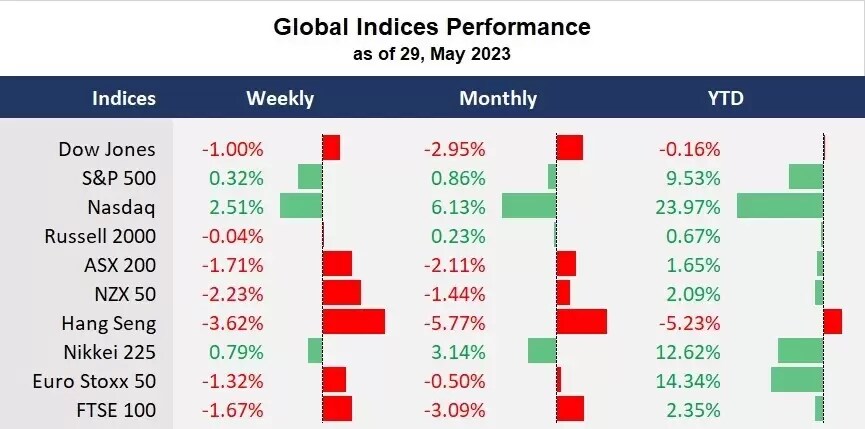

The AI-powered tech rally again defended the recent US government’s debt talk drama, with Nasdaq up 24% year to date, continuing the bull run. Among the well-known mega techs, Nvidia’s stocks soared 167%, followed by Meta Platforms, up 118%, suggesting that investors have been chasing front runners’ in tech stocks with healthy cash flows at the back of a slowdown rate hikes by the central banks and easing inflationary pressure globally.

On the other hand, the White House and Republicans reached a tentative deal to raise the government’s borrowing ceiling, avoiding a possible historical US sovereign debt default, which may fuel further optimism in the broad markets at the open this week. The US markets will close on Monday for the Memorial Day public holiday. In this shortened week, the most influential economic data will be the US non-farm payroll this Friday. China’s manufacturing and services PMIs for May are also the parameters for the country’s economic trajectory, steering those growth-sensitive commodity prices, such as copper, iron ore, and crude oil.

On the earnings front, the semiconductor manufacturer Broadcom’s earnings will be on close watch after the Nvidia-led chipmaker stocks’ surge last week.

What are we watching?

- The USD and the US bond yields are at multi-month highs: The US dollar index climbed for the third straight week to above 104 for the first time since mid-March, while the most Fed-rate sensitive bond yield on the 2-year Treasury bill rose to 4.6% at an 11-week high.

- AI chipmakers pump up: The prominent phenomenon is that AI-related chipmakers are on fire amid the heating up big tech race in the ChatGPT-alike development. Nvidia’s shares hit a record high last week, up 264% from the low in October 2022, leading other peers, such as Broadcom, AMD, and TSMC shares, to all gain between 10%-20% last week.

- Gold extends losses: gold prices slumped for the second straight week as strong USD and bond yields pressed on the precious metal price. Risk-on sentiment also weighed on haven assets.

- Bitcoin jumped over the weekend: Bitcoin rose 3.6% to just under 27,700 at a two-week high in the last 24 hours. The move may suggest that crypto traders seek another bounce amid the tech-led bull markets in the coming month.

Economic Calendar (29 May – 2 June )

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.