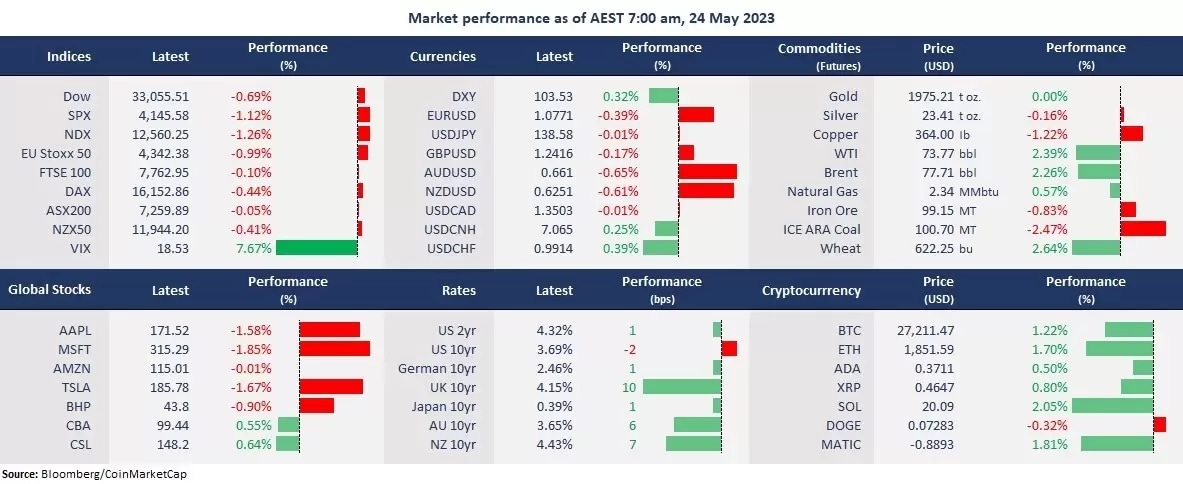

While the debt ceiling talk runs out of time, the default risk jittered short-dated bond markets, with the yield on the treasury bills maturing in early to mid-June hitting almost 6%. Treasury Secretary Janet Yellen warned of a deadline of 1 June when the government could be unable to pay its bills if the debt ceiling cannot be raised. US stock markets took a hit by the ongoing government drama, with three benchmark indexes finishing lower, led by growth stocks as the fear gauge, the VIX, jumped 7.7% to 18.53, the highest since 5 May.

Rising rates lifted the US dollar further, sending all the other currencies lower, typically in the commodity currencies, such as the Australian dollar and the New Zealand dollar, which are the most sensitive to risk sentiment. Commodities were mixed, with gold flat, copper lower, and oil rising on supply concerns.

Most Asian markets finished lower on Tuesday as sentiment soured amid the US debt default risk and Chinese economic concerns. The Japanese market snapped a seven-day winning streak, and Hong Kong equities fell to a two-month low. Elsewhere in the APAC, the Reserve Bank of New Zealand is expected to raise the Official Cash Rate (OCR) by another 25 basis points to continue combating inflation. And futures are pointing to a lower open across Asian stock markets, with the ASX 200 futures down 0.48%, the Hang Seng Index futures down 0.78%, and Nikkei 225 sliding 0.58%.

Price movers:

- 10 out of 11 sectors in the S&P 500 finished lower, with materials and communication services leading losses, down 1.54% and 1.48%, respectively. Energy is the only sector that ended in the green, up 1.04% due to a rebound in oil prices.

- Apple made a multibillion-dollar deal with Broadcom to develop 5G radio frequency components in the US. Apple said the deal is part of its 2021 commitment to invest US$430 billion in the economy. Apple’s shares fell 1.6%, and Broadcom’s stocks jumped on the news but pulled back from the day high of US$864.54, up 1.3% from the closing price on Monday.

- Alibaba’s US-listed ADR shares fell 3.8% on an announcement of cutting 7% of its workforce in the cloud division to prepare for a spinoff and an independent IPO of the unit.

- Rocket Lab’s shares slumped 6.7% following the news that the bankrupt rocket company Virgin Orbit sold its facility leases and equipment worth US$16.1 million to aerospace manufacturer Rocket Lab, founded in New Zealand. The purchase includes 3D printers and a specialty tank welding machine.

- Crude oil jumped on speculations that OPEC+ may cut outputs further to keep price stability. The US crude stockpiles also fell by 6.799 million barrels during the week ended 19 May, more than expected, according to API data.

ASX and NZX announcements/news:

- Transportation technology services company EROAD Limited (NZX/ASX: ERD reported normalized FY23 revenue of NZ$165.3 million, above guidance of between NZ$159 million and NZ$164 million. Reported revenue increased 52% to NZ$174.9 million. Profit improved from a loss of NZ$7.2 million in FY22 to a profit of NZ$1.7 million in FY23.

Today’s agenda:

- New Zealand’s Q1 retail sales.

- RBNZ Rate Decision.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.