G'day folks and welcome to another trading day with your friendly, neighbourhood CMC Market Analyst!

For real-time up-to-date data/news/research/ideas/strategies, check out our insights panel on the CMC Markets Invest platform and follow us on Twitter:

Azeem Sheriff -

Tina Teng -

CMC Markets ANZ -

CMC Markets Singapore -

CMC Markets Canada -

Trading Idea of the Day

ASX:CXO - Core Lithium Ltd - (BULLISH - long term & BEARISH - short term)

- Key levels on the chart - consider taking trades from key support/resistance zones.

- Goldman Sachs initiates a Sell rating on Core Lithium

- Core Lithium shares are down around -6.0% on Wednesday

- The investment bank expects lithium prices to begin falling in the second half of 2023.

Chinese EV subsidies have pulled forward battery demand by at least 12-24 months, according to Goldman. The team believes the battery maker overcapacity, on the back of accelerated capacity build-out amid a decelerating growth of new energy vehicles sales will eventually weigh on lithium prices," the analysts said.

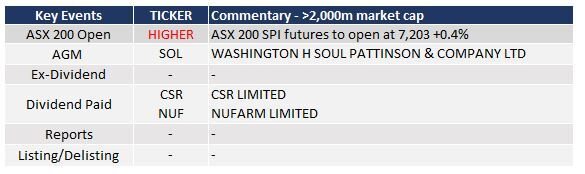

ASX & Economic Key Events

ASX Key Events Calendar (TODAY)

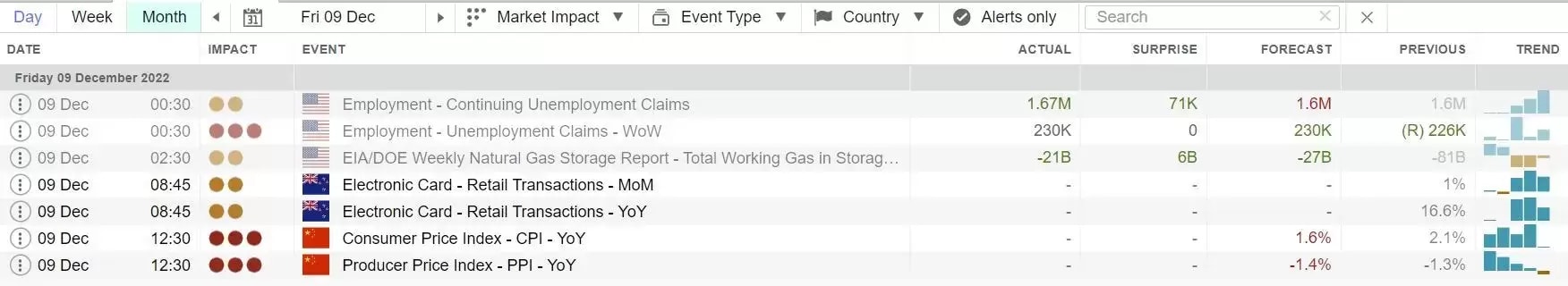

Economic Key Events (TODAY)

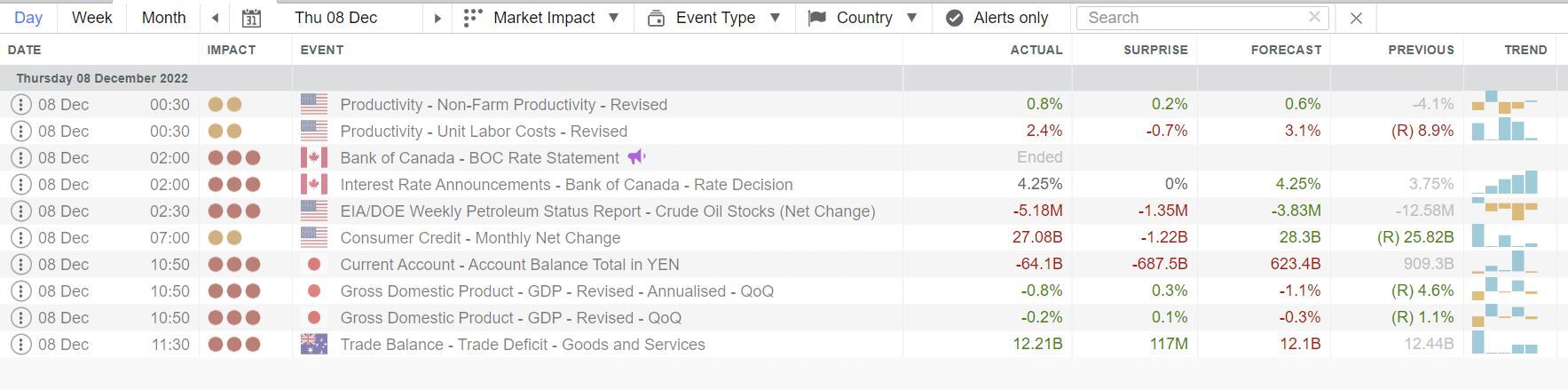

Economic Key Events (YESTERDAY)

