Bitcoin seems to have entered a new bullish cycle since the world's largest fund manager, BlackRock, filed for a spot Bitcoin ETF in mid-June. The largest cryptocurrency’s price rose about 50% from 15 June to above $37,000 in early November. During this period, Bitcoin’s price spiked every time there was positive news about the progress made toward Bitcoin’s spot ETF approval. Will this moment take it to even higher, and which level could it reach? Both micro and macro factors need to be considered when making a forecast of its trend.

The Spot ETF optimism

Bitcoin’s price jumped to above $30,000 from $25,000 in the week of the Blackrock’s announcement in June. However, its price retreated in mid-August due to a Fed-induced selloff in risk assets. The second spike in Bitcoin was caused by a court ruling in favour of Grayscale in late August. The digital asset management firm was in a lawsuit against the US Securities and Exchange Commission (SEC) for a bitcoin ETF, as the SEC denied Grayscale’s application to covert its Bitcoin Trust into an ETF in 2022. The D.C. Court of Appeals stated that the SEC “failed to explain its different treatment of similar products.”

The latest surge was induced by a rumour that BlackRock was planning to seed its spot Bitcoin ETF on 24 October. The event has pushed the largest cryptocurrency to surpass $30,000 again. And the lingering optimism took it to exceed the key resistance of $37,000 in early November.

However, the SEC has not signed off on Bitcoin Spot ETF applications just yet. The progress looks promising, with some experts expecting the first approval to be in 2024. Apart from BlackRock, other asset management firms, such as WisdomTree and Valkyrie, are also awaiting approval from the commission.

What role does the Fed play in driving Bitcoin’s trend?

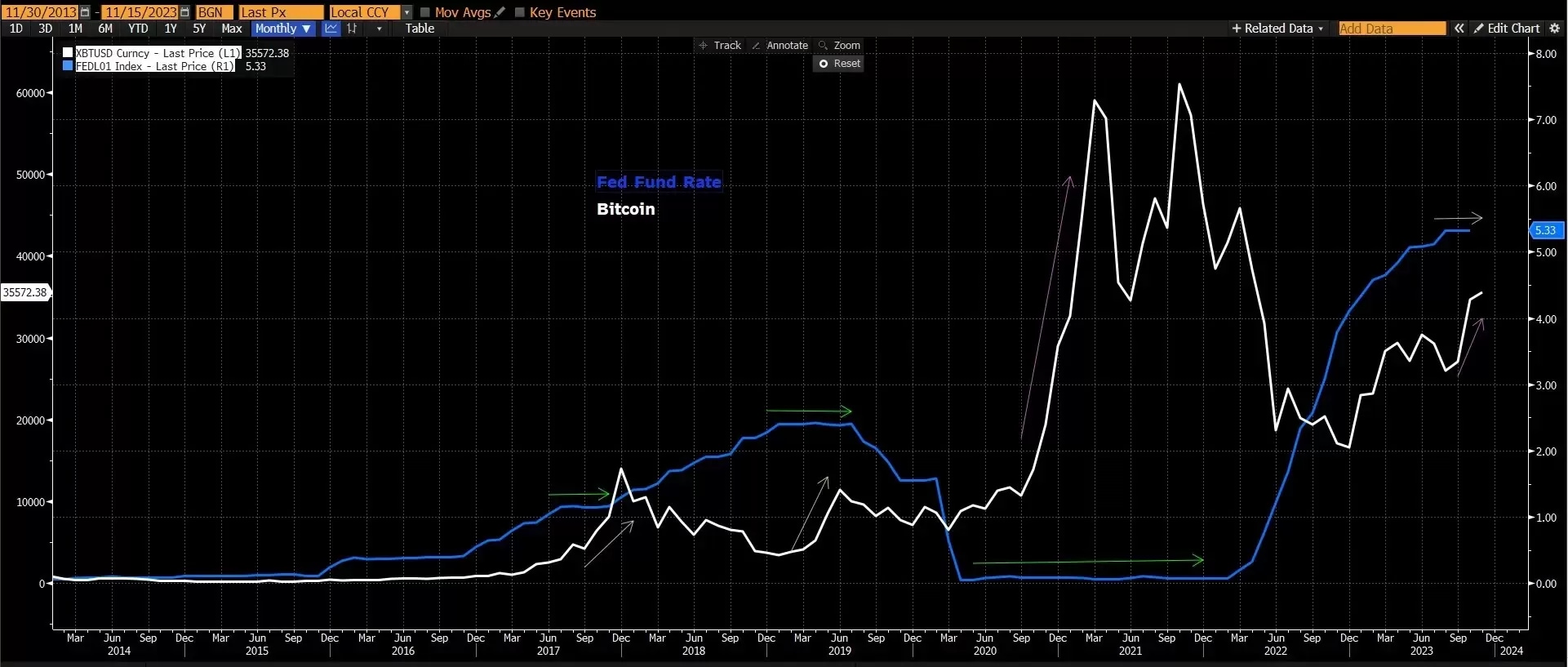

In fact, Bitcoin’s bullish momentum was not only the cause of the spot ETF optimism but also the macro play out. In history, the Bitcoin bullish markets always happened during a rate-cut or a rate-plateau period. Bitcoin spiked when the US Fed stopped hiking rates between July and December in 2017, and between April and June in 2019. And the latest bull run happened after the Fed slashed the interest rates to nearly zero during the pandemic era in 2020 and 2021. This is mostly due to the liquidity conditions in the markets. Hot money flooded into risky assets when central banks injected liquidity into the economy. The pattern also showed that Bitcoin’s bullish cycle has an interval of between 15 and 18 months. The last bull market started in March 2019 and peaked in March 2021, which lasted for about two years. The period echoes the peaking rate to a rate-cut cycle of the US Fed. In a scenario that the Fed has done with its tightening job in the current hiking cycle, Bitcoin may repeat its pattern. The latest uptrend has been established from January this year, and the bullish momentum could continue to the end of 2024 if history repeats itself. Bitcoin’s price rose by more than 10 times in every bullish cycle in the past, which indicates that the price may reach above $170,000 from its low in January this time.

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.