Trade CFDs with an award-winning provider¹

- Create an account and trade on 11,000+ instruments across forex, indices, commodities, shares, ETFs, treasuries and more

Enjoy tight spreads and lightning-fast execution², with no hidden fees

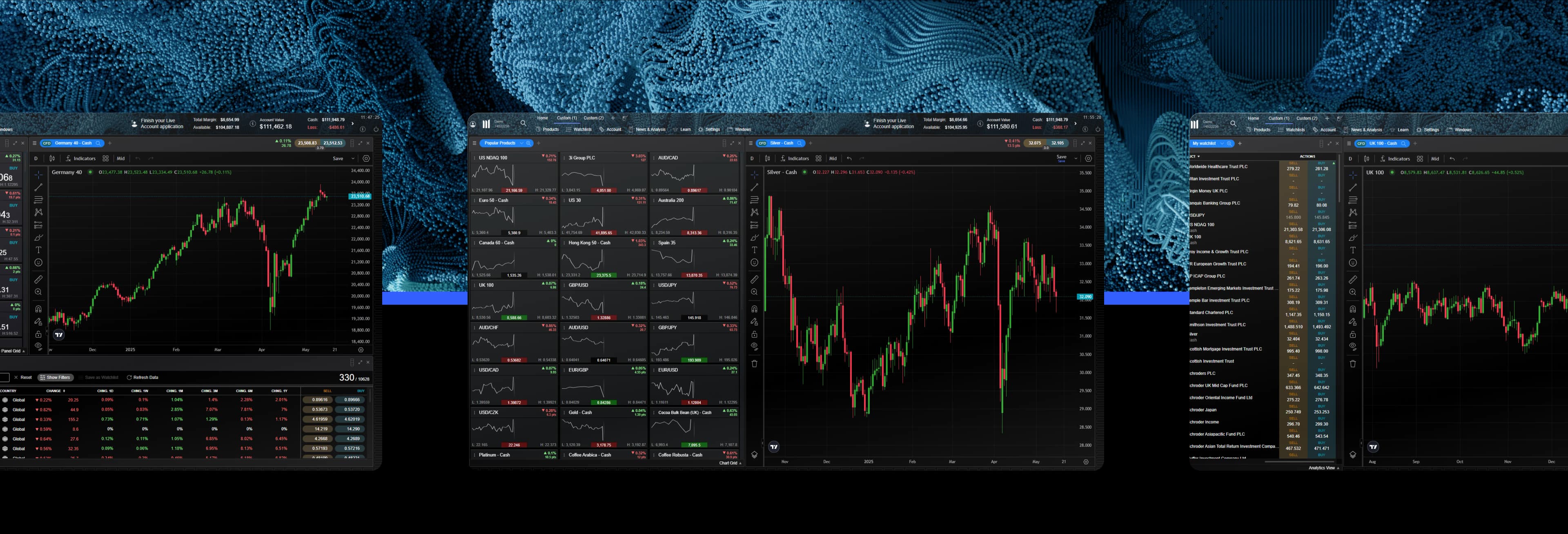

Access precise charting and advanced tools

ForexBrokers.com Awards

Good Money Guide Awards

ADVFN International Financial Awards

What is CFD trading?

CFD (contracts for difference) trading enables traders to speculate on the performance of markets such as forex, indices, commodities, and shares, without owning the underlying asset.

Why open a CFD trading account with us?

See bid and ask prices, premiums, and other relevant costs clearly before you trade. Enjoy $0 commission on all global shares.

Deposit from just 2.2% of the full value of your position to open a trade.

Experience competitive spreads across our full range of instruments.

Trade on 11,000+ instruments across forex, indices, commodities, shares, ETFs, treasuries.

Benefit from selling (shorting) as well as buying opportunities.

Gather and analyze data with TradingView charts, 115+ indicators ,and drawing tools.

Experienced customer service available 24/5 in EN, FR, and ZH to support you in your trading.

What are other traders saying about CMC Markets?

How we support our traders

You can contact us whenever the markets are open, from Sunday night to Friday night, when our experienced customer service team will be happy to help.

Our free educational resources cover everything from the stock markets to the intricacies of CFD trading.

Trade forex on award-winning platforms³

To trade with us, you choose a CFD account that suits the platform you want to use.

The standard CFD account provides access to our proprietary and award-winning CMC platform, available on PC and mobile. This account can also be linked to TradingView.

To trade on MT4, you must create a separate MT4 CFD account. This account is only compatible with MT4 and does not provide access to the CMC Platform or TradingView.

ForexBrokers.com Awards

CMC platform

ADVFN International Financial Awards

Mobile app

Get the functionality of our web platform in your pocket with mobile-optimized charting, full order-ticket features and real-time alerts

Trade CFDs on MT4

MT4 (MetaTrader4)

Trade on the world's most popular platform with our suite of free premium MT4 indicators and Expert Advisors.

Award-winning CFD broker

ForexBrokers.com Awards

Professional Trader Awards

ADVFN International Financial Awards

Good Money Guide Awards

FAQs

A contract for difference (CFD) is a derivative product which enables you to trade on the price movements of underlying financial assets (such as forex, indices, commodities, shares and treasuries). It's an agreement to exchange the difference in the value of an asset from the time the contract is opened until the time it's closed.

With a CFD, you never actually own the asset or instrument you're trading, but you can still benefit if the market moves in your favour, or make a loss should the market move against you.

Trading CFDs involves trading on leverage, which means that you can enter a position with a set initial deposit, known as the margin requirement. It's important to remember that leverage amplifies your gains and losses in equal measure, based on the full value of the trade, and not just the initial margin amount.

The main difference between CFD trading and share trading is that you don't own the underlying share when you trade on a share CFD. With CFDs, you never actually buy or sell the underlying asset that you've chosen to trade, but you can still benefit if the market moves in your favour, or make a loss if it moves against you. However, with traditional share trading, you enter a contract to exchange the legal ownership of the shares for money, and you own this equity.

When trading CFDs, it's important to understand the risks associated with financial trading in general, as well as the risks that are specific to trading CFDs. The main risks associated with trading CFDs relate to trading with leverage, account close-out, market volatility and market gapping.

Stay on top of breaking economic news events and discover what's moving the financial markets, with commentary from our global market analysts in our news and analysis section.

As a CMC client, your money is held separately from CMC Markets’ own money and is held on trust in segregated bank accounts with a Canadian bank. This account is opened and maintained in the name of CMC Markets Canada Inc. We do not use client money to hedge our positions or to meet the trading obligations of other customers. This offers you financial security and you can rest assured that your money with us is protected.

Yes, CMC Markets Canada Inc. is a member of the Canadian Investment Regulatory Organization (CIRO). CFDs are distributed in Canada by CMC Markets Canada Inc. acting as principal.

There's no cost when opening a live trading account with us. You can also view prices and use tools such as charts, Reuters news or Morningstar quantitative equity reports, free of charge. However, you'll need to deposit funds in your account to place a trade.

Our income primarily comes from our spreads, while other fees, such as overnight holding costs, make a minor contribution to our overall revenue.

Dive deeper

What is CFD trading?

Find out how contracts for difference work and explore the potential benefits.

How to trade CFDs

Learn the basics of CFD trading, from selecting a market to managing your first position.

Advantages and disadvantages of CFD trading

Understand the pros and cons of CFD trading, including flexibility, leverage, and potential risks.

Ready to get started?

Start trading with a live account today or try a demo with $10,000 of virtual funds.

Do you have any questions?

Our client services team is here whenever the markets are open.

Email us at clientmanagement@cmcmarkets.ca or call us on 1-866-884-2608.