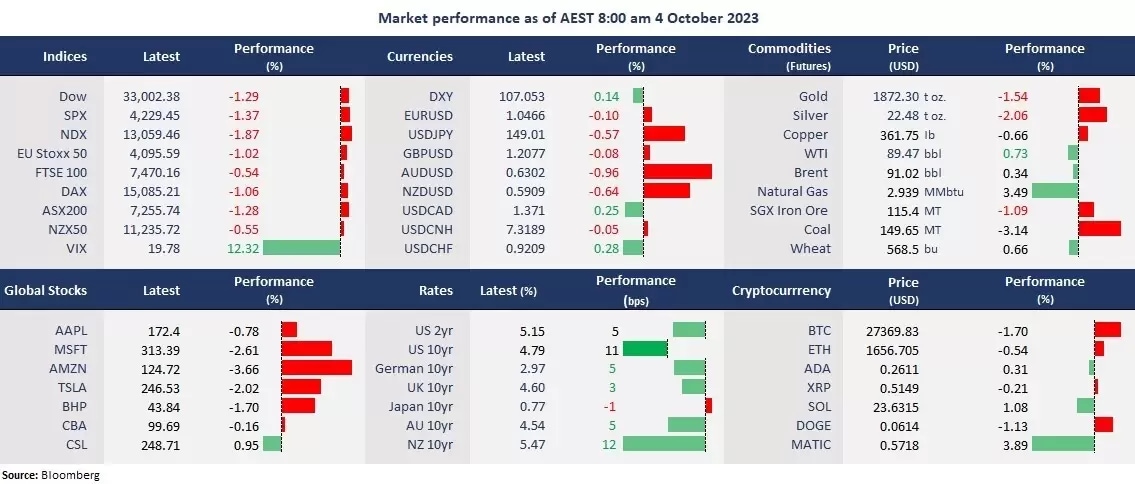

Wall Street tumbled amid the rampant US bond yields, with both the 10-year and the 30-year Treasury yields soaring to their 16-year highs of 4.8% and 4.93%, respectively, following resilient JOLTS Openings data on Tuesday. The tech-heavy index, the Nasdaq, was hit the most, down nearly 2%, with most of the mega-cap tech shares down between 2% and 3%. Risk-off sentiment continued to dominate the market movements as the VIX surged 12% to nearly 20, the highest since May.

The USD strengthened against most G10-currency pairs but weakened against the Japanese Yen on bets for a BOJ intervention. Gold extended losses, and crude oil rebounded ahead of the OPEC meeting later today.

In the APAC region, the RBA kept the interest rate at 4.1% for the fourth consecutive time as expected but signalled more rate hikes on the cards. The RBNZ’s rate decision will be the spotlight today, when the New Zealand reserve bank may follow suit to hold the OCR at 5.5%. Futures point to a lower open across the APAC. The Nikkei 225 futures fell 1.6%, and the ASX 200 futures slumped 0.62%, and Hang Seng Index futures were up 0.47%.

Price movers:

- 10 out of 11 sectors in the S&P 500 finished lower, with Consumer Discretionary, leading losses, down 2.59%, dragged by travel and leisure stocks. Utilities was the only sector that finished in the green, up 1.17% as renewable energy stocks rebounded from the recent sharp decline.

- The USD/JPY sharply retreated from pivotal resistance of just above 150 on BOJ’s intervention bets. The pair touched as low as 147.31 at a point before bouncing back to under 149. The drop happened within 15 minutes after the US JOLTS job openings were released, suggesting traders hugely bid on a BOJ foreign exchange intervention amid the resilient economic data, with 83,000 yen futures contracts traded, about 25 times of the average volume, according to Bloomberg.

- Meta is considering charging an ad-free version of Facebook or Instagram in the EU, aiming to compensate for potential ad losses due to the EU regulator’s prohibition on using personal data for commercial use. The social platform giant was under pressure from the region’s regulations over its privacy law. The user charge will be EU €13 per month for smartphones, and EU€17 per month for desktops.

- Crude oil snapped a three-day losing streak ahead of the OPEC+ meeting. The organization is expected to keep its current output cuts arrangement. Saudia and Russia both decided to extend production reductions to the end of the year.

ASX and NZX announcements/news:

- No major announcement.

Today’s agenda:

- RBNZ Rate Decision

- OPEC meeting

- US ISM Services PMI for Semptember

Maximize your potential gains! Take immediate action and seize the investment opportunities that await you. Login to the platform now!

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.