G'day folks and welcome to another trading day with your friendly, neighbourhood CMC Market Analyst!

For real-time up-to-date data/news/research/ideas/strategies, check out our insights panel on the CMC Markets Invest platform and follow us on Twitter:

Azeem Sheriff -

Tina Teng -

CMC Markets ANZ -

CMC Markets Singapore -

CMC Markets Canada -

Trading Idea of the Day

NYSE:MU - Micron Technology Inc - BULLISH BIAS

- Key levels on the chart - consider taking trades from key support/resistance zones.

- Micron has faced some difficulties over the past few quarters. In what can be described as an imperfect storm for the RAM and data storage chip provider, the company’s revenues, gross margin and profit margin all declined as the company continued to face rising operating expenses.

- EPS has come off significantly, with the company only posting earnings per share of $1.35, far less than the $2.34 it posted in the previous quarter or the $2.39 it posted in the same quarter last year.

- To address some of these factors, the company made significant reductions to the capital expenditure, expected to come down 30% to around US$8 Billion. These reductions are set to negatively impact the current year's costs but are expected to improve their economic condition in due time, as it’ll bring supply and inventory closer to where the industry demand is.

- While Micron’s end consumers in both a commercial and retail sense are finding it tough, with consumer PC demand and commercial data centre demand dropping due to supply constraints, improving supply conditions will help improve Micron’s position.

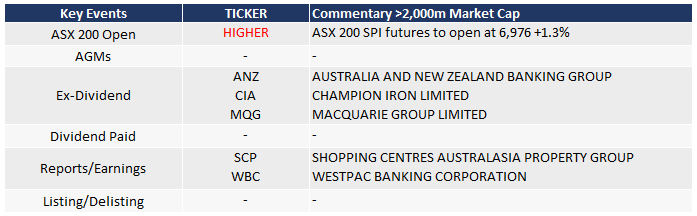

ASX & Economic Key Events

ASX Key Events Calendar (TODAY)

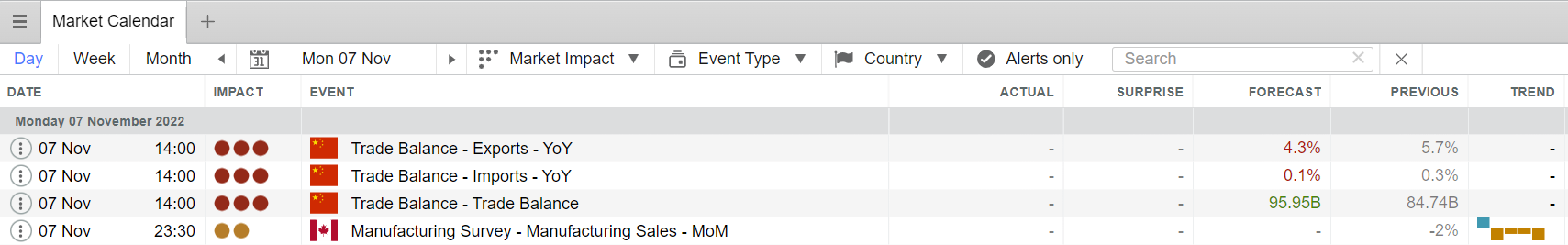

Economic Key Events (TODAY)

