Bitcoin topped the 30,000 mark for the first time in 10 months, up 6.3% from a day ago and a 78% rally from its January low. With the global crypto market cap rising 3.6% from the last day, the trading volume increased about 41% in the last 24 hours. Bitcoin is now domaining 47% of the whole market cap. The reason behind the recent broad-based rally in crypto is traders’ optimism toward central banks’ monetary policy. Bets for a sooner Fed pivot on rate hikes have been dramatically strengthened following the bank turmoil in early March. Traders see the liquidity conditions improving after a slew of bank rescue packages both in the US and EU.

In fact, Bitcoin’s bottom-out pattern had surfaced since the beginning of January when tech stocks started to rebound amid cooling inflation in the US. Dip-buys in the risk assets began to merge as investors expected a policy turnaround by central banks. Bitcoin’s positive correlation with technology stocks is seen in asset class allocations due to the similar nature of volatility. The technology behind cryptocurrencies also connects it with the broad growth stocks in broader markets.

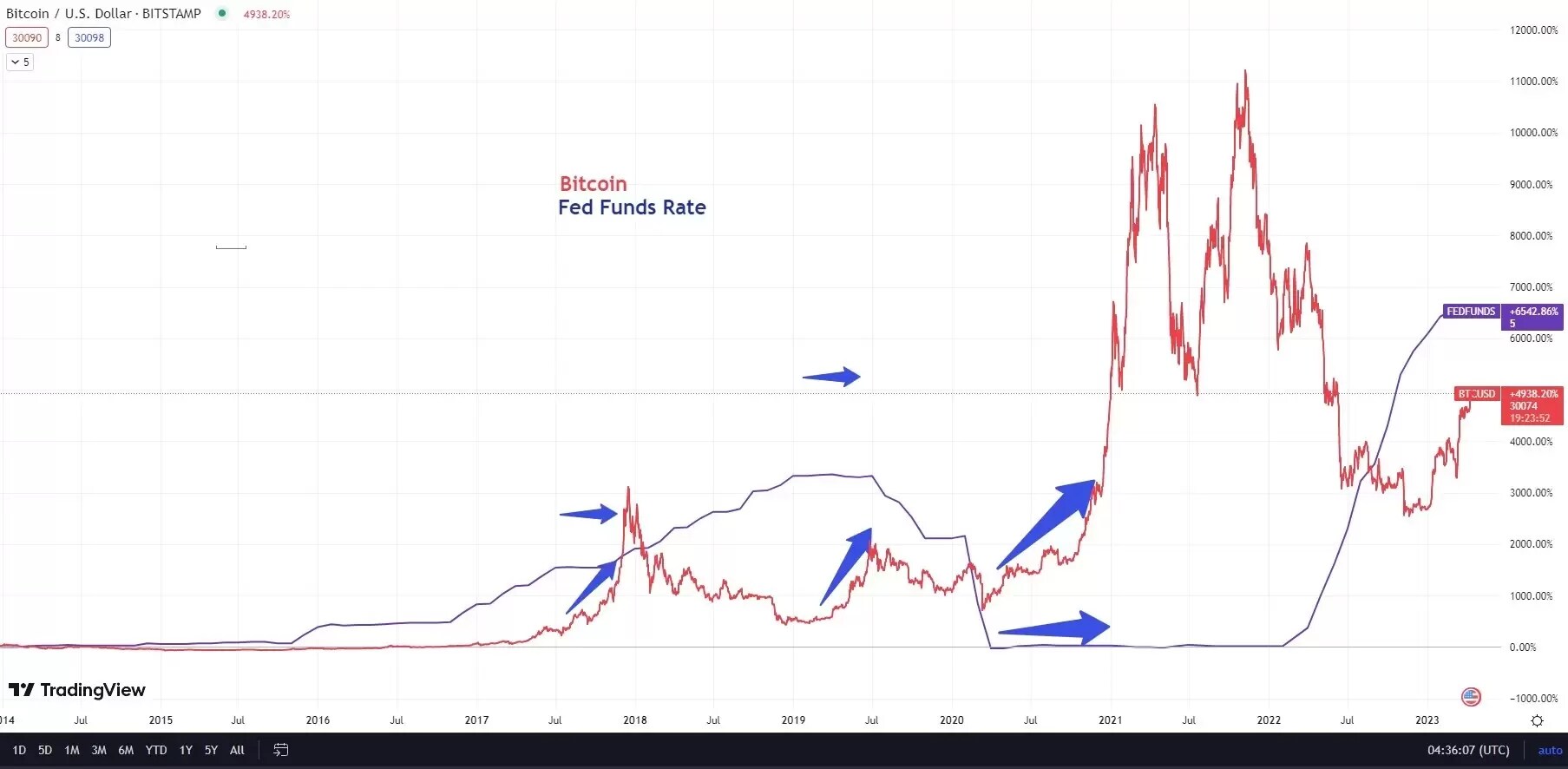

In history, Bitcoin is a typical risk asset that is mainly driven by the central bank’s policies and liquidity conditions. The bottom of the digital coin is seen when the Fed holds rates.

The latest news about Ethereum’s blockchain’s update of its proof-of-stake may have fueled Bitcoin’s rally as the criticism over Bitcoin’s fossil-fuel-generated energy could press on the supply of the world-largest cryptocurrencies. In the meantime, the upgrade of the Ethereum blockchain is expected to hugely reduce energy consumption as it changes the way of transaction verifying, which no longer requires computing power mining.

So how far may Bitcoin go?

Please see the trending video below

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.