What is indices trading?

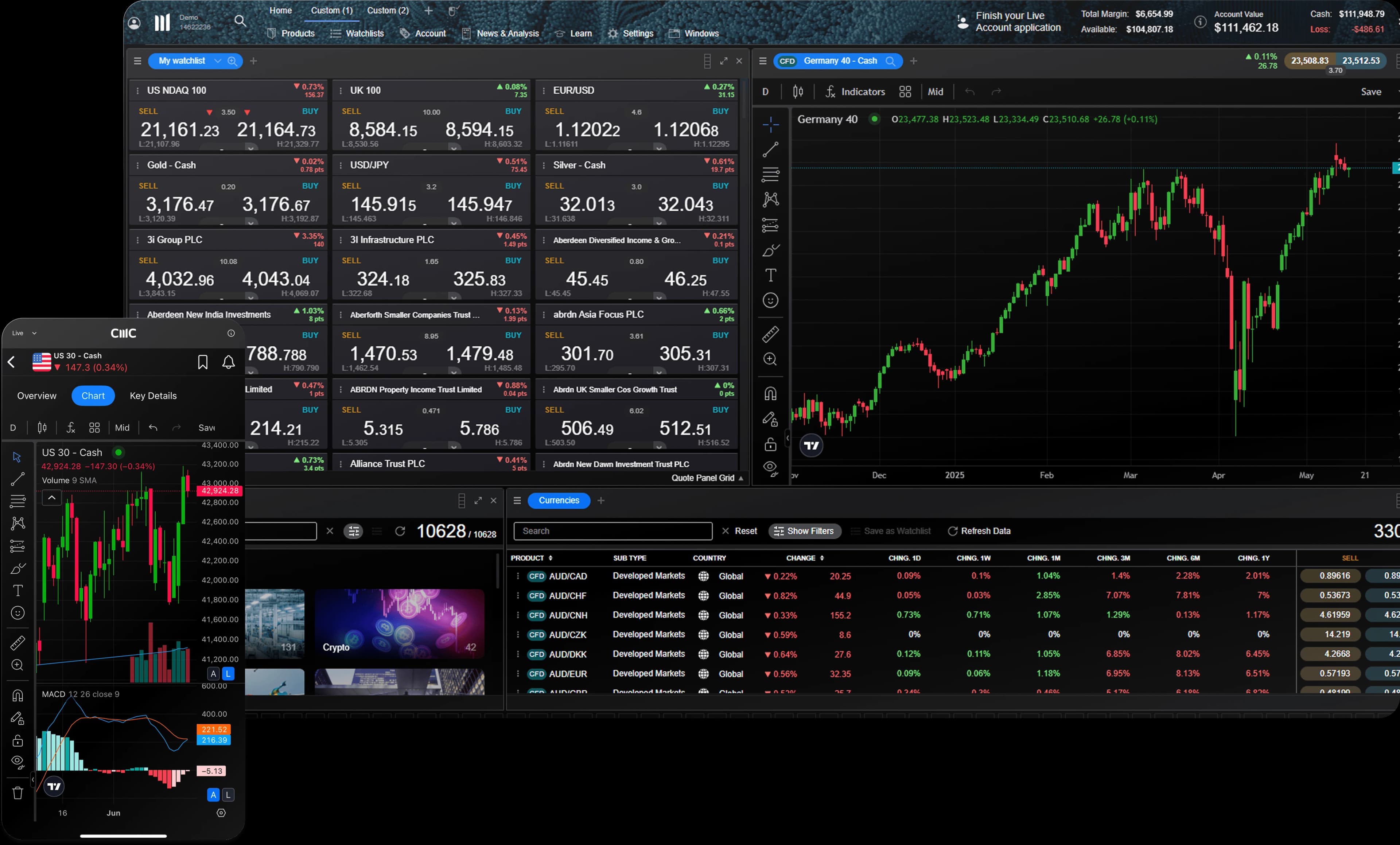

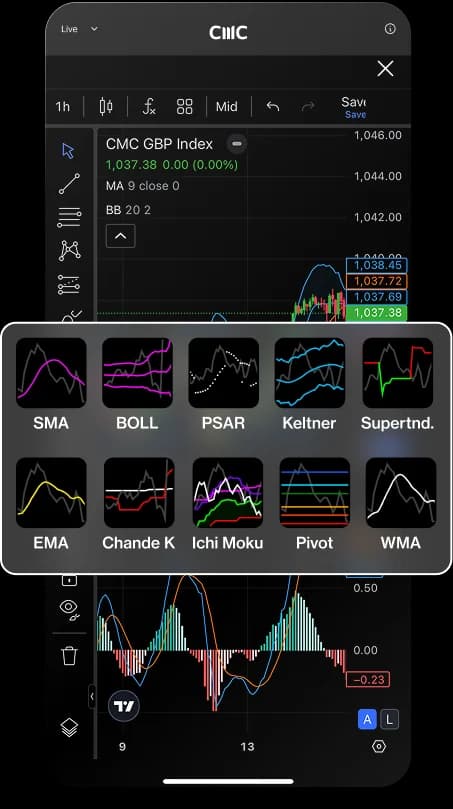

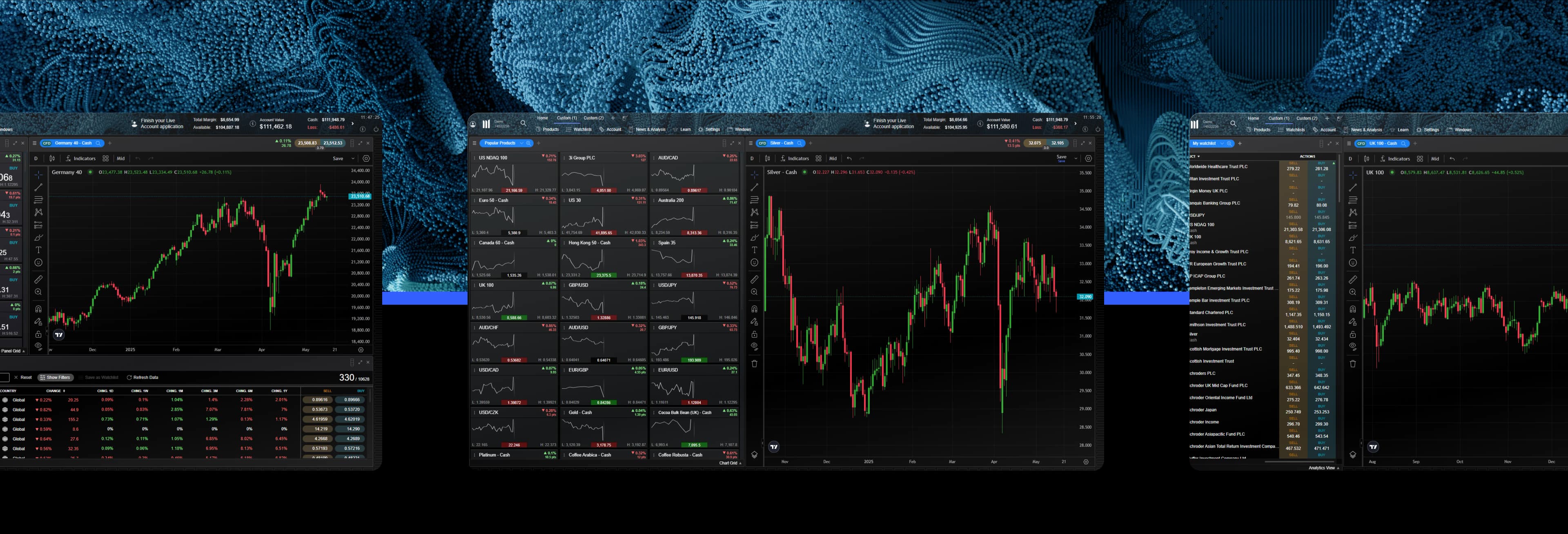

Indices trading is the buying and selling of a group of stocks that make up an index, such as our US 30 index (Dow Jones), which tracks 30 large publicly traded companies on the New York Stock Exchange.

Trading on indices is popular with short-term traders who want to speculate on highly-liquid assets, with tight spreads and minimal slippage. Speculating on indices offers traders exposure to a wide range of stocks.

Why trade indices with us?

Dive deeper

Do you have any questions?

Our client services team is here whenever the markets are open.

Email us at clientmanagement@cmcmarkets.ca or call us on 1-866-884-2608.

1 0.009 seconds CFD median trade execution time on CMC Markets' web and mobile platforms, 1 April 2024-31 March 2025.

2 Best Mobile Trading Platform, ADVFN International Financial Awards 2024; No.1 Web Platform, ForexBrokers.com Awards 2023; No.1 Most Currency Pairs, ForexBrokers.com Awards 2023; Best Charting (Germany), Investment Trends Leverage Trading Report 2023; Best Customer Service (Germany), Investment Trends Leverage Trading Report 2023; Best In-House Analysts, Professional Trader Awards 2023; No.1 Platform Technology (UK), ForexBrokers.com Awards 2022; Best CFD Provider (UK), Online Money Awards 2022; Industry Pioneer with "Outstanding" Customer Rating (Germany), Focus Money Test Edition 36/2022, "Very good" Trading Platform (Germany), Deutsches Kundeninstitut (DKI) Survey 2022.

3Based on over 2 million unique user logins across CMC's trading and investing platforms, including partners, as at November 2025.

Loading...

Loading...