The narrative surrounding Chinese technology stocks has undergone a remarkable transformation in 2025, one that investors can no longer afford to ignore. While much of the investment world remains fixated on the expensive valuations of America's Magnificent 7, a compelling arbitrage opportunity has emerged just across the South China Sea.

The 'Dragon 7' — China's equivalent of the U.S. Magnificent 7 — represents the seven most influential and innovative Chinese technology giants that dominate the digital economy. These companies includeTencent,Alibaba,JD.com,PDD Holdings(Pinduoduo),Meituan,Baidu, andNetEase, collectively chosen for their scale, growth, and transformative impact on China's economy.

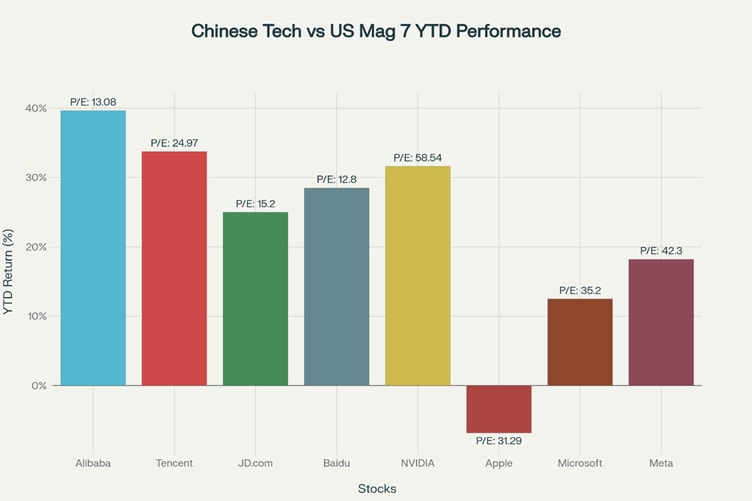

Chinese tech megacaps havedelivered a staggering US9 billion rallyfrom 1 Jan 2025 and 7 March 2025, with companies likeAlibaba posting 39.66% returns while trading at just 13.08x P/E— a stark contrast toApple's 31.29x P/E amid negative 6.84% performance.

Comparison between Alibaba and Apple stock prices, source: TradingView data

Major 'Dragon 7' members including Tencent (August 13), Alibaba (August 14), JD.com (August 14), and Meituan (August 22) are set to report earnings through the remainder of August. This earnings season is positioned to catalyse broader investor recognition of this value proposition.

The Policy Pivot That Changed Everything

The most significant development for Chinese tech investment came in February 2025, whenPresident Xi Jinping's technology symposiumformally ended the regulatory crackdown era that began in 2020. For the first time since 2018, tech leaders including Alibaba's Jack Ma, Huawei's Ren Zhengfei, and Tencent's Pony Ma gathered in Beijing, sending an unambiguous signal that private technology firms are now viewed as critical engines of innovation and growth.

This policy reversal extends far beyond symbolic gestures. China's 2025 agenda allocates substantial resources through atrillion-yuan tech fund supporting AI, quantum technologies, semiconductors, and green innovation. The transformation from the "common prosperity" constraints of 2018-2024 to today's emphasis on geopolitical tech autonomy creates a fundamentally different operating environment for Chinese tech companies.

This shift is particularly relevant for APAC investors who understand the importance of policy alignment in Asian markets. The Chinese government's strategic embrace of its tech champions mirrors successful technology development policies we've witnessed across the region, from South Korea's chaebol system to Singapore's own smart nation initiatives.

DeepSeek's Validation Moment

The emergence of DeepSeek as a formidable AI competitor has fundamentally altered global perceptions of China's technological capabilities. DeepSeek's R1 modelachieved performance comparable to OpenAI's offerings while utilising just US.6 million in development costs; a fraction of the hundreds of millions spent by Western competitors. This breakthrough demonstrates that Chinese companies can develop cutting-edge AI models despite US export restrictions on advanced semiconductors.

