What is forex trading? A guide for Canadian traders

Foreign exchange (forex) trading, is the buying and selling of one currency against another, in what is the world's most actively traded market.

The forex market operates 24/5, giving Canadian traders flexibility to trade around their schedule. Popular pairs for Canadian traders include USD/CAD (the "Loonie"), EUR/CAD, CAD/JPY, and major pairs like EUR/USD and GBP/USD.

In Canada, forex is traded through CFDs, allowing you to speculate on price movements with leverage. CMC Markets is regulated by CIRO, with your funds held in segregated accounts.

Learn more about forex trading

Account types for every trader

Forex trading tools and calculators

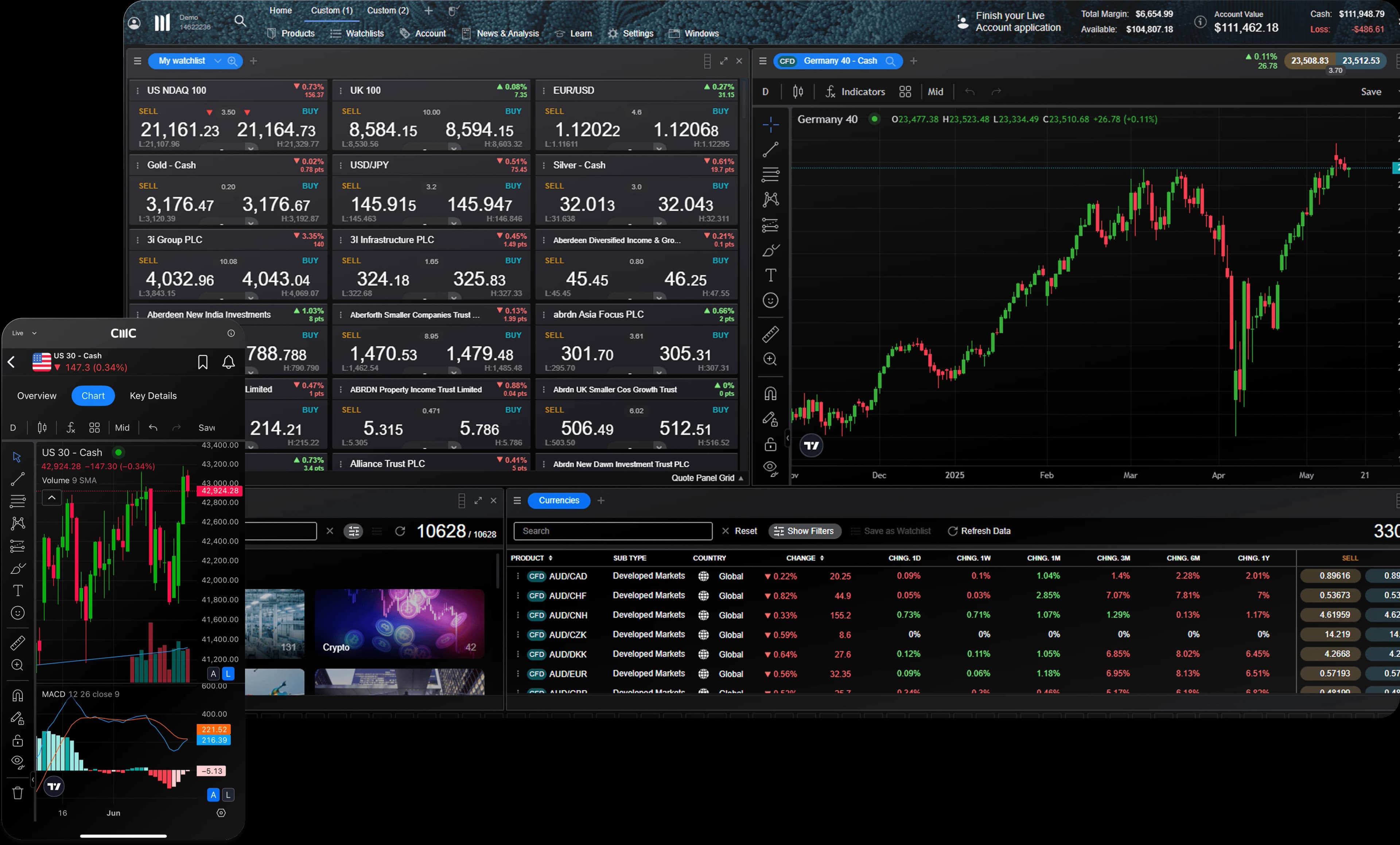

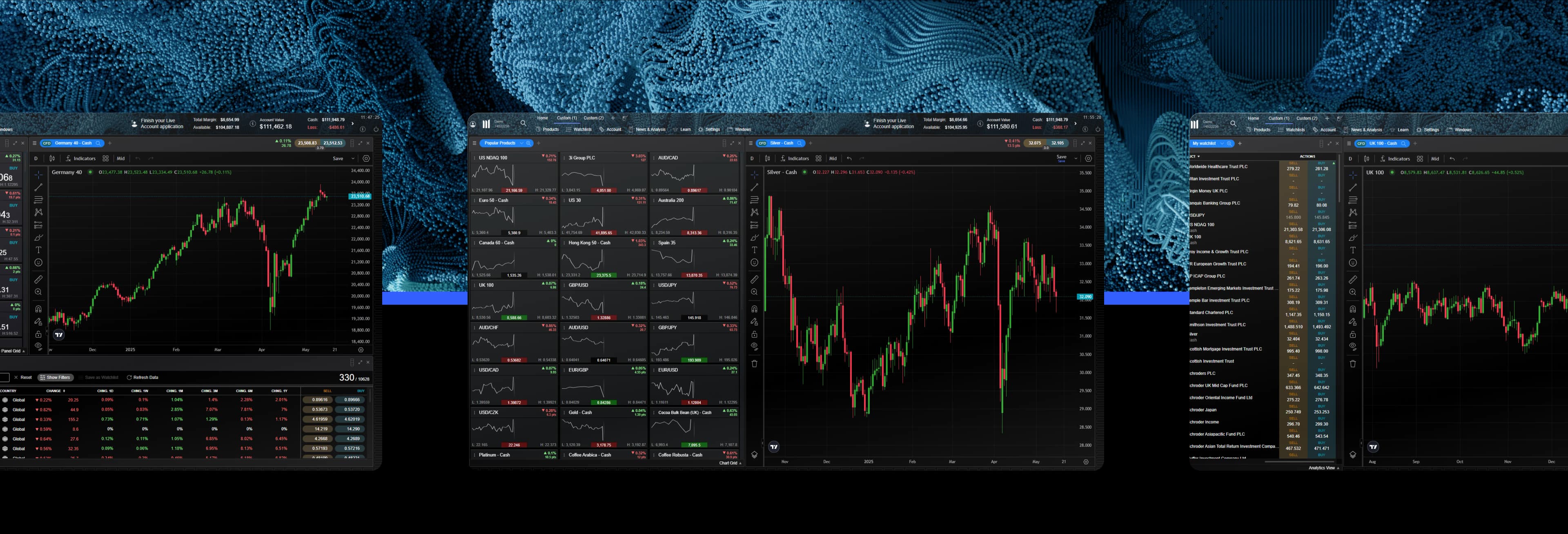

Make smarter trading decisions with our suite of professional forex tools. Calculate pip values, position sizes, and potential profits before you trade. Access advanced charting with 115+ technical indicators, pattern recognition scanners, and real-time market analysis.

Our tools help you manage risk, identify potential opportunities, and refine your forex trading strategy - all available free on our award-winning platform*. From beginners calculating their first trade to experienced traders running technical analysis, we provide the tools you need to trade with confidence.

Dive deeper

Do you have any questions?

Our client services team is here whenever the markets are open.

Email us at clientmanagement@cmcmarkets.ca or call us on 1-866-884-2608.