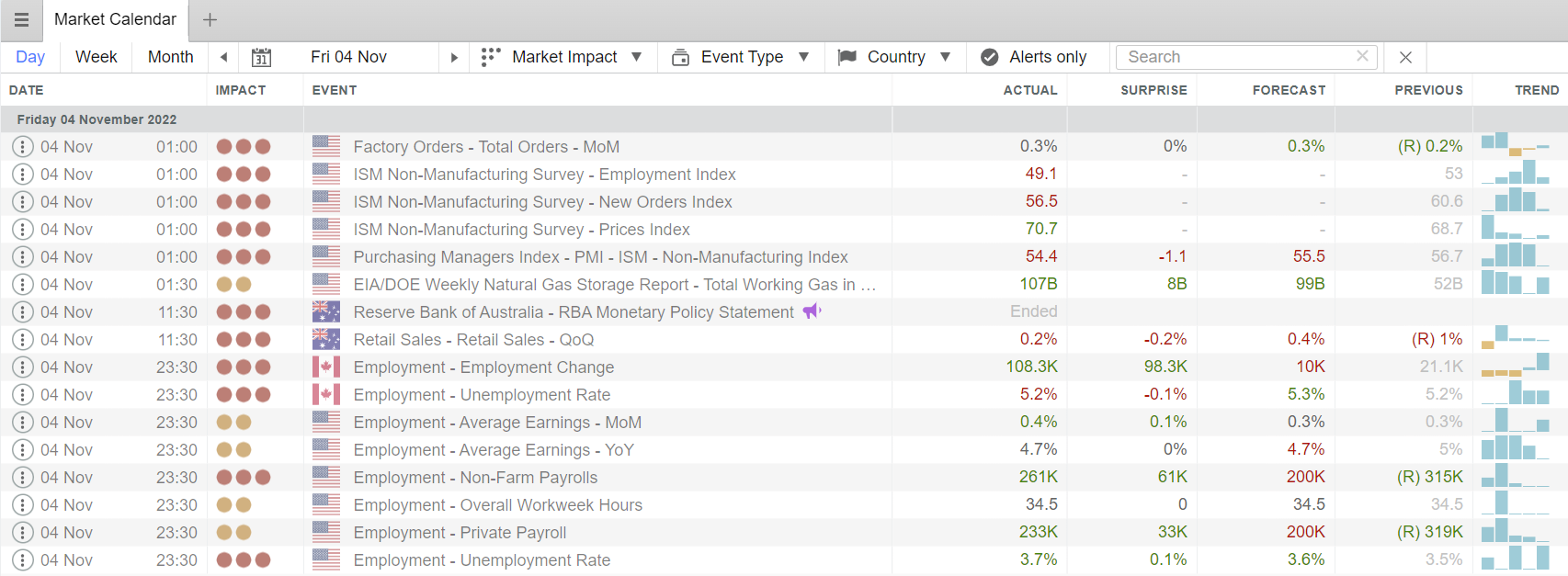

Economic Key Events (YESTERDAY)

OPTO For Investors Research

Article of the Day: Apple valued more than Amazon, Alphabet and Meta combined

Podcast of the Day: Portfolio manager Michael Kao’s dollar wrecking ball theory

APAC Daily Report

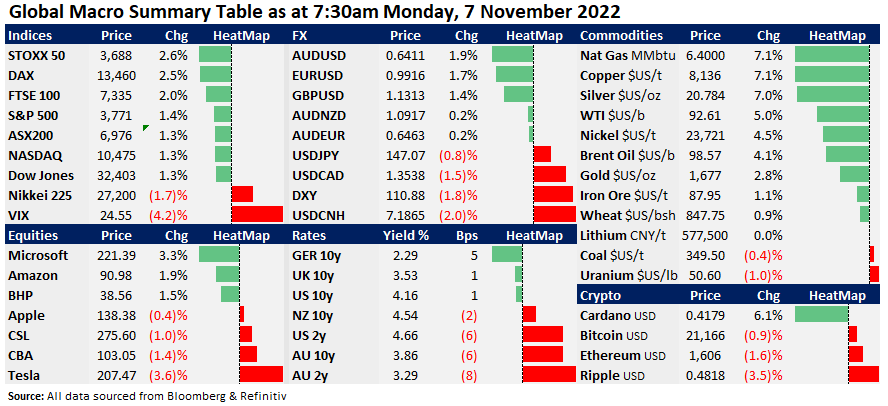

Market Snapshot & Highlights as of 7:30am AEDT

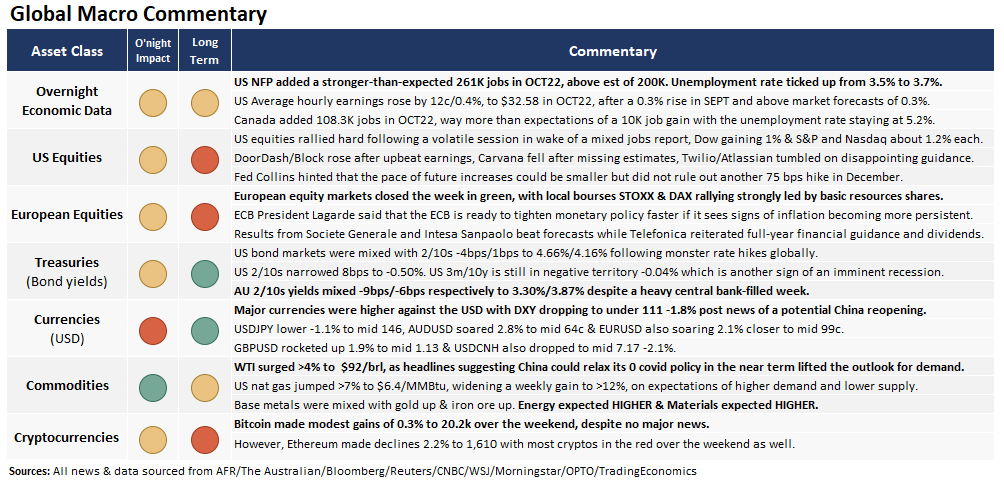

EXPECTATIONS: Energy HIGHER (higher oil prices) & Materials HIGHER on overall higher base metal prices.

Global Markets Headlines

In bankrupt Lebanon, locals mine bitcoin and buy groceries with tether, as $1 is now worth 15 cents (CNBC)

Berkshire Hathaway’s operating earnings jump 20%, conglomerate buys back another $1 billion in stock (CNBC)

Twitter co-founder Dorsey apologizes for growing the company ‘too quickly’ in wake of mass layoffs (CNBC)

China posts 6-month high Covid count as it sticks with strategy (CNBC)

Why Apple raised the price of the iPhone, but not in the U.S. and China (CNBC)

(All news & data sourced from AFR / The Australian / Bloomberg / Reuters / CNBC / Wall Street Journal / Morningstar / OPTO / Trading Economics)

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.