The US Big Seven tech stocks have amazed investors with their ability to optimize their profitability even in economic hardship. Companies like Amazon, Alphabet, Microsoft, and Meta Platforms all grew their year-on-year revenue by a double-digit percentage in the September quarter. NVIDIA was an exception, thanks to its near monopoly market shares in AI chips, which boosted its revenue growth by a whopping 206% from a year ago. By contrast, Tesla’s EV sales decelerated further, and Apple posted the third negative yearly revenue growth. Nonetheless, all the Big Seven stocks outperformed the S&P 500 in 2023. Below are the key matrices that investors should review for these big tech earnings.

Big Seven unlocks bottlenecks, but Tesla

In the recent quarterly reports, 6 out of 7 US big tech companies beat earnings expectations and posted the best yearly growth in one year, signalling a recovery in business efficiency after a brutal 2022. Tesla was the only company that reported a significant decrease in its earnings. This was due to a narrowing profit margin. The positive earnings of these large technology companies may signal a turning point in their respective growth trajectories. Three reasons may have contributed to their success in 2023: Cost cutting, the AI boom, and macro improvement.

Amid macro headwinds, Amazon, Alphabet, and Microsoft have all cut jobs by about 5-6%, and Meta laid off employees by roughly 13% as part of the measures to impose a “year of efficiency.” Tesla implemented a small headcount reduction in 2022, while Apple cut bonuses and hiring.

The Microsoft-led generative AI revolution sparked a new round of funds reallocation to these mega-cap tech firms. Of a sudden, the tech giant’s cloud businesses have become an AI-led race. AI-powered divisions, such as Microsoft's Azure, Google Cloud, AWS, Meta's AI infrastructure, and Nvidia's data center business, have emerged as crucial components in determining the valuation of these big tech companies. And the respective growth trajectory was one of the key elements driving their stock movements. By contrast, Apple and Tesla lost some shine as they did not market themselves as AI pioneers.

The macro-environment played a key role in driving market trends and companies’ performance. The US Fed slowed the pace of rate hikes and halted its hiking cycle for the last two times in September and November. China was on an economic recovery trajectory despite a bumpy journey. These macro factors improved business sentiment and consumer demand, which improved tech companies’ probability through advertising income (Meta, Amazon, Alphabet) and sales revenue (Apple, Amazon, Microsoft, and Tesla).

The AI achievements

In the September quarter earnings, Microsoft’s Azure revenue rose 29% year on year, the highest in the past three quarters. Alphabet’s Google Cloud grew 22% year on year, decelerating from the last two years, and Amazon’s AWS rose 12% annually, slightly higher than the previous quarter. Meta’s LIam-2 is free to be used by enterprise customers. Hence, there wasn’t a monetized report on its book. However, the social platform may have secured its cooperation with Microsoft’s Azure and Amazon’s AWS. NVIDIA’s data centre revenue soared 171% in the July quarter and 279% in the October quarter as the company has a different reporting calendar from other tech giants.

Apple, being predominantly a hardware-centric business, didn't showcase significant advancements on the AI front. While Tesla boasts tangible AI capabilities, especially in full self-driving, this has yet to make a meaningful impact on their bottom line. Apple’s product sales were tepid, down 5% year on year due to weakened demand in Great China. But notably, Apple’s Services division continued to lead the growth, jumping 16% year on year, the highest since the second quarter of fiscal year 2022.

Tesla’s quarterly performance was probably the weakest among the big seven tech companies, with a mere 9% year-on-year revenue growth. Tesla’s price cuts continued to hurt its profit margin, which slumped to 17.9% from 25% in the same period last year. The Cybertruck could be a catalyst for a new wave of bullish momentum in the upcoming year.

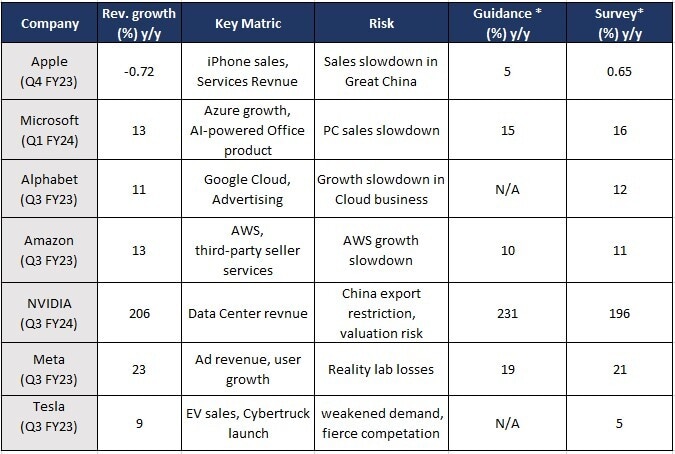

Summary of Big Seven’s quarterly revenue

*Companies who provided guidance for the current quarter in their respective earnings reports

*Analysts survey for the yearly revenue growth for the current quarter provided by Bloomberg

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.