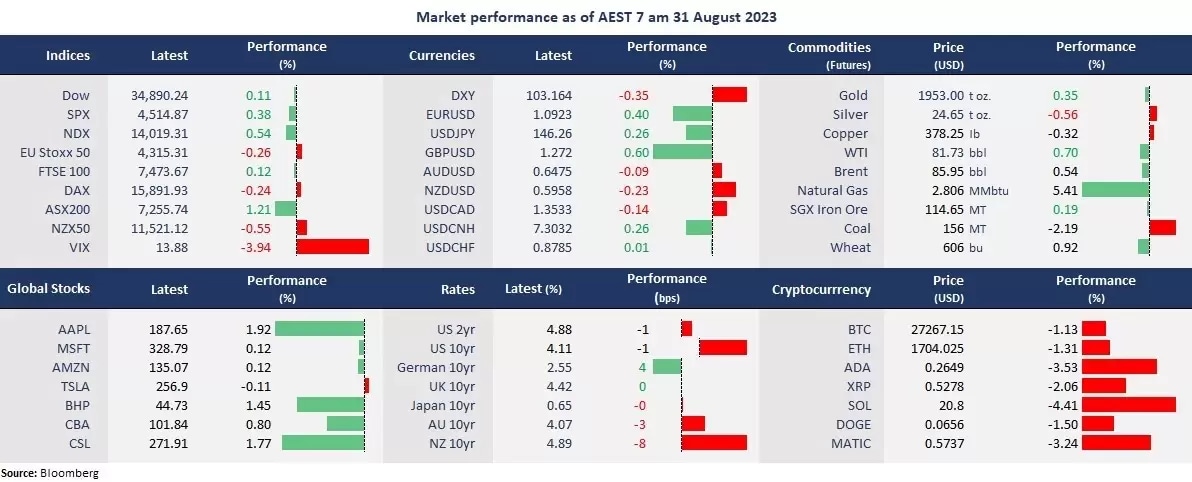

Wall Street gained for the fourth straight trading day following the Jackson Hole event last week as markets continued to price in peaking rates amid a slew of weaker-than-expected US economic data. The ADP non-farm employment data showed that private sectors only added 177,000 new jobs, the lowest since April. The second read of the US Q2 GDP was revised down to 2.1% from 2.4%, suggesting that economic growth slowed. Meanwhile, the market’s rebound is particularly seen in growth stocks as the tech-heavy index, Nasdaq, again outperforms the S&P 500 and Dow this week. Investors may rotate funds back to AI-powered tech stocks amid bond yield retreats. The US PCE, which is seen as the Fed’s favourite indication for inflation, will be on close watch today.

In FX, the notable prevailing trend is a softened USD as markets are pricing in a sooner end of the Fed’s hiking cycle than it of the ECB and the BOE. Both the Eurodollar and the British Pound strengthened against the king dollar and weighed on the dollar index. Asian currencies weakened following Australia’s lighter-than-expected July CPI data, while the Chinese Yuan and Japanese Yen continued to weaken on the central banks’ policy divergence.

Commodity markets rebounded further on a softened USD, buoying Australian mining stocks. And the light inflation print strengthened the odds for a dovish RBA, buoying the ASX 200. Futures point to a higher open in Asian stock markets, with the Nikkei 225 futures up 0.24% the ASX 200 futures rising 0.11%, and the Hang Seng Index futures climbing 0.52%.

Price movers:

9 out of 11 sectors finished higher in the S&P 500, with Technology leading gains, up 0.83%. Defensive sectors, including Utilities and Healthcare, finished in the red, down 0.43% and 0.03%, respectively.

- Salesforce’s shares jumped 5.6% in after-hours trading on earnings beat in the second quarter. The software company’s earnings per share were US$2.12, topping an estimated US$1.90 on revenue of US$8.60 billion, beating the expected US$8.53 billion. Its guidance for the third quarter also beat markets’ expectations.

- Baidu ADR shares jumped more than 4% on the news that China will approve the AI services for the first bunch of firms. Baidu said that its AI chatbot, Ernie Bot, would be available to the public today. The progress marks a new milestone for Chinese tech firms to compete in the generative AI race.

- Spot gold rose to a month-high amid a softened USD and falling bond yields. The precious metal continued to rise above the 50-day moving average. With the prevailing trend continuing, gold may rise further toward its high in July at above 1,980.

- WTI futures consolidated above US$80 per barrel for the second straight trading day as a softened USD and risk-on sentiment overshadowed China’s economic concerns. The near-term potential resistance could be around 83 from a technical perspective.

ASX and NZX announcements/news:

- No major announcement.

Today’s agenda:

- Japan’s Prelim Industrial Production & Retail Sales for July

- New Zealand Business Confidence for August

- Australian Private Capital Expenditure

- China’s Manufacturing PMI and Non-Manufacturing PMI for August

- US PCE Index for July

Maximize your potential gains! Take immediate action and seize the investment opportunities that await you. Login to the platform now!

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.