While we retain a somewhat bullish view on US indices, we also acknowledge a near-term bearish alternative for the S&P 500 ahead of today’s US Federal Reserve announcement on interest rates. We also apply our primary scenario to the Dow Jones Industrial Average.

The near-term bullish forecast that we offered last week played out well, with the S&P 500 on Tuesday testing overhead resistance at 3,917, broadly in line with our forecasts.

On Tuesday 1 November the S&P 500 reached an intraday high of 3,911.79 – the index’s highest level since 15 September. However, we believe that the rally that began on 13 October is nearing an end.

Key takeaways:

• In our primary scenario, the S&P 500 could dip slightly on today’s Fed announcement and/or Friday's non-farm payrolls data, before edging higher in subsequent days.

• Alternatively, our bear case suggests that the S&P 500 could change course abruptly, possibly re-testing the area near the 20 October low (3,656.44).

Could the S&P 500 be set to rise?

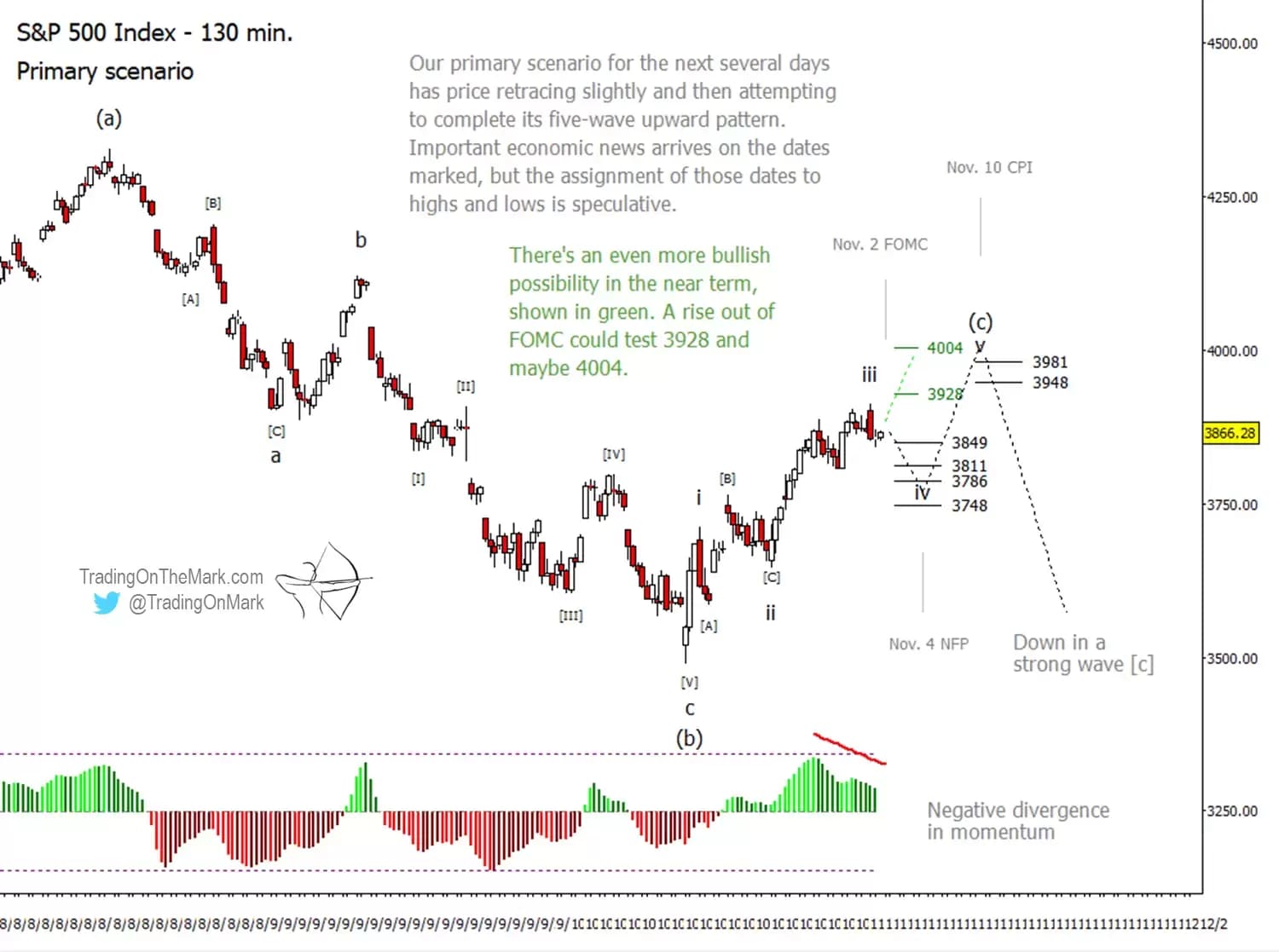

On a time frame with daily bars, our Elliott Wave count hasn't changed. The chart below shows our primary scenario on an intraday time frame, with three bars per day. It's always risky to predict market direction on the day of Federal Open Market Committee (FOMC) meeting, so we have drawn two paths for traders to watch. We prefer the scenario that has a relatively small downward retracement (wave 'iv') before a higher high in the next one to two weeks. In this case, the main support levels for wave 'iv' are at 3,849, 3,811, 3,786 and maybe 3,748 as an unlikely stretch target.

Approximate upward targets for wave 'v' sit at 3,948 and 3,981 in the scenario that involves a dip and then a rise.

