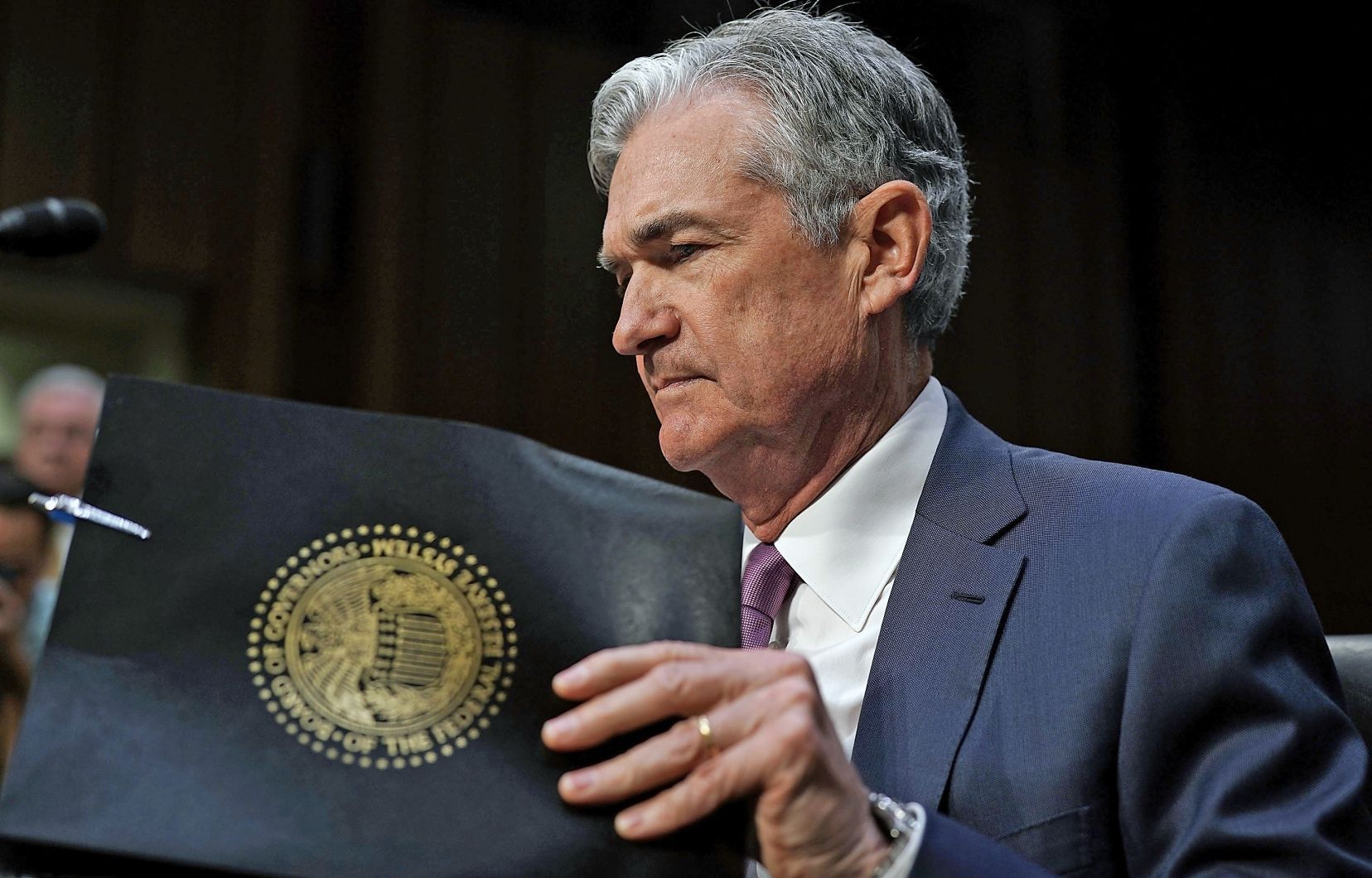

Wall Street finished higher following the selloffs in the last two days as the government bond yields pulled back from their more than one-decade highs ahead of Fed Chair Powell’s speech. In the meantime, crude oil prices pulled back from their 13-month highs simultaneously, which was seen to correlate positively with the bond yields and the US dollar. The reversal moves in the markets may be caused by technical trades in an oversold stock market and an overbought oil market as investors were repositioning. However, the three benchmarks are still pointing to a negative close for months, extending their losses since August.

On the other hand, the US government faces the risk of shutdown three days before the deadline for negotiations over funding authorization. The US government debts rose to above US$33 trillion for the first time after a surge of 50% during the pandemic. The Fed’s aggressive rate hikes caused a sharp decline in government bond demand while slowing economic growth. The government shutdown will lead to the furlough of hundreds of thousands of federal employees and a pause of some government services, including economic data releases, which will cause disruptions to the financial markets but with limited impact if it is a short-term suspension.

With China entering its golden week holiday, Asian markets turn to be quieter for the rest of the week. Futures point to a higher open across the APAC. The Nikkei 225 futures rose 0.41%, the ASX 200 futures were up 0.55%, and the Hang Seng Index futures advanced 0.58%.

Price movers:

- 10 out of 11 sectors in the S&P 500 finished higher, with Communication Services and Materials, leading gains, up 1.16%. Utilities is the only sector that ended in the red, slumping 2.19%. Most of the mega-cap tech stocks were higher, with Apple up 0.15%, Alphabet up 1.3%, Meta Platforms up 2.07%, and Tesla rising 2.4%.

- AMD’s shares jumped 5% on Microsoft tech chief, Kevin Scott’spositive comments. Kevin said AMD is “making increasingly compelling GPU offers…to the marketplace in the coming years.” The chipmaker has been in a long-term partnership with Microsoft, providing GPUs. The company announced that it started making MI300X chips designed specifically for AI models.

- Gold futures slumped to the lowest level since March due to surging bond yields and a firm USD. The precious metal may head off further support of 1,810 from a technical perspective.

- Crude oil pulled back from a 13-month high on a possible technical correction. Traders may see an overbought oil market in the past two months. Oil prices surged to the highest level since August 2022 after the US inventory data showed that the stockpile dropped to its lowest level since July last year. OPEC +’s output cuts added concerns for an undersupply market.

- Bitcoin rose to above 27,000 as risk sentiment recovered following Wall Street’s rebound. However, the digital coin faces pivotal resistance of 27,400 at the 50-day moving average. A bullish breakout of the this level may take it to test 30,000 again.

ASX and NZX announcements/news:

- No major announcement.

Today’s agenda:

- Tokyo Core CPI for September

- US Core PCE for August

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.