G'day folks and welcome to another trading day with your friendly, neighbourhood CMC Market Analyst!

For real-time up-to-date data/news/research/ideas/strategies, check out our insights panel on the CMC Markets Invest platform and follow us on Twitter:

Azeem Sheriff -

Tina Teng -

CMC Markets ANZ -

CMC Markets Singapore -

CMC Markets Canada -

Trading Idea of the Day

ASX:ABC - Adbri Ltd - (BULLISH - long term & BEARISH - short term)

- Key levels on the chart - consider taking trades from key support/resistance zones.

- Bearish divergence on RSI (monthly chart).

- MACD suggesting bearish momentum but slowing down.

- Price is at a major key support level not seen since 2009 (21yrs).

- Morgan Stanley says Adbri is a stock most likely to suffer due to weather problems, unless this changes in the near term.

- Morgan Stanley expects market conditions for construction to deteriorate further in 2023.

Morgan Stanley issued the following price target: Adbri: $1.60 (“expected to range trade until we see evidence of earnings stability and certainty on a long-run CEO.”)

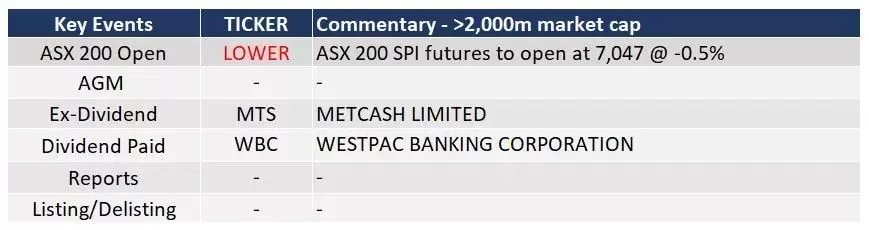

ASX & Economic Key Events

ASX Key Events Calendar (TODAY)

Economic Key Events (TODAY)

Economic Key Events (YESTERDAY)

OPTO For Investors Research

Article of the Day: What does a $3.6bn stock sale mean for Tesla’s future?

Podcast of the Day: Pedro Palandrani on Global X’s Long-Term Approach to Thematic Investing

APAC Daily Report

Market Snapshot & Highlights as of 8:00am AEDT

EXPECTATIONS: Energy HIGHER (higher oil prices) & Materials LOWER on overall lower base metal prices.

Global Markets Headlines

- FTX founder Bankman-Fried sent back to Bahamas jail in day of courtroom chaos (CNBC)

- Sam Bankman-Fried will now surrender himself for extradition before Bahamian court Monday, says source (CNBC)

- The FTX disaster has set back crypto by ‘years’ — here are 3 ways it could reshape the industry (CNBC)

- EU approves measure to limit natural gas prices in effort to combat energy crisis (CNBC)

- Elon Musk polled Twitter on whether he should step down as CEO. Most voters said yes (CNBC)

- Meta could face $11.8 billion fine as EU charges tech giant with breaching antitrust rules (CNBC)

- Global coal use is on course to hit all-time high this year, IEA says (CNBC)

- China markets lead losses in Asia-Pacific despite government pledge to stabilize economy (CNBC)

(All news & data sourced from AFR / The Australian / Bloomberg / Reuters / CNBC / Wall Street Journal / Morningstar / OPTO / Trading Economics)

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.