G'day folks and welcome to another trading day with your friendly, neighbourhood CMC Market Analyst!

For real-time up-to-date data/news/research/ideas/strategies, check out our insights panel on the CMC Markets Invest platform and follow us on Twitter:

Azeem Sheriff -

Tina Teng -

CMC Markets ANZ -

CMC Markets Singapore -

CMC Markets Canada -

Trading Idea of the Day

NASDAQ:INTL - Intel Corporation (BULLISH - long term)

- Key levels on the chart - consider taking trades from key support/resistance zones.

- CHIPS act – roughly $280B boost for new funding in domestic research and manufacturing of semiconductors in USA.

- Direct competition with TSMC in Taiwan.

- Ongoing China/US tensions, it will be difficult for China to invade Taiwan as they will need their support against USA.

- Could we see a paradigm shift back to the US with more investments coming from local companies?

- Dividend yields approximately 5% p/a.

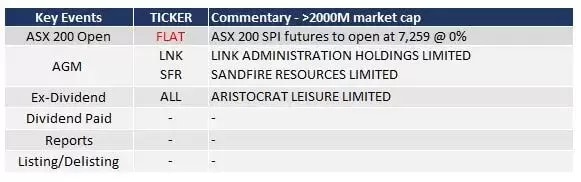

ASX & Economic Key Events

ASX Key Events Calendar (TODAY)

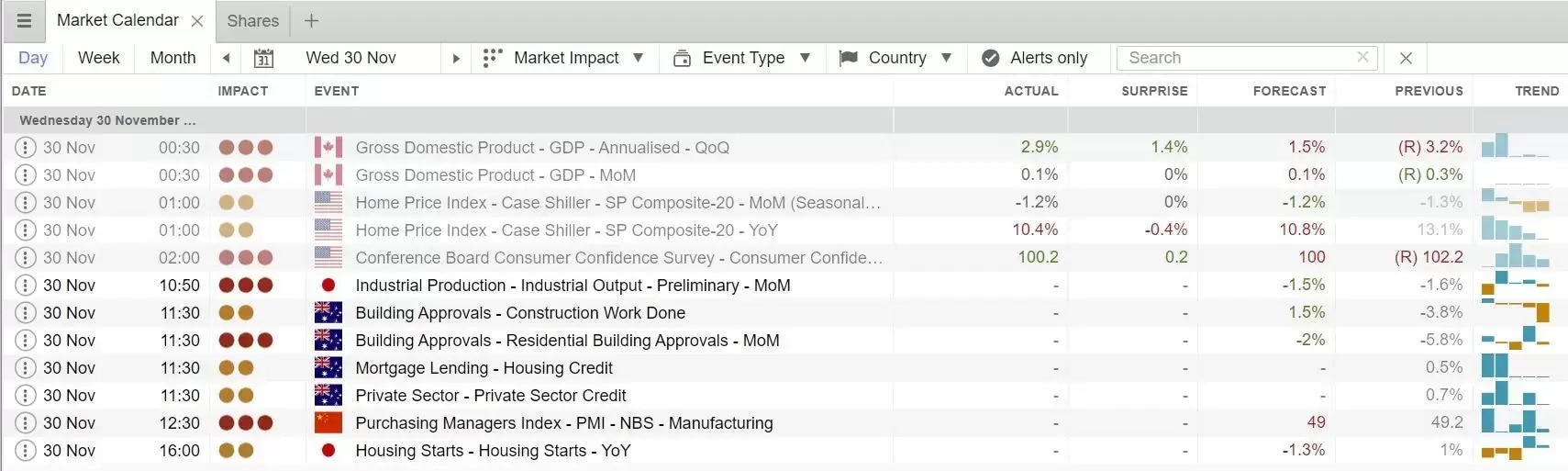

Economic Key Events (TODAY)

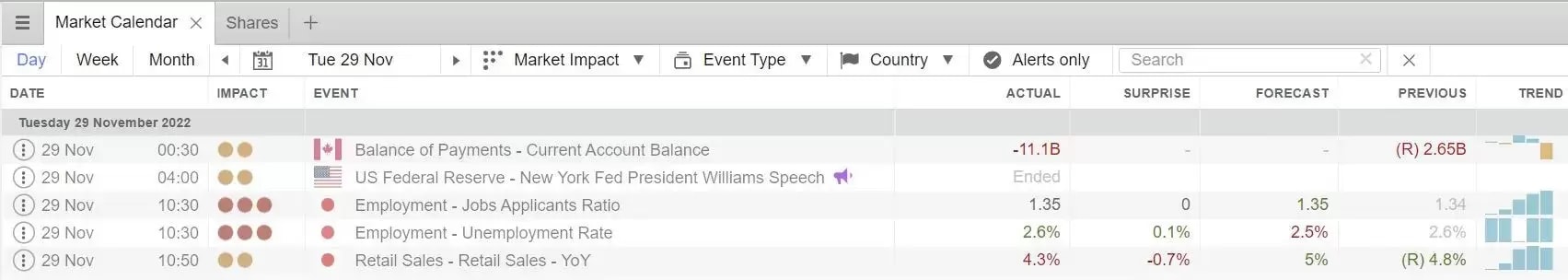

Economic Key Events (YESTERDAY)

