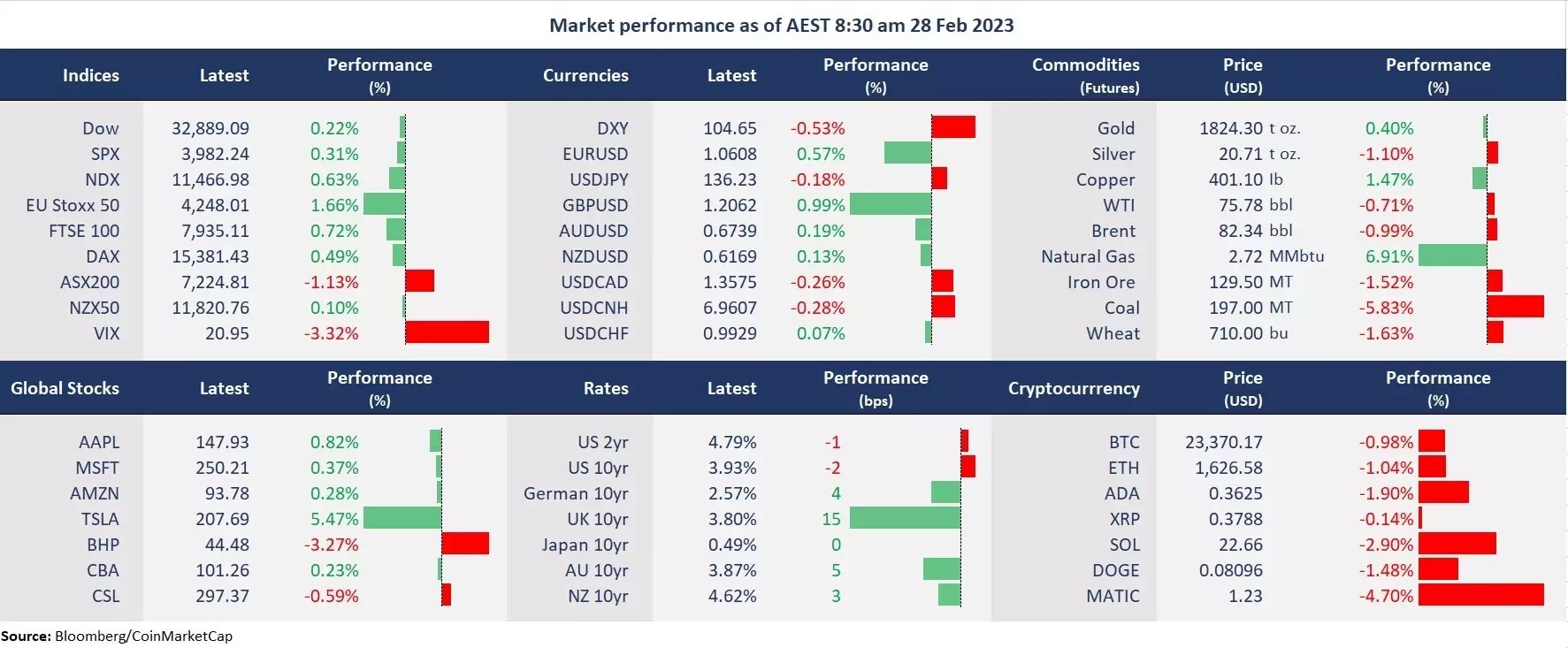

US stocks finished higher on Monday after a sharp selloff last week as bond yields retreated from the recent high, buoying growth stocks. Major tech shares mostly closed in green, with Tesla leading gains, up 5.5% on the news that the Germany plant hit a production rate of 4,000 cars per week ahead of schedule. Tech’s comeback again lifted Nasdaq to outperform both Dow and S&P 500, while the VIX slid 3% to 21, though the Fed governor Philip Jefferson vowed to stick with the 2% inflation goal.

In FX, the US dollar fell as both the sterling and the Eurodollar jumped after UK and EU reached an agreement to a crucial Northern Ireland trade deal, which also sent the European markets higher, with the FTSE 100 recovering some losses from last week, approaching 8,000 at a record high.

Asian markets are set to open higher following the positive close in both EU and US markets. The ASX futures were up 0.42% after a miner-led selloff on Monday. The Hang Seng Index futures rose 0.30% and Nikkei 225 advanced 0.40%.

- 7 out of 11 sectors in the S&P 500 finished higher, with consumer discretionary stocks leading gains, up 1.2% due to a jump in Tesla’s shares. Both the technology and communication services sectors also closed in green. The defensive sectors, including consumer staples, healthcare and utilities, however, underperformed as risk-on prevailed.

- US durable goods orders slumped 4.5% month on month in January, which is the steepest decline since April 2020, and more than an expected 4% decline, promoted by a 13.3% fall in orders for transportation equipment (mainly aircraft). But the core durable goods orders, excluding transportation, rose 0.7% from December.

- Snap launches My AI chatbot to its Snapchat + subscribers, powered by OpenAI’s GPT, a similar technology to Microsoft Bing AI. The Technology can recommend gift ideas, weekend plans and recipes as stated by Snap. The company’s shares, however, pared early gains after an initial 4% jump and finished 0.81% higher for the session.

- The British Pound strengthened 0.8% against the USD amid the new trade deal over North Ireland between the UK and the EU. The trade deal is described by the UK PM Rishi Sunak as “the beginning of a new chapter” in the Brexit breakthrough.

- Tesla’s shares jumped 5.5% on the strong production news ahead of its investor day on 1 Match. CEO Elon Musk is expected to give his vision for the company’s future, with an expectation that more grandiose promises will be made towards sustainable energy and other innovations.

- Gold found footing above 1,800 on a softened US dollar and a retreat in the bond yields. Gold fell more than 7% from the February high of 1,959. The rebound may have also been caused by technical correction as it was oversold, with key support at the 200-day moving average of 1,778.

- Crude oil fell slightly after a two-week rally as inflation concerns weighed on the economic outlook. But Russia’s export halt to Poland limited losses.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.