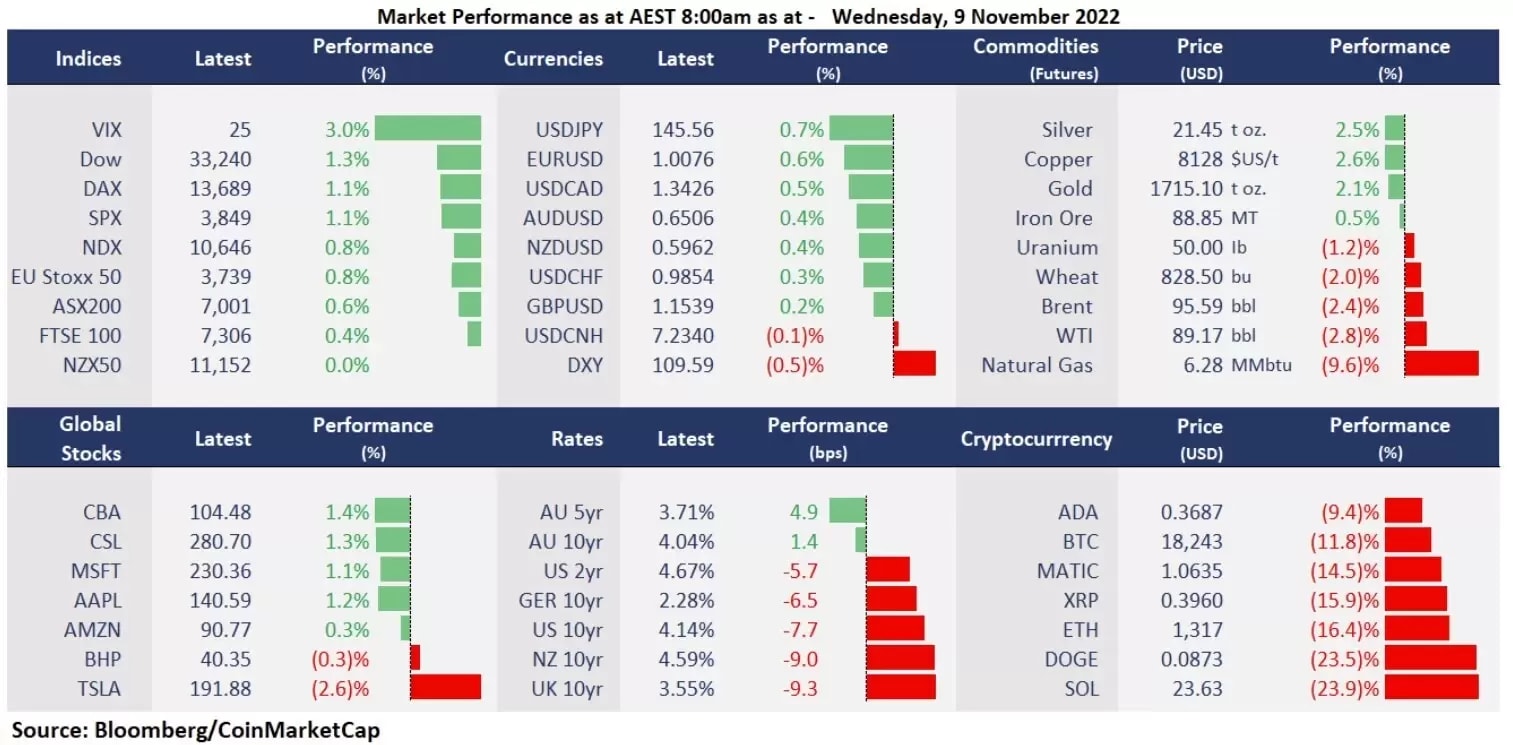

Wall Street extends the third straight trading day gains amid the US midterm election optimism after a volatile session due to a plunge in cryptocurrencies. While hopes for Republican control in House or Senate pushed up equity markets, sending both bond yields and the US dollar down, an FTX liquidity crunch-induced crash in cryptocurrencies weighed down risk assets, dragging major US indices off session highs. Gold futures popped more than $30 dollars per ounce due to a softened US dollar, to a one-month high. The crude oil, however, tumbled nearly 3% amid China’s widened Covid lockdowns. Cryptocurrencies experienced another liquidity crunch-induced selloff after the so-called stable Coin, LUNAUSTD collapsed in June amid FTX’s native token, FTT’s 80% crash.

- Industrials and Materials continued to lead Dow to outperform SPX and Nasdaq. 10 out of sectors in the S&P 500 finished higher, with Materials, technology, and Industrials leading gains, up 1.7%, 0.92%, and 0.86%, respectively. Consumer discretionary was the only sector that closed in red, down 0.3% due to a third straight trading day drop in Tesla's shares.

- Bitcoin plunged 12% amid Binance’s acquisition offer to Sam Bankman-Fried’s FTX to rescue the company from a liquidity crisis. The FTX native token, FTT plunged 80% in the last 24 hours on Binance CEO Changpeng Zhao’s announcement to offload the company’s entire holding of FTT.

- Disney shares fell 6.4% in after-hours trading due to a miss on both EPS and revenue expectations in the third quarter, despite a positive outlook in its streaming industry, Disney +. The company’s EPS is at $0.30 vs. the $0.55 estimated, and the revenue is at $20.15 billion vs. the $21.24 billion expected.

- Most Asian equity markets are set to open mixed. ASX futures were up 0.49%, Nikkei 225 futures were slightly down 0.04% and Hang Seng Index futures were up 0.19%. The Chinese CPI and PPI data will be on close watch in today’s Asian session.

- Gold popped more than $30 to a one-month high amid a drop in the global bond yields and a softened US dollar. The precious metal had a major bullish break out on the key resistance of 1,680, potentially reversing its multi-month downtrend since March.

- Crude oil slumped 3% amid China’s expanding Covid lockdowns, and US midterm elections, ahead of the key US CPI data, among which darkened demand outlooks in China may have a major impact on the oil prices.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.