At the start of 2023 the IMF was especially gloomy about the outlook for the year ahead, predicting that a third of the global economy would fall into recession against a backdrop of slowing global growth, as central banks looked set to hike rates even further. This gloomy outlook came about despite a strong end to 2022, which saw global equity markets rally strongly from two-year lows back in October 2022, although we still finished the year lower, with US markets getting hit especially hard.

After the negativity of 2022, the early days of 2023 saw European markets get off to a flier, with sharply slowing headline inflation in the US, as well PPI inflation, fuelling optimism that central bank rate hikes would soon be coming to an end, with bond markets increasingly pricing in the prospect of rate cuts before year end. This reasoning always came across as a triumph of hope over expectation given that even then central bank terminal rates were still well below the level of headline inflation.

Nonetheless there was still an expectation that European markets would perform much better, and even outperform US markets where valuations were, and still are, well above their long-term averages, especially since it was widely expected that more interest rate hikes were on the way.

For the first half of this year this narrative of European outperformance initially played out well with record highs for the FTSE 100 which achieved a new record high above 8,000 in mid-February the DAX new record highs in May, June and July, and the CAC 40 in April.

While European markets had a solid H1, US markets went against the consensus and performed even better despite the Fed Funds rate rising from 4.5% at the start of this year, to finish at 5.50% when the Fed last raised rates back in July. This consensus was largely driven by the idea that a move from a TINA (There Is No Alternative) world, to a world where money now has a value, would see many tech stocks valued against a higher benchmark when it comes to their growth potential. After all, if you could get achieve a 5% return on anything from a six-month US T-bill, or a 2-year bond, why take the risk on an expensive tech stock.

As we now know it hasn’t turned out like that, although if you scratch below the surface the rebound in US markets has been largely driven by a small cohort of US companies, called the “Magnificent seven” which have driven most of the gains for US markets. These seven companies, Nvidia, Meta Platforms, Amazon, Alphabet, Tesla, Microsoft, and Apple have helped push the likes of the Nasdaq 100 higher to the tune of over 40% year to date, while the S&P 500 has gained a slightly more modest +15%.

Compare that to the more domestically focused Russell 2000 and the difference is even starker with that US index only modestly higher on the year, although the performance here has improved somewhat in the past few days after Chairman Powell’s surprise pivot when it comes to the likelihood of rate cuts at his recent press conference.

Since the last Fed rate hike in July, we’ve seen the European Central Bank raise rates from 2.5% at the start of this year to 4.5% back in September, while the Bank of England has been equally as aggressive, hiking from 3% at the start of this year to current levels of 5.25%.

Having managed to outperform its peers in 2022, the FTSE 100 has underperformed in 2023, despite posting an early record high in the early days of 2023, while the Nikkei 225 has surged, helped by the weakness of the Japanese yen.

FTSE 100 struggles for gains in 2023

Source: CMC Markets

On a two-year timeline the FTSE 100 has performed a little more in line with its peers, with the Nikkei 225 outperforming due to the continuation of the Bank of Japan’s easy monetary policy and weak yen. Against the DAX and S&P500 it’s been a performance of steady as she goes, compared to the peaks and troughs of the latter two.

FTSE 100 steady performance from 2022-2023

Source: CMC Markets

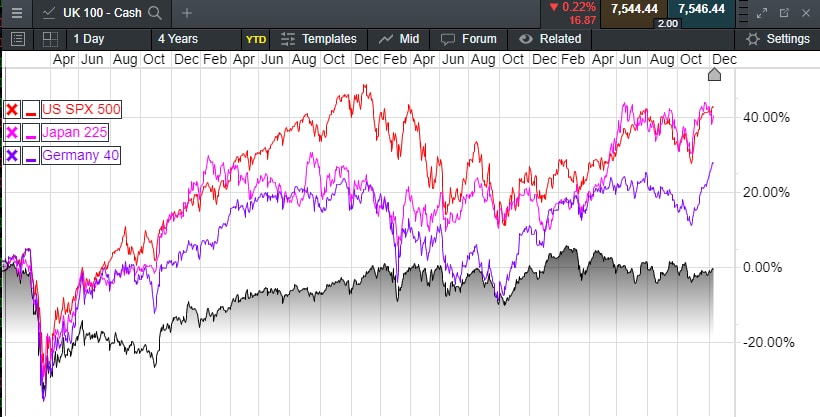

That is still small comfort, however when looked at on a longer timeline. The last 20 years have been a consistent story of serial underperformance for the FTSE100, as illustrated by the performance from pre-Covid levels and the beginning of 2020, as can be seen from the comparison chart below.

