G'day folks and welcome to another trading day with your friendly, neighbourhood CMC Market Analyst!

For real-time up-to-date data/news/research/ideas/strategies, check out our insights panel on the CMC Markets NextGen platform and follow us on Twitter:

Azeem Sheriff -

CMC Markets -

Trading Idea of the Day

ASX:PLS - Pilbara Minerals Ltd - BEARISH BIAS

- Key levels on the chart - consider taking trades from key support/resistance zones.

PLS is currently in overbought conditions, so we could expect a sell-off from current levels to 4.5 or 3.5, then a potential buy opportunity for long-term investors.

Bearish divergence on the RSI vs price action – indicating we’re in for a bearish move potentially in the short term.

PLS rallying primarily on record-level lithium prices driving the stock price higher.

With uncertainty around China, we could see lithium demand weaken, dropping the price lower to those key levels, back towards the moving average indicators.

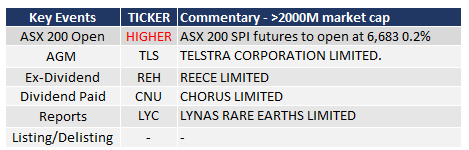

ASX & Economic Key Events

ASX Key Events Calendar (TODAY)

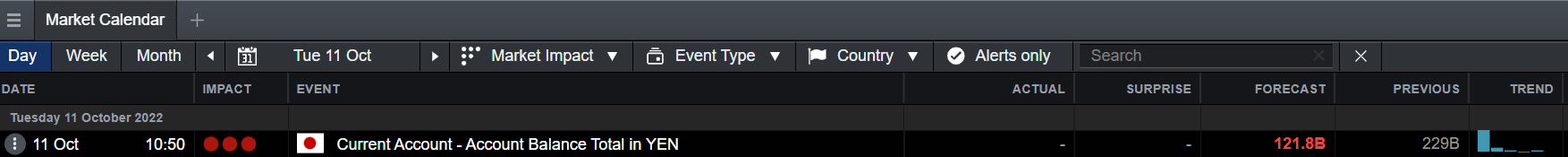

Economic Key Events (TODAY)

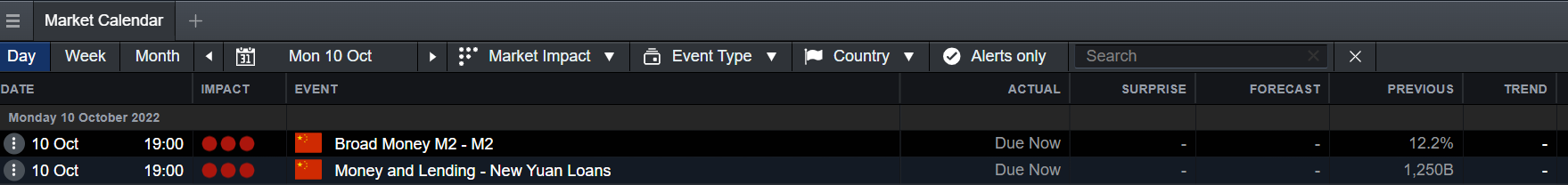

Economic Key Events (YESTERDAY)

OPTO For Investors Research

Article of the Day: Slowing demand in Q3 could put pressure on the TSMC share price

Podcast of the Day: Tidal Financial CIO Michael Venuto on the ETF industry

APAC Daily Report

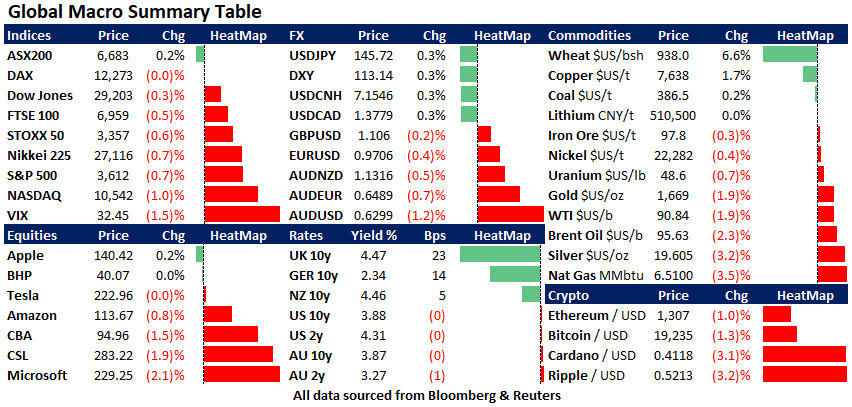

Market Snapshot & Highlights as of 7am AEST

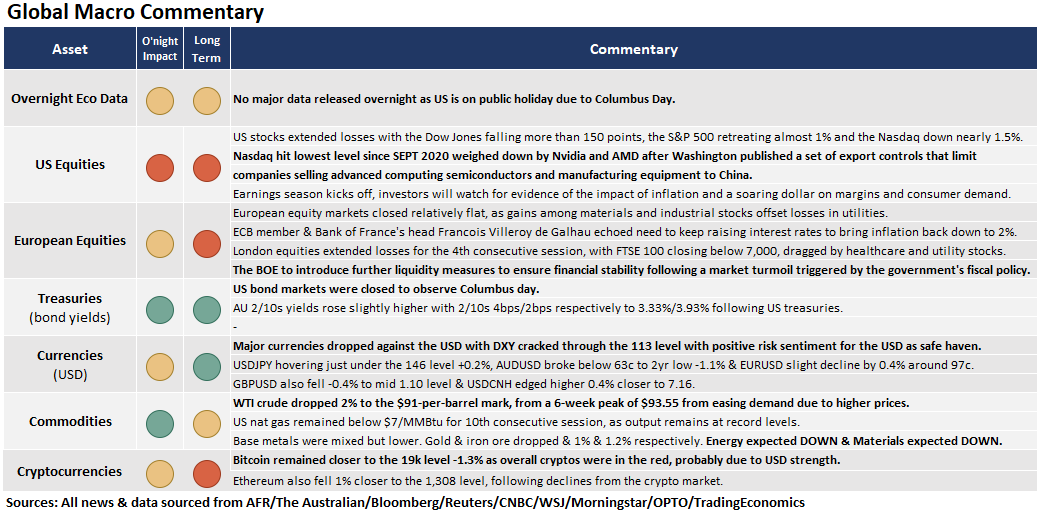

EXPECTATIONS: Energy LOWER (lower oil) & Materials LOWER on overall lower base metal prices.

Global Markets Headlines

‘This is serious’: JPMorgan’s Jamie Dimon warns U.S. likely to tip into recession in 6 to 9 months (CNBC)

- Fed’s Evans says fighting inflation is the top priority even if that means job losses (CNBC)

- Bank of England strengthens emergency stimulus to help ease market turmoil (CNBC)

- GM and Ford shares fall after UBS downgrades on expectations for weakening demand (CNBC)

- Chinese chip stocks tumble after U.S. calls for new curbs on high-end tech (CNBC)

Fed’s Brainard Says Rate Rises Will Slow Economy Over Time (WSJ)

Russia Unleashes Its Biggest Barrage of Strikes on Ukraine Since Invasion (WSJ)

(All news & data sourced from AFR / The Australian / Bloomberg / Reuters / CNBC / Wall Street Journal / Morningstar / OPTO / Trading Economics)

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.