G'day folks and welcome to another trading day with your friendly, neighbourhood CMC Market Analyst!

For real-time up-to-date data/news/research/ideas/strategies, check out our insights panel on the CMC Markets Invest platform and follow us on Twitter:

Azeem Sheriff -

Tina Teng -

CMC Markets ANZ -

CMC Markets Singapore -

CMC Markets Canada -

Trading Idea of the Day

ASX:PLS - Pilbara Minerals Ltd (BEARISH - short term)

- Key levels on the chart - consider taking trades from key support/resistance zones.

- There is strong bearish momentum to sell off the significantly overbought lithium stocks as per momentum indicators.

- S&P Global says lithium prices are lacking momentum for further increases.

- Chinese lithium carbonate spot prices have fallen 2.5 - 3% over last 2-3 weeks. Falling even further this week.

- Pilbara Minerals and Allkem sold off on rather heavy volumes last Friday from drop in lithium prices.

- China protests adding more fuel to the fire, so no positivity arose out of that.

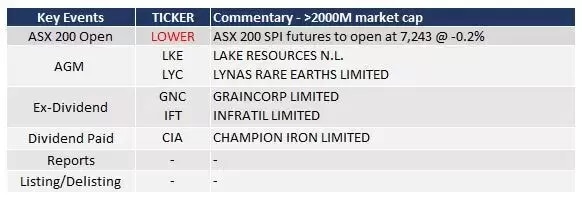

ASX & Economic Key Events

ASX Key Events Calendar (TODAY)

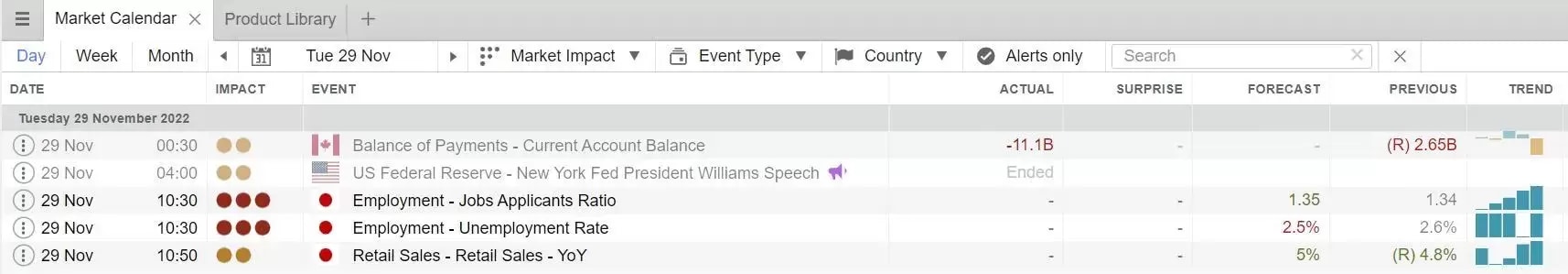

Economic Key Events (TODAY)

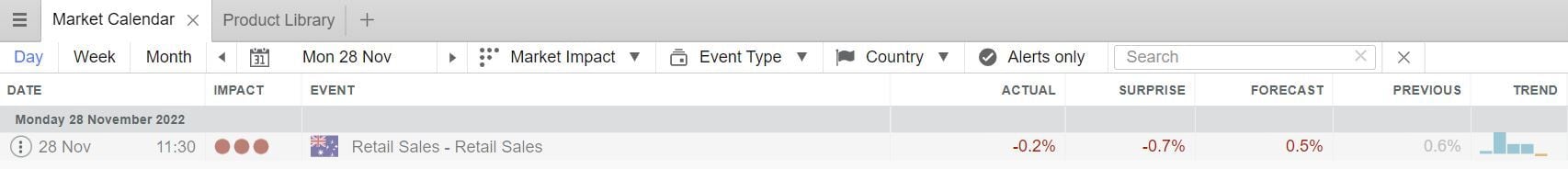

Economic Key Events (YESTERDAY)

OPTO For Investors Research

Article of the Day: Futu and Baidu share prices rise after posting robust revenues

Podcast of the Day: Michael Loukas of TrueMark on why diversification isn’t always key