FTSE 100 underperformance since 2020

Source: CMC Markets

As can be seen from the chart above the FTSE 100 is still below the levels it finished at the end of 2019, in contrast to its peers of the DAX, S&P 500, and Japanese Nikkei 225, with the S&P 500 and Nikkei matching each other for their post Covid gains.

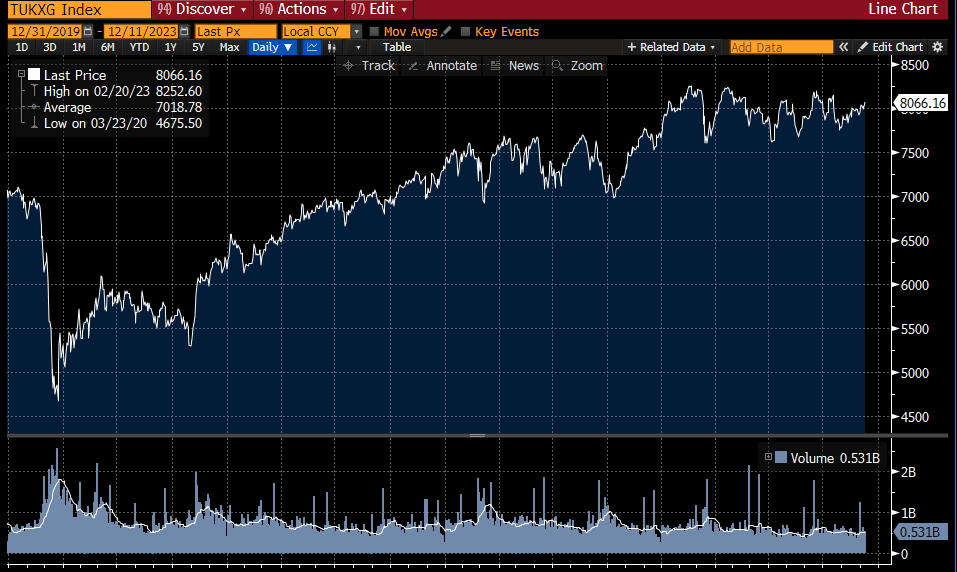

On the other hand, if we looked at the FTSE 100 as a total return index like the DAX, we would have seen a much better performance, with regular instances of record highs throughout the last 2 years, along with a gain of around 14% since the end of 2019.

FTSE 100 Total Return Index

Source: Bloomberg

Unlike last year when the likes of BAE Systems, BP and Shell did well, this year has been more of a struggle for the FTSE 100, due to weakness in commodity prices which has hindered last year’s outperformers. That said BAE Systems has still managed to continue its strong progress due to the war in Ukraine as well as the addition of the conflict in the Middle East.

This year’s outperformers have had a less defensive bias than was the case last year with the likes of Rolls-Royce and Marks & Spencer performing well on their own respective turnaround stories, while the less pessimistic outlook on the UK economy has seen strong performances from other retailers like Primark owner Associated British Foods, Next, B&M European Retail, as well as travel and leisure in the form of IAG, IHG and Premier Inn owner Whitbread.

With the next move in interest rates expected to be lower the key question is likely to revolve around the size and timing of such moves given that inflation has still not fallen back to the central bank target of 2%. This will very much depend on the extent of any downturn, and how quickly unemployment starts to rise sharply. In Europe we appear to be in recession already, while in the UK growth stalled in Q3. The US continues to be the strongest economy, after a strong Q3.

Nonetheless the trend for this year has been inflation continuing to slow from the peaks of earlier this year, with lower inflationary pressure in supply chains contributing to weakness in headline and core PPI readings. While this is likely to feed into less inflation pressure on the headline and core CPI measures as we head into 2024, it may not take us back to 2%.

Markets are currently pricing in the prospect of rate cuts next year, even with headline inflation still well north of the central banks 2% inflation targets. That may well happen; however, the degree of cuts being priced could well be where markets come unstuck, especially since the move back to 2% from current levels may prove to be the hardest part of the journey.

FTSE 100 daily chart

Source: CMC Markets

Nonetheless there is no reason to suppose that stock markets won’t maintain the resilience seen through 2023, with the FTSE 100 having strong support at 7,200 which needs to hold to maintain the outlook for further gains on a move through 7,750 and revisit the highs this year at 8,046.

The biggest risk for markets heading into 2024 is likely to be in a deterioration of the situation in the Middle East and the conflict spreading beyond the point where we are now with concerns over transit security in the Red Sea and Suez Canal region.

A further escalation by Houthi rebels to physical assets in Saudi Arabia and Egypt would be a dangerous escalation likely to prompt a counter response and a further geopolitical shock.

At the start of this year, we knew the world had become a more dangerous place with the Russian invasion of Ukraine. 12 months down the line the global situation has become even more serious, with the events in the Middle East and could become even more so in 2024.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.