Index Trading

Index trading allows you to speculate on the price movement of entire stock markets without having to pick individual stocks.

With us, you can trade on indices via spread betting or CFDs, giving you exposure to major markets like the S&P 500, FTSE 100, and Dow Jones with leverage.

Why Trade Indices With CMC Markets

Your Favourites in One Place

Trade on more than 80 cash and forward indices based on S&P 500, FTSE 100 and dozens of other global markets.

Precise Pricing

We combine multiple feeds from tier-one banks to get you the most accurate bid/ask prices.

Minimal Slippage

With fully automated, lightning-fast execution in 0.0040 seconds.

Professional Research

Free access to quantitative equity analysis from Morningstar.

Dedicated Customer Service

Our experienced team is here whenever the markets are open to support you on your trading journey.

No Partial Fills

No dealer intervention - we don't reject or partially fill trades based on size.

Index Trading Costs

Index trading lets you capture the movement of entire markets like the S&P 500, FTSE 100, or Dow Jones without analysing individual stocks. Trade indices via CFDs with leverage, giving you efficient exposure to major global economies and sectors in a single position.

*Rebate amount is in USD and per million in turnover

Account Types for Every Trader

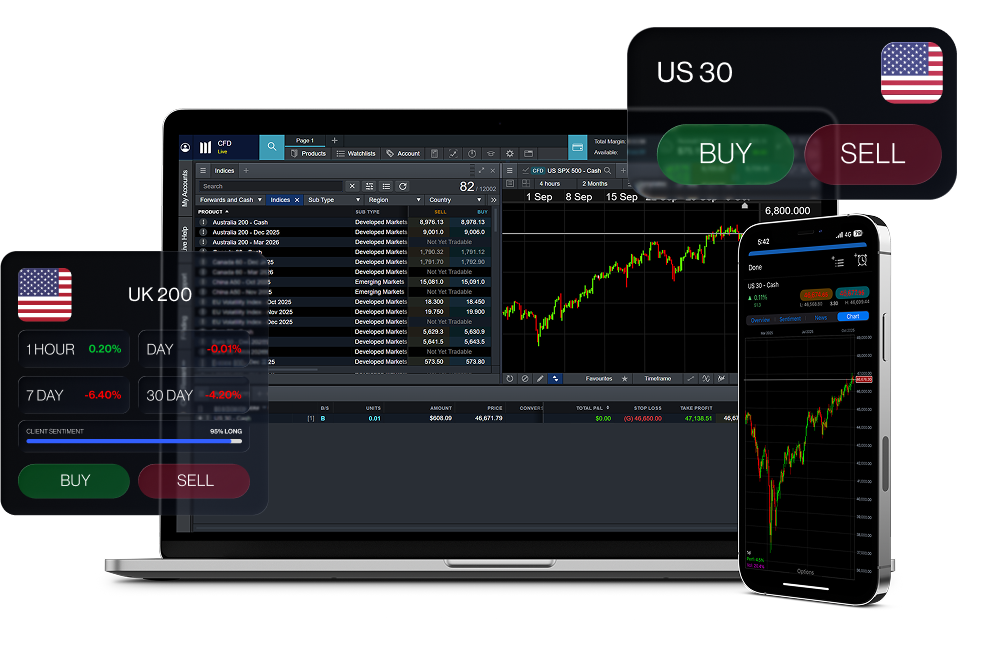

Get access to over 80 cash and forward indices on our platform.

Our award-winning proprietary trading platform combines institutional-grade features and security, with lightning-fast execution and best-in-class insight and analysis.

Trade CFDs on popular indices, forex pairs, commodities and cryptocurrencies with the world's favourite trading platform, backed by our exceptional service.