Bitcoin topped the $30,000USD mark last week for the first time in 10 months, up more than 80% year-to-date, while the global crypto market cap rose 61%, and the trading volume increased about 231% during the same period. Bitcoin’s dominance is at 46% of the whole market cap currently, according to CoinMarketCap. Not only the largest cryptocurrency, the second most popular digital coin, Ethereum also topped 2,100 at a 9-month high last Friday, a few days after the announcement of the “proof-of-stake (POS)” update, which is called Shanghai, or Shapella. The upgraded blockchain enables users who have staked their Ether to validate transactions instead of computer-powering intense mining. The upgrade is seen as a major step toward reducing fossil-fuel-generated energy consumption.

However, the reason behind the recent broad-based rally in cryptocurrencies is not just impulsive dip-buys.

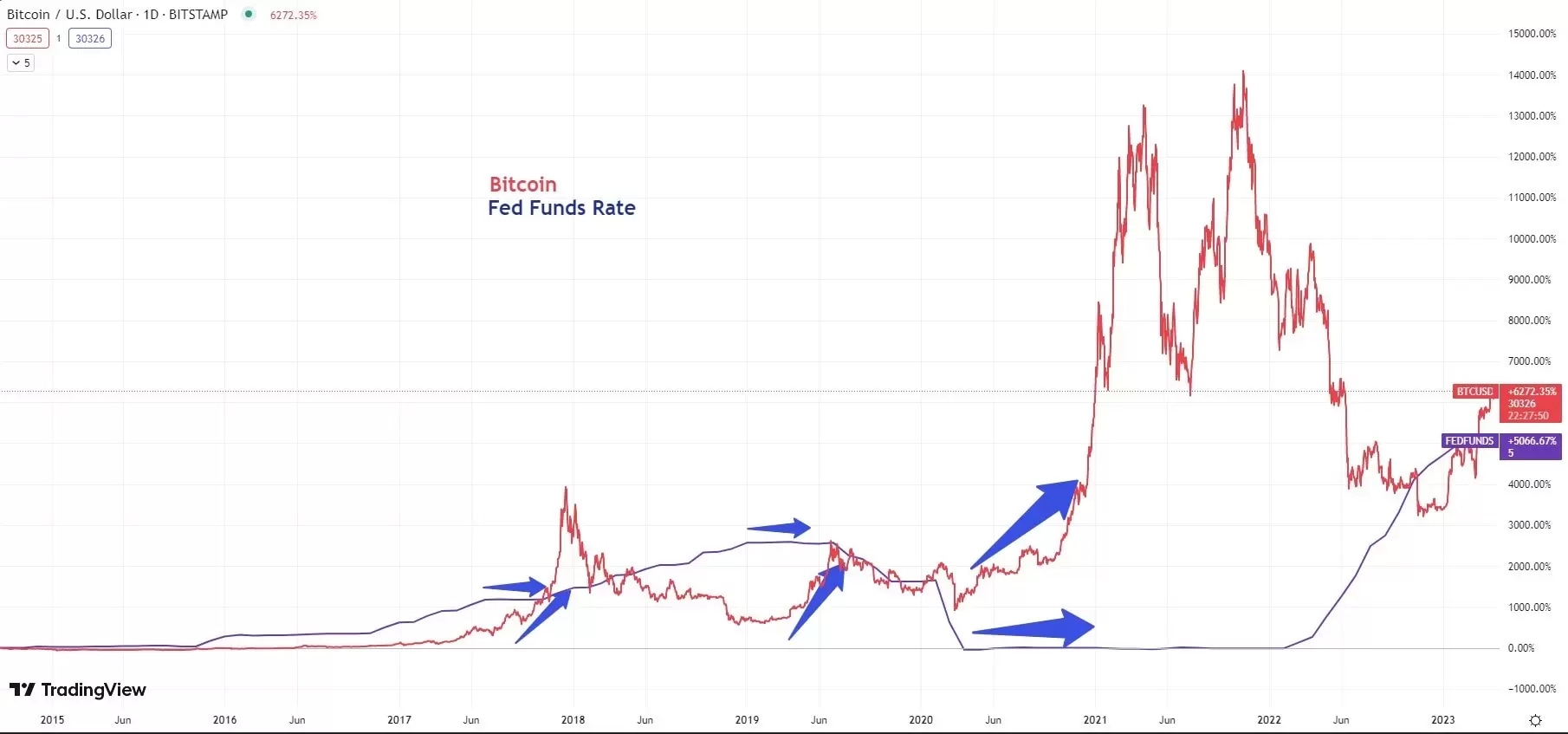

The macro context plays a key role in impacting crypto markets

Bets for a sooner Fed pivot on rate hikes have been dramatically strengthened following the bank turmoil in early March. Traders see the liquidity conditions improving after a slew of bank rescue packages both in the US and EU, which boosted a new wave of buying frenzy in cryptocurrencies since mid-March when Bitcoin broke through the key resistance of the 50-day moving average around 25,000, while Ethereum rose above 1,700.

In fact, both Bitcoin and Ethereum bottom-out patterns had surfaced since the beginning of January when tech stocks started to rebound amid cooling inflation in the US. Dip-buys in the risk assets began to merge as investors expected a policy turnaround by central banks. Crypto’s positive correlation with technology stocks is seen in asset class allocations due to the similar nature of volatility. The technology behind cryptocurrencies also connects them with growth stocks in broader markets.

In history, the biggest cryptocurrency, Bitcoin, is a typical risk asset that is driven by the central bank’s policies and liquidity conditions. The bottom of the digital coin is seen when the Fed holds rates.

The downside risks remain

Despite a multi-month jump in both Bitcoin and Ethereum, the rally in cryptocurrencies still faces downside risks in terms of the central bank’s policy. The price correction could be sharp if risk-off sentiment slashes broad markets again. As the cryptocurrency market is still relatively new, there is no such way to do the traditional valuation like stock markets. Therefore, the market cap of a cryptocurrency can be inflated or deflated by market sentiment. Or in other words, cryptocurrencies can be seen as purely speculated markets, though supply and demand could still be fundamentals that provide trending clues.

The road to crypto adoption

Crypto adoption tends to mount when central banks provide more liquidities, such as Tesla’s announcement to accept Bitcoin as payment and EI Salvador’s adoption of Bitcoin as legal tender, which all happened when the interest rates were ultra-low, and the cryptocurrencies were in a surge. The speed of crypto utilization has slowed down since the central banks started the aggressive process of tightening their monetary policies. The severe price fluctuations make it hard for businesses to grow their adoption. Plus, regulatory issues are another roadblock for the mess adoption of crypto payments as Cryptocurrencies operate in a legal grey area in many countries, and regulatory changes can have significant impacts on their price.

The newly developing digital world still faces changelings in frauds and hacking. The notorious FTX’s former CEO, Sam Bankman-Fried, caused billions of dollars in losses and was charged with federal fraud. Therefore, while considering investing in cryptocurrencies, it is better to do your own analysis against the macro backdrop and all the above issues that matter.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.