamlessly open and close trades, track your positions, set up notifications and analyse mobile-optimised charts.

FAQs

New to CMC Markets?

Is it free to open an account?

There's no cost when opening a live spread betting or CFD trading account. You can also view prices and use tools such as charts, Reuters news or Morningstar quantitative equity reports, free of charge. However, you will need to deposit funds in your account to place a trade. Learn about the costs involved in spread betting and CFD trading

What are the costs of trading on indices?

There are a number of costs to consider when spread betting and CFD trading, including spread costs, holding costs (for trades held overnight which is essentially a fee for the funds you borrow to cover the leveraged portion of the trade), rollover costs for expired forward trades, and guaranteed stop-loss order charges (if you use this risk-management tool).

Is CMC Markets regulated?

CMC Markets Germany GmbH is a company authorised and regulated by the German Federal Financial Supervisory Authority (BaFin) under registration number 154814. CMC Markets meets the requirements of Section 84 of the German Securities Trading Act (WpHG) with regard to customer funds. It keeps retail client funds separate from its own funds in segregated bank accounts.

How does CMC Markets protect client funds?

CMC Markets Germany GmbH is a company authorised and regulated by the Federal Financial Supervisory Authority (BaFin). CMC Markets meets the requirements of Section 84 of the German Securities Trading Act (WpHG) with regard to customer funds. It keeps retail client funds separate from its own funds in segregated bank accounts. In the unlikely event that CMC Markets Germany GmbH is unable to meet its financial obligations, the EdW would cover up to 90% of the receivables from transactions (maximum EUR 20,000) provided certain criteria are met.

How does CMC Markets make its money?

Our income comes primarily from our spreads and commissions, while other charges - such as overnight holding costs - make a small contribution to our total revenue.

New to index trading?

What are indices?

Indices are a measure of a section of shares in the stock market, created by combining the value of several stocks to create one aggregate value. Major financial indices include the Dow Jones Industrial Average, FTSE 100, CAC 40, and Dax 30. The Dow Jones index, for example, represents 30 large publicly-listed companies traded on the New York Stock Exchange. Learn more about indices

How to trade on indices?

You can start trading on indices by opening a live account. If you would like to practise your index trading strategy, open a demo account to trade with virtual funds.

What is leveraged trading?

One of the advantages of spread betting and CFD trading is that you only need to deposit a percentage of the full value of your position to open a trade, known as trading on leverage. Remember, trading on leverage can also amplify losses, so it’s important to manage your risk.

Why spread betting?

Spread betting allows you to trade tax-free on a wide range of financial markets 24 hours a day, from Sunday nights through to Friday nights. Trade on your phone, tablet, PC or Mac on a wide range of instruments using leverage. Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

How does spread betting/trading CFDs on indices actually work?

When you spread bet or trade CFDs on indices on our platform, you don’t buy or sell the underlying index. Instead, you’re taking a position on whether you think the index will go up or down.

With spread betting, you buy or sell an amount per point movement for the index instrument you’re trading, such as £5 per point. This is known as your stake.

With CFD trading, you buy or sell a number of units for a particular instrument. For every point or unit that the price moves in your favour, you gain multiples of your stake, and vice versa.

While you can trade on leverage, your profits and losses are based on the full value of the trade. As a retail client, you will never lose more than the amount in your account.