OPTO For Investors Research

Article of the Day: GameStop share price gains despite earnings miss and cash burn

Podcast of the Day: Champel Capital’s Amir Weitmann on investing in deep tech

APAC Daily Report

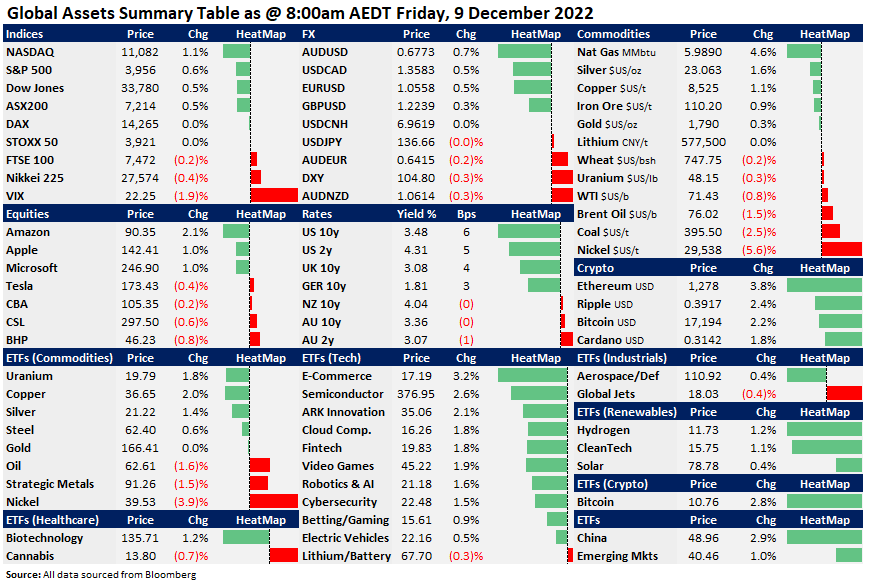

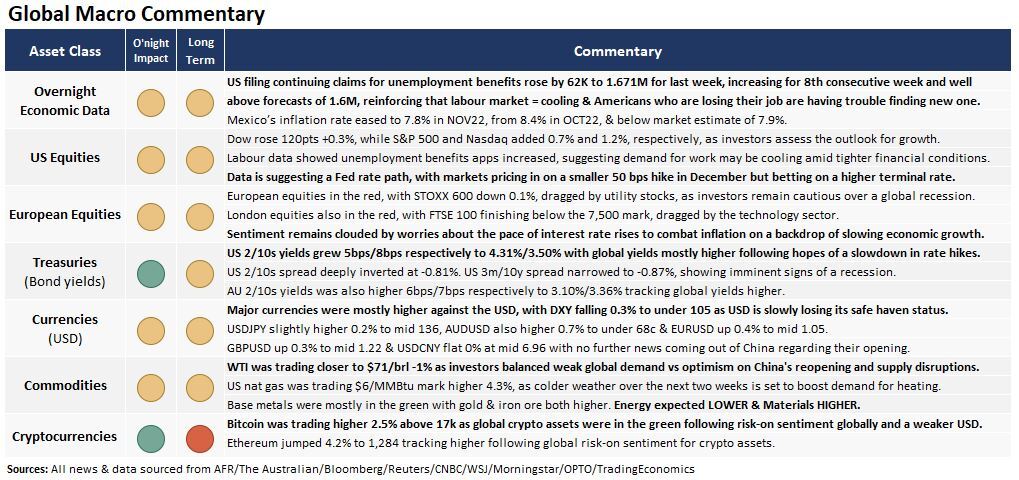

Market Snapshot & Highlights as of 8:00am AEDT

EXPECTATIONS: Energy LOWER (lower oil prices) & Materials HIGHER on overall base metal prices.

Global Markets Headlines

- FTX spokesman Kevin O’Leary says he lost his $15 million payday from crypto firm (CNBC)

Russia’s Ukraine onslaught shows zero signs of a winter lull as conflict rages (CNBC)

- FTC sues to block Microsoft’s acquisition of Activision Blizzard (CNBC)

- Retail traders think stocks will bottom in 2023 — and they plan to load up on Big Tech (CNBC)

- Tech layoffs in Southeast Asia mount as unprofitable startups seek to extend their runways (CNBC)

- Russian oil price cap, EU sanctions cause crude tanker bottleneck (CNBC)

Letter From Apple Supplier Foxconn’s Founder Prodded China to Ease Zero-Covid Rules (WSJ)

(All news & data sourced from AFR / The Australian / Bloomberg / Reuters / CNBC / Wall Street Journal / Morningstar / OPTO / Trading Economics)

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.