Technicals and fundamentals have aligned to suggest that the coming week could be an active one for trading in USDJPY. This major forex pair has broken out of a technical base just as the news spotlight turns to these two countries with the Fed and Bank of Japan both holding meetings this week.

Technicals:

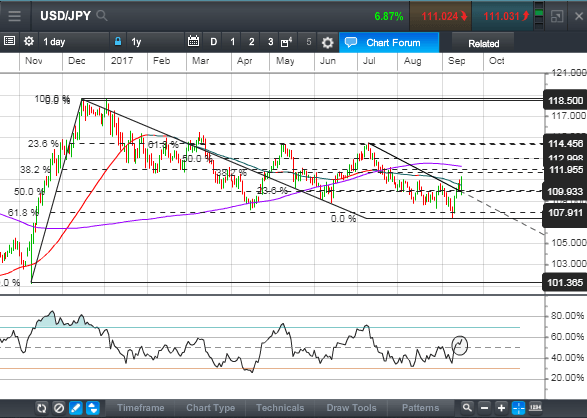

The USDJPY pair has been quite active over the last year staging a number of big swings in both directions. After declining through the summer, the pair has decisively turned back upward this month.

A summer decline ended in a Morning Star three day pattern (circled) that saw the pair decline on the first day, stage a reversal the second day and rally the third day. This indicated a sea change in dominance from exhausted bears to emergent bulls. Adding to the strength of the turn, at the bottom, the pair completed a common 62% Fibonacci retracement of its previous uptrend, a point corrections are often capped. At the bottom the pair dipped under the 62% retracement level near 107.90, fell then rallied, a classic bear trap pattern that suggested bears had been washed out.

In recent days, the upturn has accelerated. The RSI indicator has regained 50 to confirm an upturn in momentum. A bullish engulfing day Friday that also saw the pair confirm a breakout over 110.00 and then retake its 50-day average near 110.50 indicated bulls continue to gain strength.

Initial resistance has emerged near 111.00 with its next potential upside resistance zone between 111.60 and 112.00, where two Fibonacci levels cluster, then the 200-day average near 112.30. Initial pullback support levels appear near 110.20, a Fibonacci cluster near 109.95 and a higher low near 109.50.

Fundamentals:

There are a number of factors that could drive trading action in this pair this week.

Role of the Japanese Yen as a defensive haven (along with gold and CHF)

After rallying through the summer, the flight to defensive havens appears to have peaked and capital appears to be moving back out into risk markets. While North Korea has dominated the headlines and could flare back up again, the bigger political risk driver impacting capital flows appears to be easing US domestic political turmoil. With the White House starting to deal directly with the Democrats on hurricane aid, immigration (Dreamers) and government funding, the risk of an economically disruptive government shutdown has started to decline encouraging traders to pull capital out of havens.

This week’s Fed meeting and the US Dollar

The Fed is widely expected to start normalizing its balance sheet this week. At this point the street may focus more on what could happen in December, through comments in the statement, press conference and member projections. The Fed’s party line has been for three rate hikes this year and so far there have been two. With US political turmoil settling down a bit, the window for the Fed to act may remain open through December, when previously it had appeared the Fed would only be able to make a move in one of September or December. A hawkish Fed could boost USD relative to JPY

This week’s Bank of Japan meeting and the Japanese Yen

The Bank of Japan’s pedal to the metal stance on monetary stimulus has started to look increasingly lonely relative to other central banks. The Fed and the Bank of Canada have each raised interest rates twice this year, the ECB is expected to announce details of tapering its QE program in October or December and the Bank of England is now openly taking about raising its interest rate, perhaps as soon as November.

The Bank of Japan meets a few hours after the Fed at which time we may get a better idea of whether Governor Kuroda remains ultra-dovish or if change is in the air at the BoJ as well. A dovish central bank could weigh on the Yen, a hawkish turn could spark a rebound.

CMC Markets is an execution only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

CMC Markets Canada Inc. is a member of the Investment Industry Regulatory Organization of Canada and Member-Canadian Investor Protection Fund / Membre-Fonds canadien de protection des épargnants. CFDs are distributed in Canada by CMC Markets Canada Inc. dealer and agent of CMC Markets UK plc. Trading CFDs and FX involves a high degree of risk and investors should be prepared for the risk of losing their entire investment and losing further amounts. CMC Markets is an execution only dealer and does not provide investment advice or recommendations regarding the purchase or sale of any securities.

CFD and FX trading with CMC Markets is only available in jurisdictions in which CMC is registered or exempt from registration, and in Alberta is available to Accredited Investors only. CMC Markets neither solicits nor accepts business or accounts from residents of the United States of America.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.