Want to make an experienced trader laugh? Tell him or her “it’s different this time”. Whether the topic is epic heights for Bitcoin, or share market multiples and valuations at record levels, the various versions of the “it’s different” argument make experienced traders laugh nervously.

The reason is that it’s never different. Although economies and markets grow and evolve, the activity is the result of human endeavour, and human nature remains constant. Market prices are the product of crowd behaviour. At the basic level, prices change with the balance of buyers and sellers, and understanding the thinking of the crowd gives insights to where the market is headed.

It’s almost certain there will be a terrible reckoning in share markets. Simply put, shares are too expensive. The price to (forward) earnings ratio for the Australia 200 index has eased back slightly over the last two weeks as analysts revised estimates upward in light of the recent reporting season. Regardless, at 19 times it remains near 20 year highs. Similarly, the price to sales ratio is at 2.5 times, the highest mark this century.

Anecdotal measures of market sentiment look even worse. Investors may do well to recall Sir John Templeton’s observation that bull markets mature on optimism and die in euphoria. There’s plenty of evidence of euphoric thinking right now. Reddit traders who claim stonks only go up, and to (always) buy the dip, are a good example. Those with more than a year’ s experience in markets know this is both untrue and dangerous.

If you’re a market professional you can’t get into an Uber at the moment without being asked what stocks to buy. This updated version of the taxi driver index speaks directly to the human nature of markets. When stocks (or any market) are a popular and widespread topic of discussion, it’s an indication that participation levels are high. When everyone one who can and will buy into the market has done so, there’s no one left to keep driving the market higher. Under these conditions, a panic can cause enormous damage to shares prices in a short period of time.

The most popular version of the “it’s different this time” argument right now revolves around interest rates and the action of central banks. Its proponents argue that historic liquidity and the lowest interest rates in living memory not only justify stretched valuations, but make them sustainable.

The problem is that recent bond market moves are indicating that the low in interest rates has passed, and outlook is now that rates rise rather than fall. The buoyancy in share markets reflects confidence in an enormous economic recovery this year. Rising bond yields are a reminder that growth brings inflationary pressures, and a judgement that this pressure will restrict the ability of central banks to maintain their current accommodation.

Like good comedy, timing is crucial in markets. The challenge for investors is that the market performance from here is in the hands of the crowd. While there is a lot of evidence that the “fools are dancing”, there is no telling when the music will stop.

A better time to prepare for a market correction is before the crowd turns. The right answer for an individual trader or investor depends on their own circumstances, but among other measures they can increase cash levels, employ diversification across and within asset classes, and use tools such as options and CFDs to hedge their exposure.

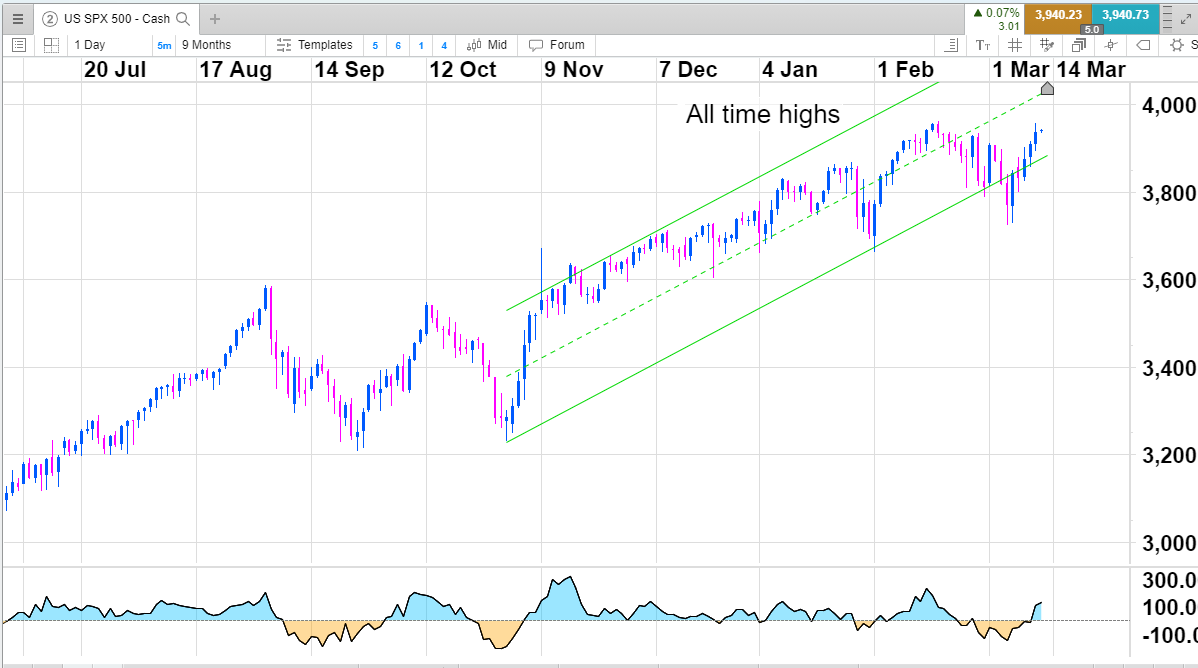

Traders should bear in mind that there may be a number of false breaks. Concerning news will spark a sharp fall, breaking the upward momentum and creating the impression that the share market is about to crater, only for the mood to turn suddenly and propel indices to new highs. This can prove frustrating to those who anticipate a fall.

However successful trading and investing is not about being right 100% of the time, nor capturing every possible market move. Nobody can predict the future with certainty. Instead, investors can prepare themselves and their portfolios for a number of scenarios. Frothy share market valuations and euphoric sentiment mean that a market correction or crash sometime in 2021 is among them.

*This article first appeared in the Australian Financial Review

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.