The even more bullish path, shown as a dotted green line on the chart below, envisions an abrupt rise in the market following the FOMC announcement. In that case, our attention would be on resistance near 3,928 and 4,004 as the current impulse extends upward. All of these levels are based on standard Fibonacci retracement and extension ratios.

Alternative path worth bearing in mind

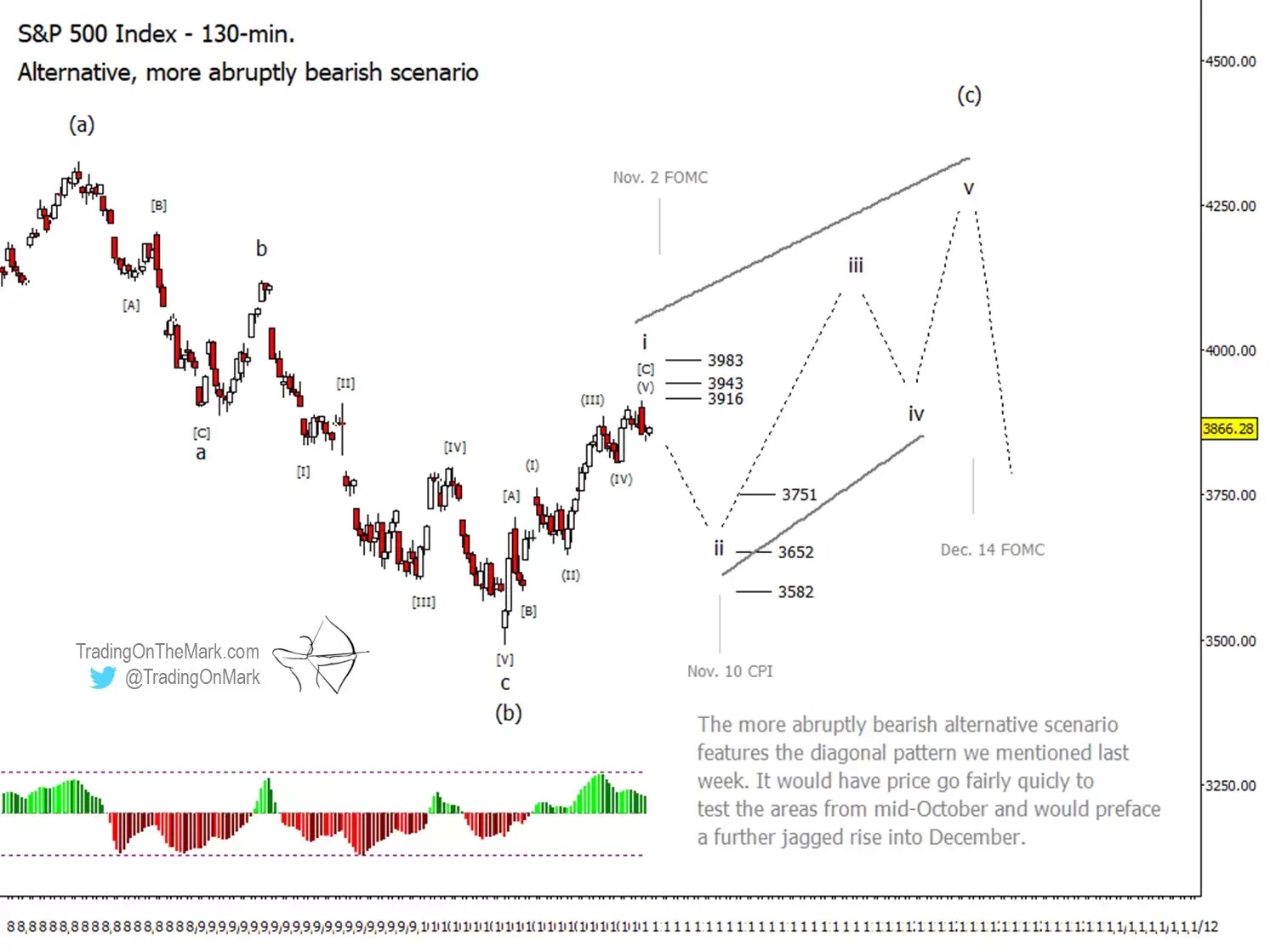

Our next chart outlines a bearish alternative scenario for the S&P 500, and features the diagonal pattern we mentioned last week.

In this view, the rally from 13 October could be considered a complete upward wave 'i' of the diagonal, soon to be followed by a downward wave 'ii'.

The first major support level in this bearish scenario sits at 3,751, which is also near one of the supports shown in the primary scenario. If that area were to fail, the index would probably test 3,652 or 3,582 before attempting a bounce.

Looking further ahead, the diagonal scenario would present a volatile rise in the index, possibly going into December. Keep in mind, however, that this is an alternative scenario and not our preferred path. We mention it so that traders can be prepared.

Dow poised for uptick?

The intraday chart of the Dow 30, below, shows how our primary dip-then-rise scenario could translate to this index. The main supports to watch for a dip are at 32,182 and 31,692, with 30,898 being a stretch target that could shake bulls out of the market.

Approximate upward targets for the rise await at 33,289, 34,243, and 34,547. We will be able to refine these resistance levels if our primary scenario begins to play out.

For more technical analysis from Trading On The Mark, follow them on Twitter. Trading on the Mark's views and findings are their own, and should not be relied upon as the basis of a trading or investment decision. Pricing is indicative. Past performance is not a reliable indicator of future results.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.