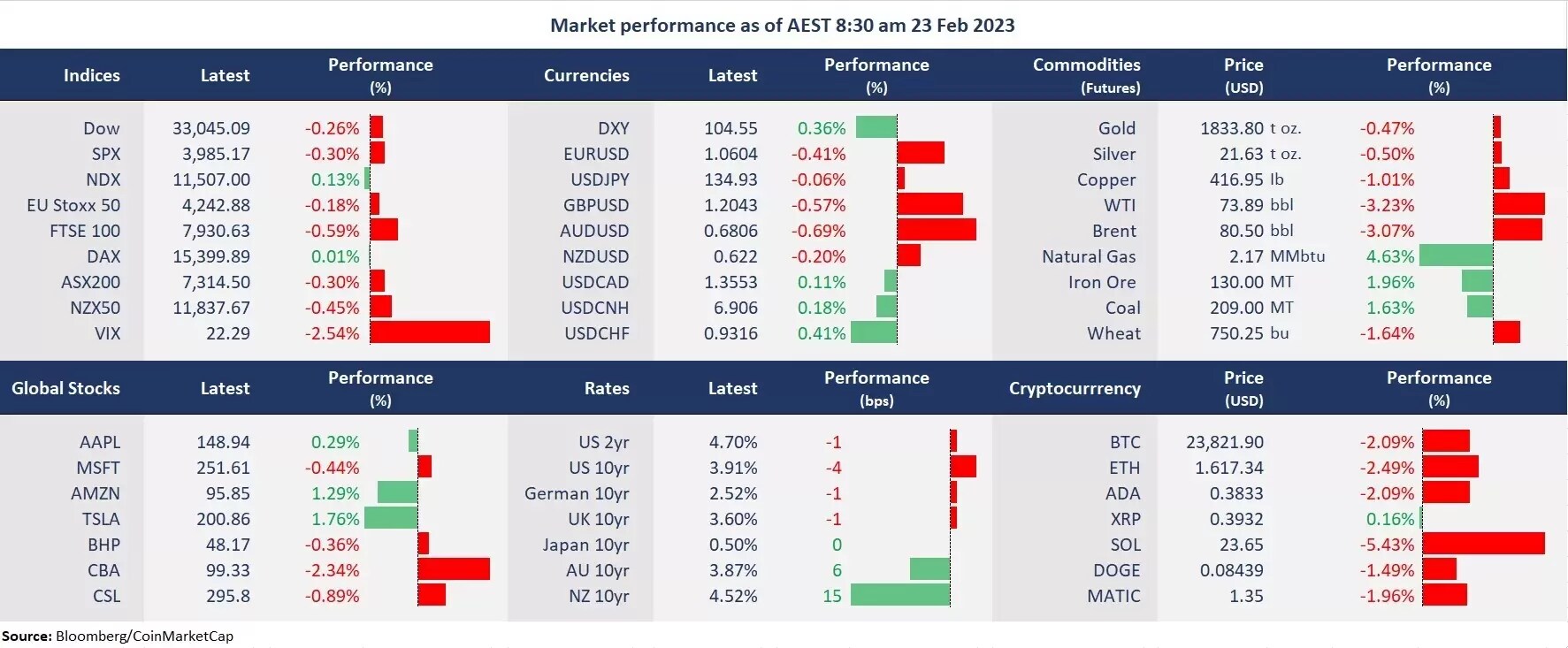

US stocks ran off a session high and finished mixed after the FOMC meeting minutes showed that the Fed expected to continue rate hikes to bring inflation down to the 2% target. The US flash services PMI signalled economic activities moved out of contraction territory for the first time since June 2022, and the manufacturing PMI also came as higher than an estimate. The existing home sales, however, fell for the twelfth straight month to the slowest pace in January due to rising rates. A pick-up in economic activities and ongoing moderate housing markets are perhaps what the Fed is happy to see. While a rate hike cycle is still on course, whether there will be only a mild recession is key to driving further market movements. Tech shares’ outperformance may suggest investors are optimistic about the economic playout for the time being. On the other hand, the US dollar strengthened further as the terminal Fed rates are now projected much higher than before January. The Fed St. Louis Fed President James Bullard expects the interest rate to hit 5.37% at a peak later this year.

- 9 out of the 11 sectors in the S&P 500 finished lower, with Real Estate leading losses, down 1.2%. Consumer Discretionary and Materials stocks were higher, up 0.5% and 0.7%, respectively. Tesla’s shares rose 1.8% on the news that the EV maker will make its global engineering headquarters in California.

- Microsoft adopts the AI chatbot to the Bing app. Microsoft announced its new AI-powered Bing apps for both iPhone, Android, and Skype. Users will be able to add Microsoft AI to group chats on Skype and ask questions and the answers will be displayed in bullet points.

- Baidu Inc. announced a US$5 billion share buyback following better-than-expected earnings results. The Chinese search engine giant reported 33.1 billion yuan (US$4.8 billion) in the fourth quarter, topping an estimated 32.1 billion yuan. Its shares jumped 6% before the US markets opened but pulled back and finished lower, down 2.6% on Wednesday.

- Gold futures slid on a strong US dollar as the dollar index rose to 104.56, the highest seen on 5 January. Gold prices may continue to be under pressure at the back of climbing bond yields and USD.

- Crude oil slumped for the second straight trading day on economic concerns.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.