Calculating spread betting margins

In order to open a position on your account, you will need to deposit an amount of money known as margin.

The margin you will be required to deposit reflects a percentage of the full value of the position you wish to open. We refer to this as position margin on our platform. The position margin will be calculated using the applicable margin rates, as shown in the product library on the platform.

For shares, different margin rates may apply depending on the size of your position or the tier of your position (or a portion of your position) in that instrument. The portion of the position that falls within each tier is subject to the margin rate applicable to that tier.

In order to calculate the position margin, the level 1 mid-price (shown on the platform) is used.

Position margin example

Company ABC (GBP) margin rates

| Tier | Position size (stake) | Margin rate |

|---|---|---|

| 1 | 1-10 | 20% |

| 2 | >10-30 | 25% |

| 3 | >30-50 | 30% |

| 4 | >50-100 | 35% |

| 5 | >100 | 50% |

Based on the margin rates in the table below for Company ABC (GBP), a position of £65 per point, using the level 1 mid-price of 275 (£2.75), would require a position margin of £5,018.75.

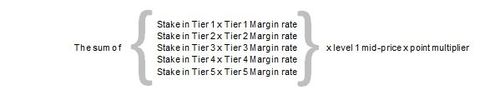

Your position margin requirement is calculated as follows:

| Tier | Position size | Margin rate | |

|---|---|---|---|

| 1 | 10 | 20% | 10 x 275 x 20% = £550 |

| 2 | 20 | 25% | 20 x 275 x 25% = £1,375 |

| 3 | 20 | 30% | 20 x 275 x 30% = £1,650 |

| 4 | 15 | 35% | 15 x 275 x 35% = £1,443.75 |

| 5 | 0 | 50% | 0 |

| Total | 65 | Total = £5,018.75 |

The notional value of your total position is: £17,875.00 (65 x 275).

Spread betting using margin allows you to open a position by only depositing a percentage of the full value of the position. This means that your losses will be amplified and you could lose more than your deposit. Profits and losses are relative to the full value of your position. Spread betting using margin is not necessarily for everyone and you should ensure you understand the risks involved and if necessary seek independent professional advice before placing any spread bets.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.