APAC Daily Report

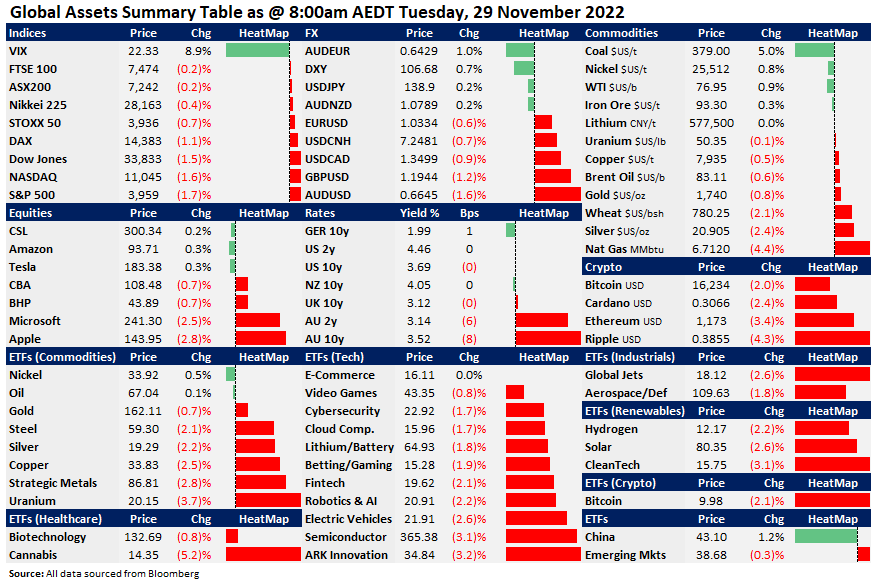

Market Snapshot & Highlights as of 8:00am AEDT

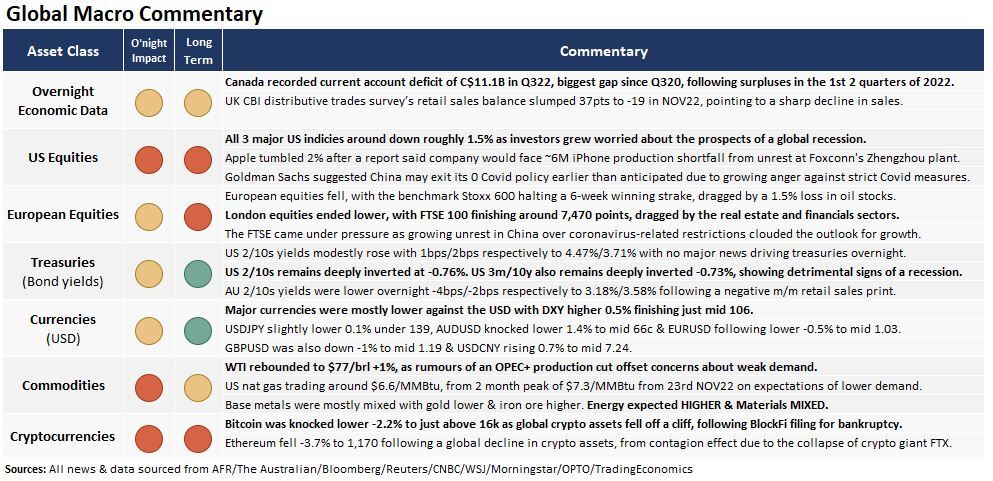

EXPECTATIONS: Energy MIXED (mixed oil prices) & Materials HIGHER on base metal prices.

Global Markets Headlines

- Crypto firm BlockFi files for bankruptcy as FTX fallout spreads (CNBC)

- Disney hiring freeze will stay in place, CEO Bob Iger tells employees (CNBC)

- Anti-lockdown protests showing ‘extraordinary’ breadth across China (CNBC)

- China protests send global stocks lower as strategists see Covid disruption persisting (CNBC)

- China might not make major changes to its Covid policy any time soon, despite weekend protests (CNBC)

- UK property demand slides 44% after market-rocking mini-budget (CNBC)

- BlockFi Files for Bankruptcy as Latest Crypto Casualty (WSJ)

Fed’s Williams Says Inflation Fight Could Last Into 2024 (WSJ)

(All news & data sourced from AFR / The Australian / Bloomberg / Reuters / CNBC / Wall Street Journal / Morningstar / OPTO / Trading Economics)

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.