US dollar index retraced for a second day to 97.33 area ahead of tonight’s FOMC interest rate announcement. The futures market is currently pricing in a 97.3% likelihood of a 25bps rate reduction to be carried out tonight.

More important is probably the Fed’s future guidance of further rate cuts down the road.

The central bank has already cut its policy rate twice recently, calling it a ‘mid cycle adjustment’ in an effort to prevent the economy from falling into a recession amid trade uncertainties and global slowdown.

However, this has also introduced criticism on the Fed’s neutrality as its key references – employment market and inflation – have both remained at relatively healthy levels. Three rate cuts this year is probably sufficient for the year including the measure to start the Fed balance sheet expansion – a mechanism that is similar to the previous three rounds of quantitative easing. Some dry powder probably need to be reserved as rescue measures in the future economic downturn.

The US dollar may carry on its downward trajectory if the Fed actually cut rates tonight and provide an accommodative policy outlook. This will likely lead to a quick rebound in euro, yen, aussie, pound and yuan. But the fall in dollar could again prove to be short-lived against the backdrop of uncertainties surrounding the Brexit and UK elections, US-China trade talk and unexpected geopolitical jitter, which are likely to cushion the downside of the dollar.

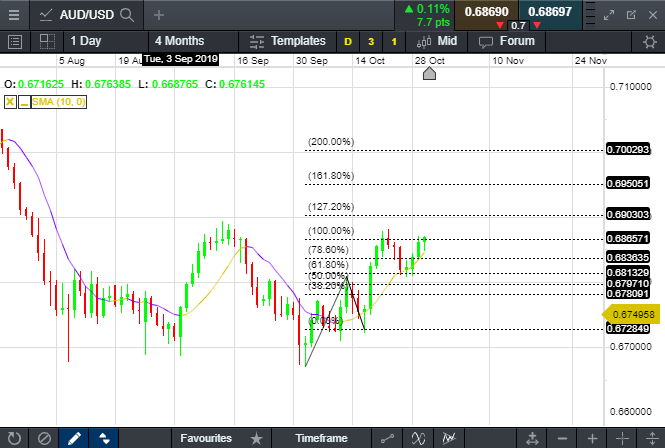

Technically, GBP/USD has found a key support at 1.282 area and consolidated above this level in the past five trading sessions. Immediate resistance level can be found at 1.300 area. AUD/USD is challenging a key resistance at 0.687-0.688 area, which it failed to break out twice previously. A successful breakout will open room for more upside towards 0.690 and then 0.695 area.

US equity market suffered selloff in the technology sector following Google’s earnings miss. Sectorial rotation exhibited risk-off pattern, with healthcare (+1.16%), materials (+0.67%), energy (+0.42%) outperforming, whereas communication (-0.95%), information technology (-0.62%) and consumer discretionary (-0.59%) lagging.

Asian markets were mixed this morning, as traders prefer to stay on the side lines waiting for the Fed’s rate decision. Singapore’s Straits Times Index re-attempted to stand above 3,200 points, a key psychological level. Fed’s rate cut will likely benefit the real estate, industrial and consumer sector whereas banks will see their net interest margin compressed by narrower rate band.

AUD/USD

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.