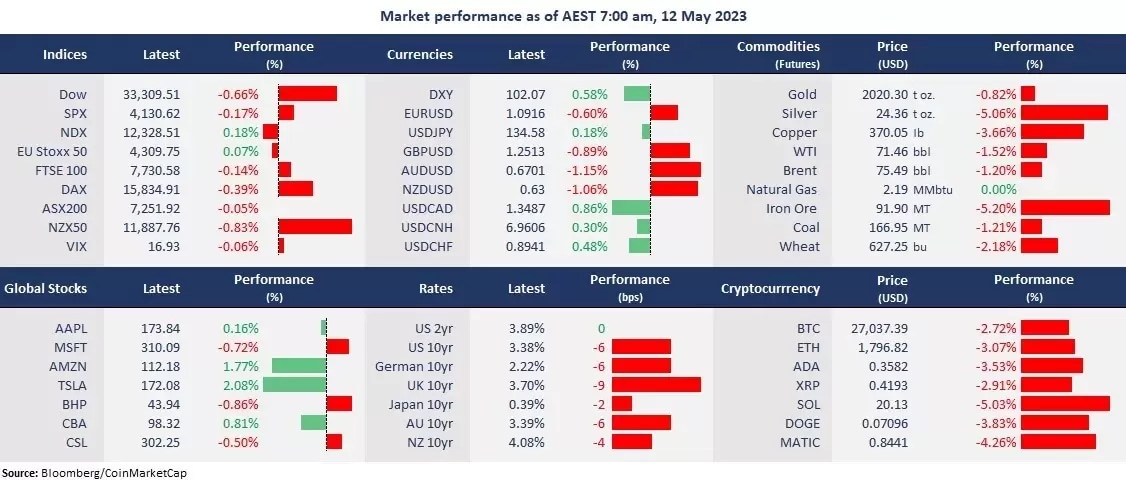

US stocks extended the divergent moves between cyclical stocks and growth sectors as Alphabet’s AI blueprint flared up buying frenzy in tech again, while growth-sensitive sectors, such as banks and energy, continuing to suffer a recession fear-led sell-off.

This led to another mixed close on Wall Street, with the Nasdaq rising for the second straight trading day, while Dow and S&P 500 were down. Disney’s disappointing earnings slashed its shares by more than 8% due to another user loss in the streaming business, which also dragged on the Dow. The troubled bank, PacWest, plunged more than 20%, pressing on risk sentiment.

The US reported another promising economic data reading to prove inflation is cooling, with the April headline PPI slowing to 2.3% from 2.7% in the prior month. In the meantime, jobless claims jumped to 264,000, the highest level since October 2021. The data may point to an imminent economic downturn.

The US dollar strengthened, despite a drop in rates. This may be interpreted as investors seeking safe-haven assets. Commodity prices fell broadly amid a strong US dollar, typically in silver, copper, and crude oil, which are seen as a barometer of economic health, in turn slashing commodity currencies against the USD, including the Australian dollar, Canadian dollar, and New Zealand dollar.

US-listed Chinese shares jumped after the e-commerce giant JD.com beat earnings expectations, sending the Hang Seng Index higher, with futures pointing to a higher open of 0.67%. However, ASX 200 futures were down 0.17%, and Nikkei 225 futures were flat.

Price movers

Eight out of 11 sectors in the S&P 500 finished lower, with energy and real estate stocks leading losses, down 1.24% and 1.02%, respectively. The telecommunication sector outperformed, up 1.65%. And Consumer discretionary and consumer staples also ended in the green.

Alphabet’s shares jumped for the second straight trading day to 116.59, the highest seen in August 2022. The search engine giant introduced a series of AI-powered software and hardware. Google announced that its workplace tools would let users create and populate documents into spreadsheets with AI.

Elon Musk posted on Twitter that he would step down as Twitter’s CEO and will hire a new CEO. His role will transition to executive chair and CTO, overseeing product, software, and sysops. Tesla’s shares rose 2% on Thursday.

The Chinese second largest e-commerce company JD.com jumped 7.8% after the company reported stronger-than-expected first-quarter earnings. The rival of Alibaba’s revenue came as 243 billion yuan (US$35 billion), topping an expected 239.42 billion yuan. Its net profit came in at 6.3 billion yuan, compared with a loss of 3 billion yuan from a year ago. It announced that CEO Xu Lei would step down, and CFO Sandy Ran XU was appointed the new CEO.

Bank of England raised the interest rate by 25 basis points to 4.5%, as expected. Governor Andrew Bailey upgraded the UK GDP growth to be flat in the first half of the year and 0.9% by mid-2024 from a decline in the previous meeting. However, both GBP and FTSE 100 fell as markets doubted the economic outlook.

ASX and NZX announcements

Serko (ASX/NZX: SKO) refers to a media release announcing that travel management company CWT has committed to a new partnership with Booking.com.

QBE Insurance Group Limited (ASX: QBE)’s first quarter premium was up 11%, or a 14% increase in constant currency. The company expects Crop gross written premium to be about A$4.08 billion in FY23, with a net earned premium of approximately A$1.4 billion

Today’s agenda

New Zealand visitor arrivals for March m/m and inflation expectations for the second quarter

UK’s March GDP

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.