G'day folks and welcome to another trading day with your friendly, neighbourhood CMC Market Analyst!

For real-time up-to-date data/news/research/ideas/strategies, check out our insights panel on the CMC Markets NextGen platform and follow us on Twitter:

Azeem Sheriff -

CMC Markets -

Trading Idea of the Day

ASX:MQG - Macquarie Group Ltd - BULLISH BIAS (long term)

- Key levels on the chart - consider taking trades from key support/resistance zones.

- Macquarie group has been focusing recently on renewable energy which is providing it with a competitive advantage over other banks especially in the investments area.

- Macquarie Group has the best of both worlds with exposure to mortgages and also investments/asset management, so higher NIM will support it's lending business whilst maintaining its leadership in global asset management

- A strong USD will assist with Macquarie's earnings report next month as most of Macquarie's income/assets are derived from the US, so could see a positive earnings report, beating expectations with positive forward guidance.

ASX & Economic Key Events

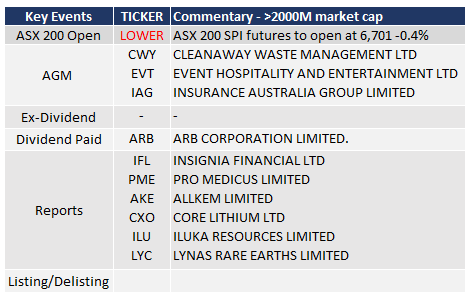

ASX Key Events Calendar (TODAY)

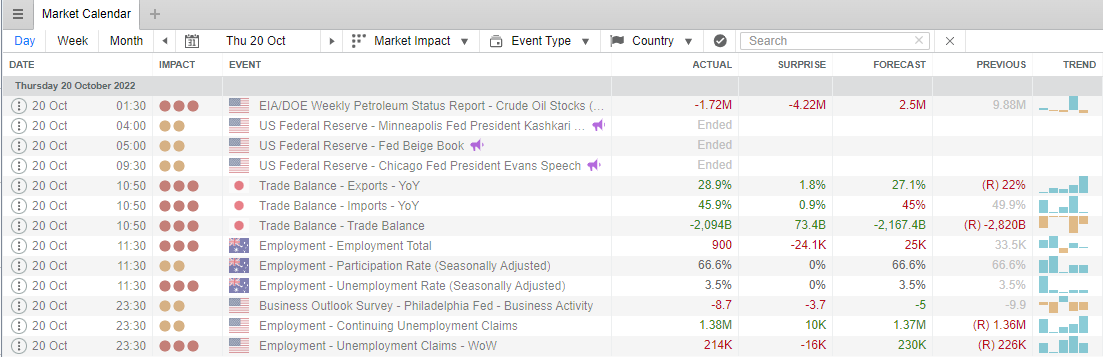

Economic Key Events (TODAY)

Economic Key Events (YESTERDAY)

OPTO For Investors Research

Article of the Day: Apple’s Foxconn targets 5% of global EV production

Podcast of the Day: Market strategist Kiril Sokoloff’s thematic investment radar

APAC Daily Report

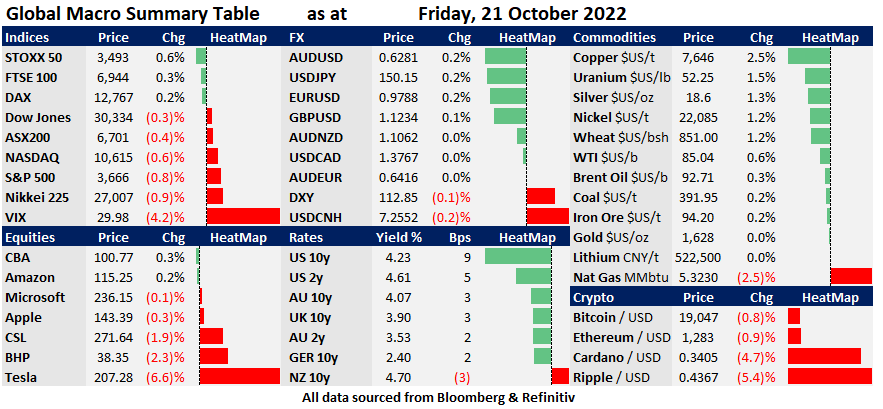

Market Snapshot & Highlights as of 8am AEDT

EXPECTATIONS: Energy FLAT/LOWER (flat energy prices) & Materials FLAT/LOWER on overall base metal prices.

Global Markets Headlines

With UK leader Liz Truss quitting, here are the top contenders to replace her (CNBC)

- Fed’s Harker sees ‘lack of progress’ on inflation, expects aggressive rate hikes ahead (CNBC)

- Tesla shares slide after Q3 revenue miss, Bernstein says earnings call ‘didn’t sit well with us’ (CNBC)

- 10-year Treasury yield tops 4.2% for first time since 2008 (CNBC)

- Customers battle to regain billions in bitcoin the DOJ recovered in its largest seizure of stolen crypto (CNBC)

- Turkey slashes interest rates by 150 basis points despite inflation at 83% (CNBC)

- Japanese yen hits 150 against the U.S. dollar, weakest levels not seen since August 1990 (CNBC)

Liz Truss Resigns as U.K. Prime Minister After Tax Plan Caused Market Turmoil (WSJ)

(All news & data sourced from AFR / The Australian / Bloomberg / Reuters / CNBC / Wall Street Journal / Morningstar / OPTO / Trading Economics)

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.