Equity markets are enjoying a very bullish move today as the US presidential election has taken centre stage, and for now it has eclipsed the health crisis and the restrictions.

Europe

Stocks are building on yesterday’s gains as an absence of negative news has assisted the mood. The non-stop headlines about the battle for the White House has acted as a nice distraction from what is going on in terms of tighter restrictions. Stocks enjoyed a very positive move yesterday and that sentiment has been carried into today. In London, it is a broad-based rally, as banking, house building, transport, travel, commodity and hospitality stocks are showing gains.

Crest Nicholson shares hit their highest level since June on the back on this morning’s bullish statement. The house builder expects adjusted pre-tax profit to be slightly ahead of the £37.9 million consensus estimate, and it is predicted to be at the upper end of the £35-£45 million forecast. In addition to the upbeat earnings forecast, the company confirmed that it will be reinstating its dividend – this effectively reiterates it’s a bullish outlook, as it signals to the market that it is confident in its future earnings ability. Construction activity across the board was impacted because of the lockdown but it seems that work has just been pushed back into 2021. Crest said that forward sales stood at 2,289 units, up from 2,013 units one year ago.

Associated British Foods revealed a 12% drop in full year group revenue, and adjusted operating profit slumped by 31% to £1.02 billion. Primark, the cheap and popular clothing brand, is owned by Associated British Foods, and it suffered greatly because of the pandemic – it doesn’t have an online operation, hence why operating profit at the unit slumped by 62% to £362 million. The Primark business will be held hostage by the pandemic, but nonetheless, the company will continue to open new stores – as it is very popular when it is open. On the bright side, the AB Food division registered a 15% jump in earnings, while the sugar division saw earnings come in at £100 million, up from £30 million in the previous year.

Wizz Air Holdings Plc confirmed that passenger numbers tumbled by 69.1% in October. The load capacity was 45% and the load factor was 66%. The brutal numbers are hardly surprising when you consider what is going on in the aviation industry.

Weir Group, the engineering company that specialises in providing services to industries such as mining, confirmed that orders in the third quarter dropped by 11%. The company reiterated that it is on track to achieve its cost-saving target for 2020.

IWG Plc shares are up 7% on the day following the release of its third quarter trading update. Total revenue in the three month period dropped by 14.2% to £583.3 million. The serviced office company trimmed the number of sites it operates by 33 to 3,359. It is on track to achieve its annualised cost savings target of £200 million.

US

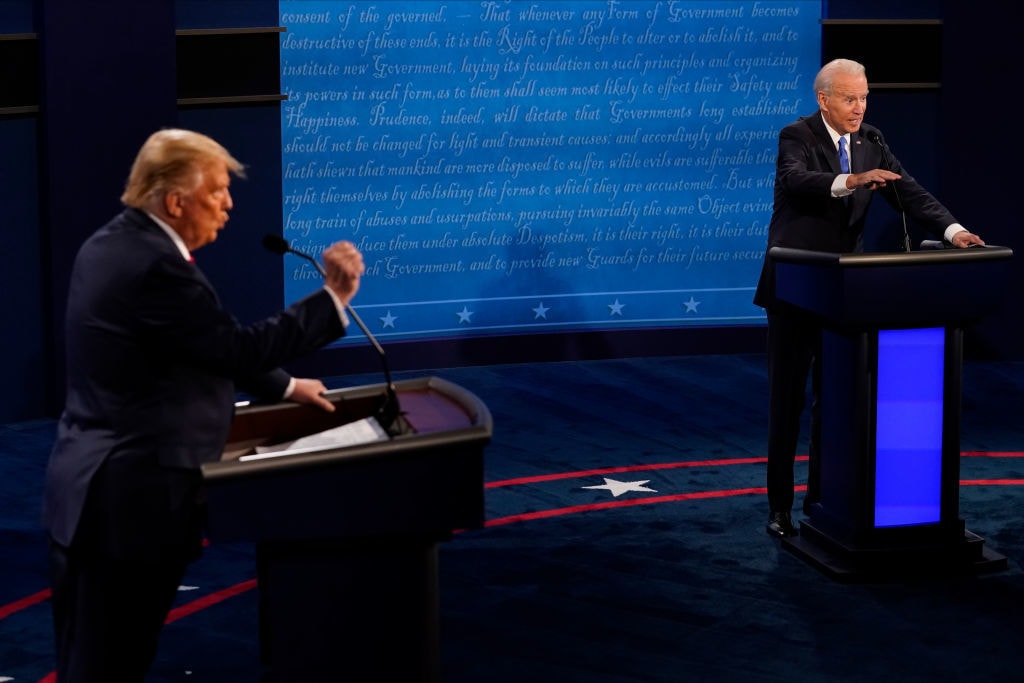

The mood on Wall Street is optimistic even though things are heating up in terms of the election. President Trump and Joe Biden are going head to head today. Biden is leading in the opinion polls, and even though he is considered to be less pro-business than Mr Trump, stocks are showing decent gains. When the election is over, we should have a clearer picture in terms of what to expect from the planned coronavirus stimulus package, so it seems that dealers just want the event out of the way, but hopefully a clear winner emerges. A contested result would likely weigh on stocks.

Wayfair Inc, the online furniture group, continues to perform well as e-commerce remains robust. Third quarter EPS was $2.30, and that smashed the 80 cents consensus estimate. Revenue for the three month period rose by 66.5% to $3.8 billion, exceeding the $3.64 billion forecast. The company confirmed that repeat customers placed 71.9% of total orders in the quarter.

PayPal Inc posted its third quarter figures last night. EPS was $1.07, which easily topped the 94 cents consensus estimate. Revenue increased by 25% to $5.46 billion. Quarterly total payment volume was a record level of $247 billion. The payment group predicts that full year EPS will grow 37-38%. The surge in online shopping helped the company. For the fourth quarter, the group expects adjusted profit to grow by 17-18%, while analysts were anticipating 24% growth, so that took the shine off the solid figures. The stock is down a little but it hit a record high late last month.

Alibaba Group Holdings shares have sold off after it was announced that Ant Group’s planned initial public offering in Shanghai and Hong Kong has been suspended by regulators. Ant is affiliated with Alibaba.

FX

Traders are in risk-on mode and in turn they have dumped the US dollar – lately it has been a popular safe haven play, so today we are seeing the opposite of that of strategy. Yesterday, the greenback hit its highest level since late September and now dealers are keen to trim their exposure to the currency.

EUR/USD and GBP/USD have been lifted by the weaker dollar. There were no major economic announcements from the eurozone or the UK today so the move in the dollar has been the main story.

AUD/USD is up over 1%, even though the Reserve Bank of Australia cut interest rates by 0.15% to 0.1% - meeting forecasts. The central bank said that negative interest rates are very unlikely, and that seems to have assisted ‘the aussie’.

Commodities

Gold has been driven back above the $1,900 mark on account of the drop in the US dollar. The metal is traded in dollars, so when the currency becomes cheaper, the commodity becomes relatively cheaper to purchase too. It the past few sessions, it has been moving higher, and if the bullish move continues it could retest the 50-day moving average at $1,914.

The bullish sentiment that is driving stocks higher seems to be lifting oil too. WTI and Brent crude are building on the gains that were achieved yesterday, when Russia indicated that it might keep the existing production cuts in place for longer than initially planned.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.