What is a contract for difference?

A contract for difference (CFD) is a popular form of derivative trading. CFD trading enables you to speculate on the rising or falling prices of fast-moving global financial markets (or instruments) such as shares, indices, commodities, currencies and treasuries.

CFD trading explained

Some of the benefits of CFD trading are that you can trade on margin, and you can go short (sell) if you think prices will go down or go long (buy) if you think prices will rise. CFDs are tax efficient in the UK, meaning there is no stamp duty to pay*. You can also use CFD trades to hedge an existing physical portfolio.

Introduction to CFD trading: how does CFD trading work?

With CFD trading, you don’t buy or sell the underlying asset (for example a physical share, currency pair or commodity). You buy or sell a number of units for a particular instrument depending on whether you think prices will go up or down. We offer CFDs on a wide range of global markets and our CFD instruments includes shares, treasuries, currency pairs, commodities and stock indices, such as the UK 100, which aggregates the price movements of all the stocks listed on the FTSE 100.

For every point the price of the instrument moves in your favour, you gain multiples of the number of CFD units you have bought or sold. For every point the price moves against you, you will make a loss. Please remember that losses can exceed your deposits.

'Ready to practise trading CFDs? Open a demo account now, or learn more about trading CFDs with CMC Markets.

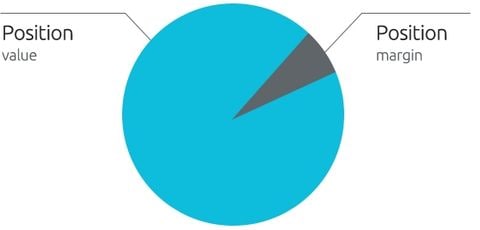

What is margin and leverage?

CFDs are a leveraged product, which means that you only need to deposit a small percentage of the full value of the trade in order to open a position. This is called ‘trading on margin’ (or margin requirement). While trading on margin allows you to magnify your returns, your losses will also be magnified as they are based on the full value of the CFD position, meaning you could lose more than any capital deposited.

What are the costs of CFD trading?

Spread: When trading CFDs you must pay the spread, which is the difference between the buy and sell price. You enter a buy trade using the buy price quoted and exit using the sell price. The narrower the spread, the less the price needs to move in your favour before you start to make a profit, or if the price moves against you, a loss. We offer consistently competitive spreads.

Holding costs: at the end of each trading day (at 5pm New York time), any positions open in your account may be subject to a charge called a 'holding cost'. The holding cost can be positive or negative depending on the direction of your position and the applicable holding rate.

Market data fees: to trade or view our price data for share CFDs, you must activate the relevant market data subscription for which a fee will be charged. View our market data fees

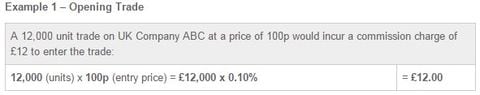

Commission (only applicable for shares): you must also pay a separate commission charge when you trade share CFDs. Commission on UK-based shares on our CFD platform starts from 0.10% of the full exposure of the position, and there is a minimum commission charge of £9. View the examples below to see how to calculate commissions on share CFDs.

Please note: CFD trades incur a commission charge when the trade is opened as well as when it is closed. The above calculation can be applied for a closing trade; the only difference is that you use the exit price rather than the entry price.

Learn more about CFD trading costs and commissions

What instruments can I trade?

When you trade CFDs with us, you can take a position on over 12,000 instruments. Our spreads start from 0.5 points on forex pairs like EUR/USD. You can also trade the UK 100 from 1 point, Germany 40 from 1.2 points, and Gold from 0.3 points. See our range of markets

Example of a CFD trade

Buying a company share in a rising market (going long)

In this example, UK Company ABC is trading at 98 / 100 (where 98 pence is the sell price and 100 pence is the buy price). The spread is 2.

You think the company’s price is going to go up so you decide to open a long position by buying 10,000 CFDs, or ‘units’ at 100 pence. A separate commission charge of £10 would be applied when you open the trade, as 0.10% of the trade size is £10 (10,000 units x 100p = £10,000 x 0.10%).

Company ABC has a margin rate of 3%, which means you only have to deposit 3% of the total value of the trade as position margin. Therefore, in this example your position margin will be £300 (10,000 units x 100p = £10,000 x 3%).

Remember that if the price moves against you, it’s possible to lose more than your margin of £300, as losses will be based on the full value of the position.

Outcome A: a profitable trade

Let's assume your prediction was correct and the price rises over the next week to 110 / 112. You decide to close your buy trade by selling at 110 pence (the current sell price). Remember, commission is charged when you exit a trade too, so a charge of £11 would be applied when you close the trade, as 0.10% of the trade size is £11 (10,000 units x 110p = £11,000 x 0.10%).

The price has moved 10 pence in your favour, from 100 pence (the initial buy price or opening price) to 110 pence (the current sell price or closing price). Multiply this by the number of units you bought (10,000) to calculate your profit of £1000, then subtract the total commission charge (£10 at entry + £11 at exit = £21) which results in a total profit of £979.

Outcome B: a losing trade

Unfortunately, your prediction was wrong and the price of Company ABC drops over the next week to 93 / 95. You think the price is likely to continue dropping so, to limit your losses, you decide to sell at 93 pence (the current sell price) to close the trade. As commission is charged when you exit a trade too, a charge of £9.30 would apply, as 0.10% of the trade size is £9.30 (10,000 units x 93p = £9,300 x 0.10%).

The price has moved 7 pence against you, from 100 pence (the initial buy price) to 93 pence (the current sell price). Multiply this by the number of units you bought (10,000) to calculate your loss of £700, plus the total commission charge (£10 at entry + £9.30 at exit = £19.30) which results in a total loss of £719.30.

View more CFD trading examples

Short-selling CFDs in a falling market

CFD trading enables you to sell (short) an instrument if you believe it will fall in value, with the aim of profiting from the predicted downward price move. If your prediction turns out to be correct, you can buy the instrument back at a lower price to make a profit. If you are incorrect and the value rises, you will make a loss. This loss can exceed your deposits.

What are the risks?

- When trading with leverage, you could make large losses if your bet is unsuccessful and the market moves against you.

- If you don't have sufficient funds in your account to cover balance changes, there is a risk that your positions may be closed out.

- The financial markets can be volatile, especially the stock and forex markets.

- There are a number of extra fees associated with CFD trading that traders often forget, including holding costs, commissions on shares, and GSLO premiums.

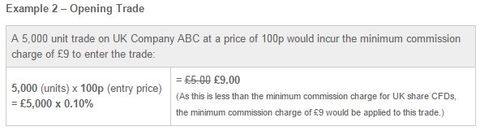

Hedging your physical portfolio with CFD trading

If you have already invested in an existing portfolio of physical shares with another broker and you think they may lose some of their value over the short term, you can hedge your physical shares using CFDs. By short selling the same shares as CFDs, you can try and make a profit from the short-term downtrend to offset any loss from your existing portfolio.

For example, say you hold £5000 worth of physical ABC Corp shares in your portfolio; you could hold a short position or short sell the equivalent value of ABC Corp with CFDs. Then, if ABC Corp’s share price falls in the underlying market, the loss in value of your physical share portfolio could potentially be offset by the profit made on your short selling CFD trade. You could then close out your CFD trade to secure your profit as the short-term downtrend comes to an end and the value of your physical shares starts to rise again.

Using CFDs to hedge physical share portfolios is a popular strategy for many investors, especially in volatile markets.

Attend one of our regular CFD trading webinars or seminars and improve your CFD trading skills.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.