Macro Scenes:

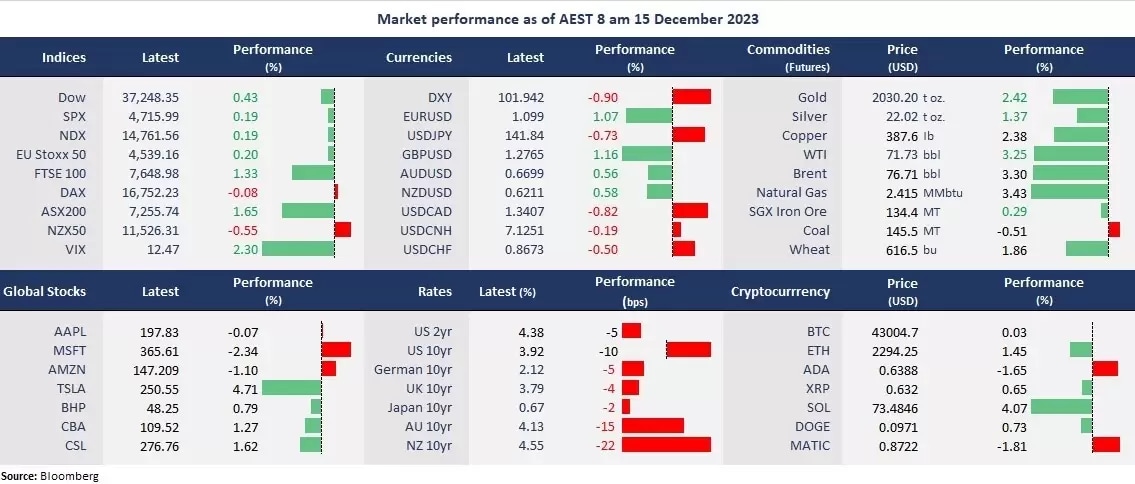

- Wall Street pared gains: The US stock markets finished marginally higher but pared early gains as the Fed-induced rally lost some steam. While the Dow rose further, hitting a new high, mega-cap techs were mostly down. The Real Estate sector has been the biggest beneficiary of the Fed’s pivot, up 6% in the past two days. The US 30-year mortgage rate fell below 7% for the first time since August.

- USD tumbled: The US dollar index deepened losses, down 0.9% to below 102 for the first time since the beginning of August. The ECB and BOE kept their interest rates unchanged but reinstated the necessity to maintain the restrictive policy. The relatively hawkish stance strengthened the Eurodollar and the British Pound significantly against the USD, which contributed to the decline of the king dollar.

- 10-year US Treasury yield under 4%: The US bond yields continued to slide one day after the Fed’s pivot signals. The 2-year bond yield slipped to the lowest since June.

- Crude oil jumped: Oil prices rebounded for the second straight trading day as a weakened USD lifted commodity markets. The much larger-than-expected US inventory data fueled the oil market’s initial comeback on Wednesday. An oversold market can also be a key factor that causes a rebound.

- Asian markets to open mixed: Equity markets across Asia were boosted by the Fed’s pivot tone on Thursday. The Chinese stock markets saw a potential bottom reversal pattern, and the Australian extended a four-day winning streak. ASX 200 futures were up 1.65%, the Hang Seng Index futures rose 1.07%, and Nikkei 225 futures fell 0.73%.

Chart of the Day:

Tesla, daily – Tesla’s shares rose 4.7% on Thursday. It found strong support at the 50-day moving average, bullishly topping the trendline resistance. This may take its shares higher to its July high of nearly US$297 per share again.

Company News:

- Amazon (NDX: AMZN) won the court battle against the European Commission regarding a tax advantage in Luxembourg back in 2017 when Amazon was ordered to pay back 250 million euros. The European Court of Justice said the European Commission failed to prove an illegal tax advantage of Amazon.

Today’s Agenda:

- Australia’s Flash Manufacturing and Services PMI for December

- China’s Industrial Output, Retail Sales, Fixed Asset Investment, and Unemployment Rate for November

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.