Our bearish near-term outlook for US stock markets, as outlined in our 13 December article, unfolded mostly as we expected up to the end of last month, particularly as regards the Nasdaq 100. However, bears retreated during the first couple of weeks of 2023 as the Nasdaq 100, S&P 500 and the Dow made gains.

Current patterns on both the Nasdaq 100 and the Dow lead us to favour a mild bullish bias prior to the US Federal Reserve’s next policy meeting, which will take place from 31 January to 1 February. Thereafter, we expect the longer-term downtrend to resume.

Most observers expect the Fed to signal a dovish shift at its upcoming meeting. Irrespective of what happens, current market sentiment fits the classic “buy the rumour, sell the news” scenario for traders. In other words, US indices could spend the next two weeks ramping up, before the Fed’s announcement resets expectations.

Thus, for both the Dow and the Nasdaq 100, we’re monitoring resistance levels that we think might be tested in the next two weeks. We expect only moderate increases during this period, and intraday traders may encounter some volatility.

Dow could tick higher before possible dip

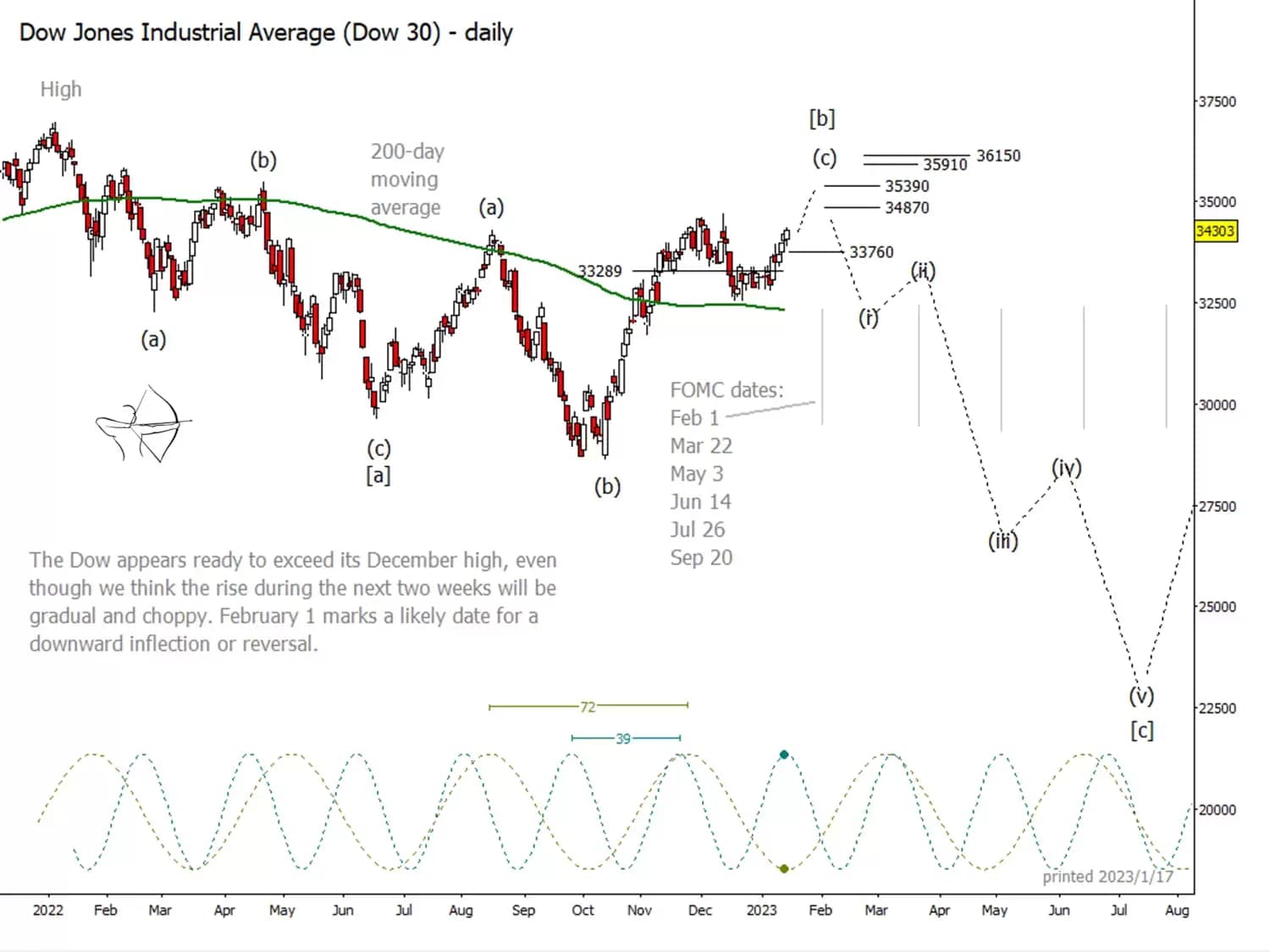

Drawing on Elliott Wave theory, our main scenario for the Dow – which closed at 33,910.85 on Tuesday 17 January – sees wave (c) of [b] climbing to between 34,870 and 35,390, as shown on the chart below. Stretch targets for a rally include 35,910 and 36,150.

However, this near-term bull case could face a setback if the Dow were to break below 33,760 prior to the Fed’s end-of-month meeting (dates of upcoming Federal Open Market Committee [FOMC] meetings are listed on the above chart). A decline wouldn’t necessarily precipitate a bigger downward reversal, but it could signal that the market is ready to reward traders who can trade ‘market chop’ or at least know how to avoid it.

After the Dow tops out, our scenario suggests that a strong five-wave decline could play out over the coming months.

Nasdaq 100 yet to break above key level this year

While the Dow climbed above its 200-day moving average (DMA) in November and then used it as support for an extra bounce, the Nasdaq 100 remains well below its 200-DMA. During the next two weeks, we would like to see the Nasdaq 100 challenge its December high by climbing towards 11,780 or even 12,100. The higher levels marked on the chart below at 12,470 and 13,120 could produce a market reaction if tested, but we think the index is more likely to stall at a lower level.

Bulls would probably like the Nasdaq 100 to remain above 11,220. A break and close below this level before the next FOMC meeting could trigger some choppiness.

The Nasdaq 100 support targets marked in black at 10,090, 8,840, 8,580 and 7,940 on the above chart are based on our primary scenario. However, if the index breaks above the December high and tests 12,100 or higher in the near term, we would shift our wave count to the alternative scenario marked by the blue labels. In that case, we would recalculate support levels, although they wouldn’t change drastically.

For more technical analysis from Trading On The Mark, follow them on Twitter. Trading On The Mark's views and findings are their own, and should not be relied upon as the basis of a trading or investment decision. Pricing is indicative. Past performance is not a reliable indicator of future results.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.