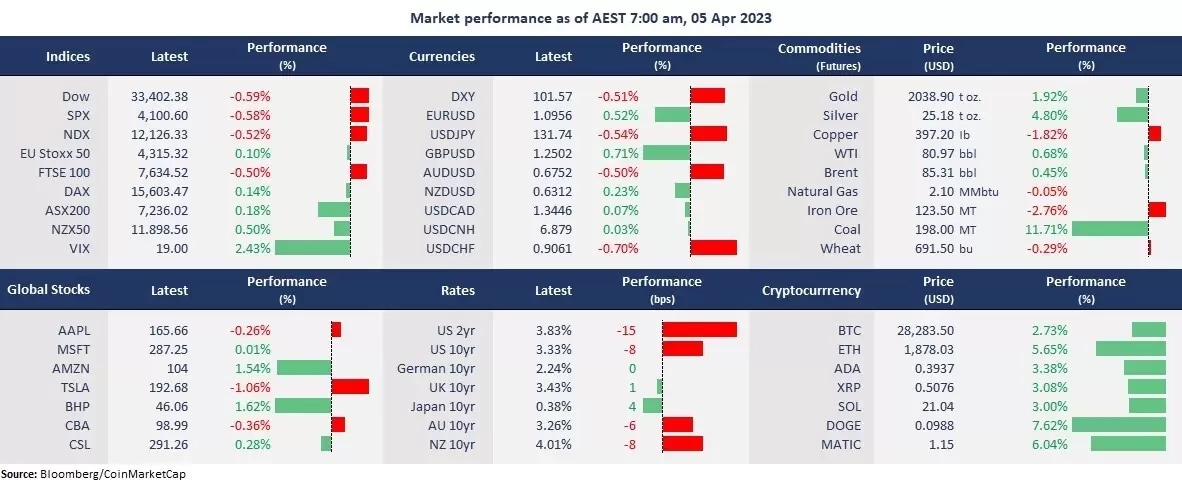

Wall Street fell after the US reported the lowest job openings for February in nearly two years, which renewed recession fears following the bank crisis early in March. Fed funds futures from the CME Group shifted odds toward a pause in rate hikes by the Fed in May, sending bond yields and the US dollar down and lifting haven assets, such as gold, the Eurodollar, the Swiss Franc, and the Japanese Yen. In the sector performance, cyclical stocks, including financials, energy, and industrials, led broad losses, while defensive sectors, like utilities and healthcare, outperformed. Notably, the cash-rich big techs were resilient as investors seek for safety.

Commodities continued to benefit from a softened dollar, with gold futures soaring another 1.9% to a one-year high level, while crude oil consolidated above $80 per barrel after OPEC+’s unexpected output cuts. However, the growth-sensitive industrial metals, including copper and iron ore, fell on demand concerns.

Following RBA’s decision to hold on to rates, the Reserve Bank of New Zealand will hold the policy meeting later today when the bank is expected to raise the cash rate by another 25 basis points but may signal a pause after it.

Asian markets are set to open mixed. The ASX 200 futures slipped 0.17%, Hang Seng Index futures rose 0.59%, and Nikkei 225 futures fell 0.53%.

Price movers:

- 7 out of the 11 sectors in the S&P 500 finished lower, with energy, financial, and industrial stocks leading losses, down between 1- 2%. The growth sectors, including consumer discretionary and technology, were also lower. It is worth noting that the communication services sector has been outperforming broad markets this year amid dip-buys in Meta. While defensive sectors, like healthcare and utility, ended in the green, real estate stocks also rose due to a decline in rates.

- British Pound rose to a 10-month high of above 1.25 against the US dollar following BOE’s chief economist’s warning of inflation risk to remain. The king dollar weakened further after the US reported the weakest job openings, with available positions at 9.93 million in February, below 10 million for the first time since May 2021.

- The surge in the oil price took a breather, despite marginal gains, as the economic worry again sparked demand concerns. However, a softened US dollar and China’s economic recovery remain bullish factors for traders.

- Gold futures continued to soar due to the weakness in the US dollar, a jump in bonds, and risk-off sentiment. Gold futures were up about 25% from the November low when the USD index peaked at just under 106. With gold prices heading off an all-time high, caution is needed for a potential pullback risk.

- Cryptocurrencies were higher as optimism toward Fed’s dovish turn continued to boost the digital coins. From a technical perspective, both Bitcoin and Ethereum may face a pullback risk due to overbought.

ASX and NZX announcements/news:

- Magellan revealed $3.4 billion in loss from institutional mandates in March. The fund management company has $43.2 billion under management on 31 Mach, a sharp decline from $45.4 billion as of 28 February.

- Tribeca Global Natural Resources completed its 1-for-4 entitlement offer. The company raised $16.04 million, including the top-up facility and shortfall facility.

- Viva Energy agreed to acquire the OTR Group for $1.15 billion from Peregrine Corporation.

- Carsales raised $121 million from retail investors in the second stage of the entitlement offer.

Today’s agenda:

- RBNZ rate decision. The Reserve Bank is expected to raise the cash rate by 25 basis points, bringing the OCR to 5%, and hold from there amid economic risk.

- RBA governor Philip Lowe will speak at the National Press Club one day after the bank pauses rate hikes.

- US ADP non-farm payroll for March, providing clues for the labor market conditions.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.