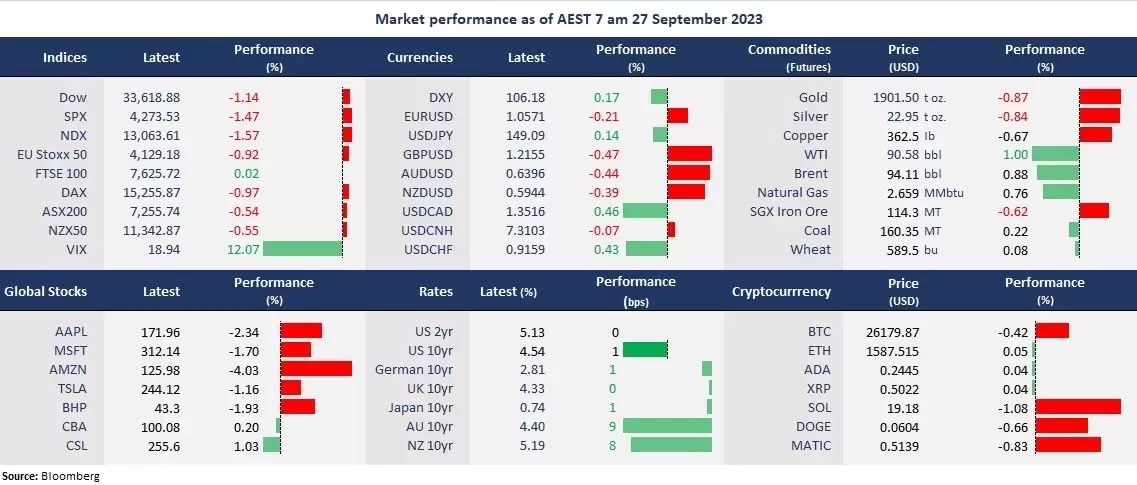

Wall Street sank on a broad-based selloff following concerned economic data, with the S&P 500 tumbling to the lowest since early June. The US CB Consumer Confidence unexpectedly fell to a three-month low as consumers’ short-term outlook deteriorated to the level that signals a recession within the next year. Sentiment soured since the Fed signalled more rate hikes last week, sending the Treasury yields soaring. High yields in the money market may be causing investors to cash out from equities over profit-taking, while risk-off continued to dominate the market trend as the VIX spiked 12% to nearly 19, the highest level seen in May.

In the FX, the US dollar index continued to climb and pressed on the other major currencies. Metal prices particularly suffered from the strong king dollar, with gold futures down US$18 per ounce and copper futures down 0.7% and briefly hit the lowest level since May. By contrast, energy prices were resilient amid rising geopolitical tensions in major economies, and undersupply remained a concern to crude oil and natural gas.

In Asia, the Chinese government’s delay on Evergrande’s US$30 billion offshore debt restructuring continued to weigh on sentiment, with equity markets all closing in the red across the APAC region on Tuesday. And futures point to a mixed open. The Nikkei 225 futures slid 0.59%, the ASX 200 futures slid 0.38%, and the Hang Seng Index futures were up 0.02%.

Price movers:

- All 11 sectors in the S&P 500 finished lower, with Utilities and Consumer Discretionary, leading losses, down 3.05% and 2.03%, respectively. Technology and Communications Services also slumped amid the intensifying selloffs in mega-cap tech stocks, down 1.78% and 1.34%, respectively.

- Amazon’s shares slumped more than 4% due to the monopoly lawsuit filed in the Federal Trade Commission.17 states are suing Amazon over allegations that the e-commerce behemoth abused the marketplace by inflated prices while excluding other rivals.

- Tesla’s shares slid 1.2% on the EU’s investigation over its electric vehicles export from China to Europe, which is part of the EU’s China EV probe over unfair China subsidies to their EV makers. The EU may impose measures to counter Chinese EV imports and protect its local manufacturers.

- Alibaba’s logistic arm, Cainiao, has filed for an IPO on the Hong Kong stock exchange, which is among the first round of market debut of the Chinese e-commerce giant’s units after the split. The offering may raise at least US$1 billion.

- Crude oil bounced off a session low and finished higher as undersupply concerns continued to fuel the upside momentum. Despite broad selloffs in risk assets, China’s manufacturing and services PMIs are expected to improve in September, which could be a bullish sign for the oil market. However, oil prices face near-term resistance of their recent highs at about US$93 for WTI and at about $96 for Brent.

ASX and NZX announcements/news:

- No major announcement.

Today’s agenda:

- Australian August CPI

- US Durable Goods Orders for August

- US Crude Oil Inventories

Maximize your potential gains! Take immediate action and seize the investment opportunities that await you. Login to the platform now!

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.