OPTO For Investors Research

Article of the Day: Falling dollar boosts US Global Go Gold and Precious Metal Miners ETF

Podcast of the Day: Michael Loukas of TrueMark on why diversification isn’t always key

APAC Daily Report

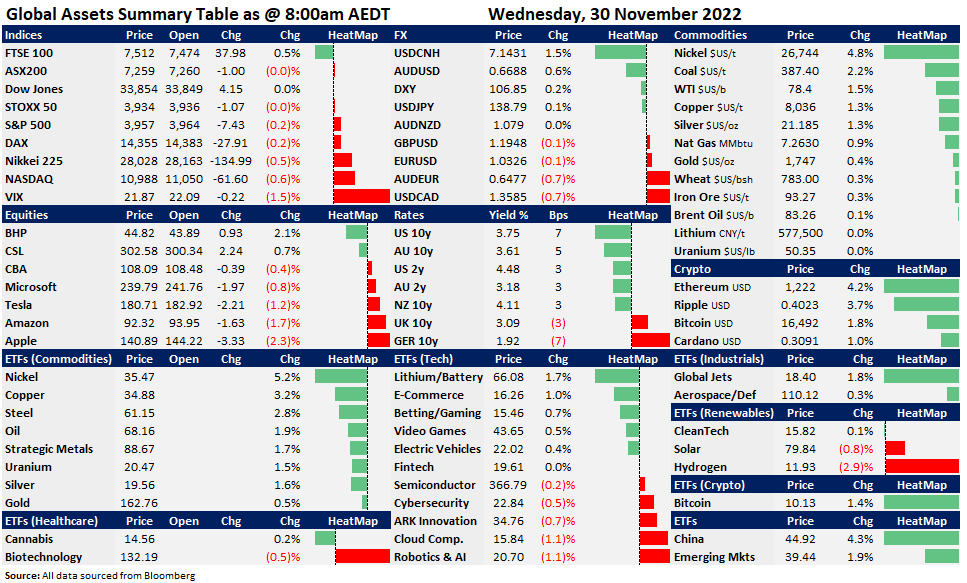

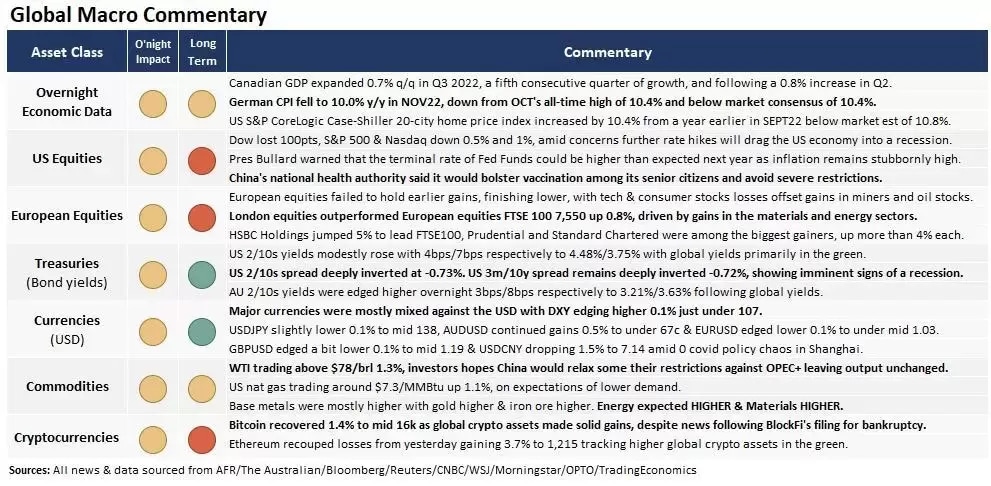

Market Snapshot & Highlights as of 8:00am AEDT

EXPECTATIONS: Energy HIGHER (higher oil prices) & Materials HIGHER on overall commodity prices.

Global Markets Headlines

- ‘Losing is not an option’: Putin is ‘desperate’ to avoid defeat in Ukraine as anxiety rises in Moscow (CNBC)

- Goldman Sachs sees ‘high probability’ of OPEC cut — and expects oil prices to hit $110 next year (CNBC)

- China touts vaccination progress as it seeks reopening path; encourages booster shots for seniors (CNBC)

- iPhone maker Foxconn entices angry workers in China to return as Apple faces supply crunch (CNBC)

- Chinese Tesla rival Nio and giant Tencent partner to work on self-driving tech (CNBC)

- HSBC eyes bumper dividend from $10 billion sale of Canada business to RBC (CNBC)

(All news & data sourced from AFR / The Australian / Bloomberg / Reuters / CNBC / Wall Street Journal / Morningstar / OPTO / Trading Economics)

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.