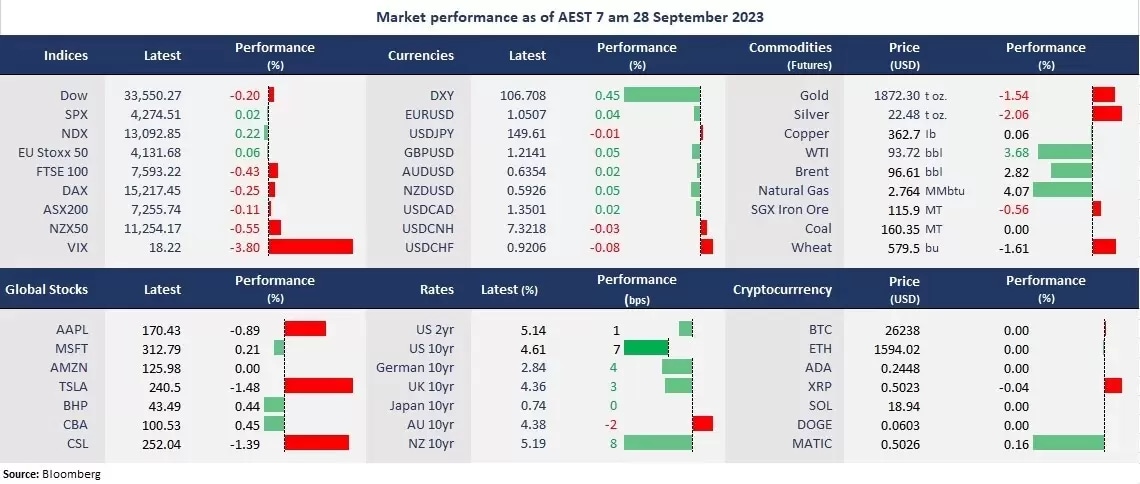

US stocks finished mixed, with the Dow extending losses, while the S&P 500 and Nasdaq managed to inch up as surging bond yields continued to weigh on the equity markets. The US 10-year bond yield hit 4.61%, a new high since 2007, and the yield on the 2-year bond jumped 7 basis points to 5.14%. The S&P 500 and Nasdaq point to the worst monthly performance since December 2022. In the meantime, the SPX Fear & Greedy Index entered the extreme fear territory, suggesting markets may have been oversold. But the cautious movements are likely to continue in the run-up to the third-quarter US earnings season.

The US dollar accelerated surging, with the dollar index reaching the highest seen in November 2022. Metal prices tumbled further, with gold and copper futures slumping 1.54% and 2.06%, respectively. However, crude prices continued to soar, with the oil-west-texas-cash">WTI futures breaking through pivotal resistance, potentially heading off US$100 per barrel. The price surge in gas and oil lifted the energy stocks further, leading to the S&P 500 gains.

Asian markets were more resilient in comparison with the EU and US peers as the divergent Monetary policy stance may shift funds to the region. China’s property concerns were fading somewhat, with its Hong Kong benchmark index eased losses. However, futures point to a lower open across the APAC. The Nikkei 225 futures were down 0.24%, the ASX 200 futures slid 0.13%, and the Hang Seng Index futures fell 0 20%.

Price movers:

- 6 out of 11 sectors in the S&P 500 finished lower, with Utilities leading losses, down 1.93%. Energy stocks outperformed, up 2.51% amid the jumping oil prices. Technology and Communication Services were up on tech’s comeback, up 0.17% and 0.54%, respectively.

- The chip maker, Micron’s shares fell more than 4% despite an earnings beat, as its guidance for the current quarter is weaker than expected. The company lost US$1.07 per share, less than an estimated loss of $1.18 per share. Revenue was $4.01 billion, topping the expected US$3.93 billion. However, the company expects a loss of US$1.07 per share, much higher than the expected 95 cents per share

- Peloton shares soared 16% in after-hours trading on a five-year partnership with Lululemon. The exercise equipment and media company will provide exclusive fitness content for Lululemon’s app.

- Meta’s shares were lower but bounced a session low following the launch of the new Quest 3 headset with a big leap in the technology advance. The new device features mixed reality, which enables users to interact with the real world, akin to Apple’s Vision Pro. The price is at US$499.99, much lower than Apple’s mixed reality headset.

- The grocery store, Costco’s shares rose 2% amid a beat on quarterly earnings expectations. The company’s earnings per share was US$4.86, topping an estimated US$4.79 The revenue was US$78.9 billion, higher than the expected US$77.39 billion. Comparable sales rose 1.1% year on year. The financial reports said shoppers purchased more groceries than big-ticket items.

- WTI futures jumped to the highest level since August 2022 following a larger-than-expected draw in the US inventory data. According to the US Energy Information Administration, the crude inventory decreased by 2.2 million barrels during the week ending 22 September from the previous week, much more than an expected draw of 600,000 barrels.

- Gold futures fell off key resistance of 1,900 amid surging US bond yields and the US dollar. The precious metal may head off further support of about 1,840 if the prevailing trend continues.

ASX and NZX announcements/news:

- No major announcement.

Today’s agenda:

- New Zealand ANZ Business Confidence

- Australian Retail Sales for August

- US Final Q2 GDP

- US Crude Oil Inventories

Maximize your potential gains! Take immediate action and seize the investment opportunities that await you. Login to the platform now!

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.