For institutional investors, this technological validation reduces one of the primary concerns about Chinese tech stocks: long-term competitive positioning. When Tencent became the first major Chinese tech companyto integrate DeepSeek technology into WeChat and its AI assistant Yuanbao, it showcased how Chinese companies can leverage domestic innovation to maintain competitive advantages that international players cannot easily replicate in the Chinese market.

The Valuation Arbitrage Value Investors Can't Ignore

For value-conscious Asian investors, Chinese tech companies trade at an average price-to-earnings ratio of 18x forward earnings, representing more than a 40% discount to the Magnificent 7 despite comparable or superior growth prospects.

Consider these comparisons:

- Tencent: 24.97x P/E with 33.75% YTD gains vs.NVIDIA: 58.54x P/E with 31.63% YTD performance

- JD.com: Approximately 15.2x P/E with 25%+ YTD returns vs.Tesla: 85.2x P/E with -12.4% YTD performance

What makes this particularly attractive for Singapore-based investors is the additional layer of diversification these positions provide. While maintaining exposure to global technology trends, investors can benefit from China's domestic consumption recovery and the government's stimulus measures designed to boost spending in categories where e-commerce platforms maintain strong market positions.

Earnings Season: The Catalyst for Recognition

As major Chinese tech companies report through August 22, we're witnessing broad-based earnings recovery with Q2 2025 growth expectations exceeding forecasts.Tencent's anticipated 10.8% year-over-year revenue growth, driven byAI integration across its 1.4 billion monthly active WeChat users, exemplifies how Chinese companies are monetising technological capabilities at scale.

Alibaba's cloud division,reporting 18% revenue growth— the fastest since 2022 —with AI-related sales achieving triple-digit growth for seven consecutive quarters, validates the sector's transformation from regulatory target to innovation champion. These improvements represent structural advantages in the world's largest consumer market.

For active traders in our region, the earnings volatility creates tactical opportunities. Historical patternssuggest Chinese tech stocks often experience volatility spikes before earnings, creating entry opportunities for patient investors, followed by sustained outperformance lasting 4-6 weeks for companies beating expectations.

Strategic Implications for APAC Portfolios

From a portfolio construction perspective, Chinese tech stocks offer superior risk-adjusted returns through several structural advantages that resonate with regional investment themes. The scale economics of Chinese cloud providers leveraging massive domestic user bases, regulatory alignment creating natural barriers for foreign competitors, and deep integration with traditional Chinese industries provide sustainable competitive moats.

The currency dimension adds another layer of opportunity. USD/CNY volatility has created additional risk, but hedging costs have declined significantly in 2025, making hedged exposure more attractive. Many Chinese tech companies generate significant international revenue, providing natural hedging, while strategic allocation timing can capitalise on currency dislocations.

Looking Forward: A Generational Shift

The transformation of Chinese tech from "un-investable" regulatory targets to strategic innovation champions represents one of the most significant shifts in global technology investment. Early recognition and positioning in this transition offers substantial alpha generation potential as the broader investment community adjusts to this new reality.

The convergence of attractive valuations, improving fundamentals, supportive policy environment, and validated technological competitiveness creates a compelling case for Chinese tech stocks as alternatives to increasingly expensive US Magnificent 7 companies. The current earnings season provides an optimal entry point for investors seeking exposure to what may prove to be the next decade's most significant technology investment theme.

For traders and investors in Asia-Pacific, the question is no longer whether to consider Chinese tech exposure, but how quickly to position for what appears to be a multi-year revaluation cycle. The great tech rotation is underway, and Singapore's proximity to this transformation provides a strategic advantage for those prepared to act on it.

Disclaimer: CMC Markets Singapore may provide or make available research analysis or reports prepared or issued by entities within the CMC Markets group of companies, located and regulated under the laws in a foreign jurisdictions, in accordance with regulation 32C of the Financial Advisers Regulations. Where such information is issued or promulgated to a person who is not an accredited investor, expert investor or institutional investor, CMC Markets Singapore accepts legal responsibility for the contents of the analysis or report, to the extent required by law. Recipients of such information who are resident in Singapore may contact CMC Markets Singapore on 1800 559 6000 for any matters arising from or in connection with the information.