Our late-January forecasts for the currency pairs EUR/USD and GBP/USD performed well, and there were some trading opportunities to be had after the euro and the pound fell through their designated confirmation levels. In this post, we refine our euro forecast and introduce a near-term map for the Japanese yen.

Euro to hit fresh low in 2023?

We believe the euro could push for a new low against the US dollar this year, although we encourage readers to review the alternative bullish scenario mentioned in our 24 January article. Price has not yet reached the zone where the market will decide between the two big-picture paths, meaning that possible bear and bull routes remain open. For the next few months we're bearish on the euro, though for the next few days we're mildly bullish.

Price appears to have completed an impulsive (five-wave) move down from the early February high and is now in the late stages of an upward corrective retracement. The structure of sub-wave 'c' of (ii) doesn't appear complete yet, and we'd like the euro to move a bit higher to test $1.0739, $1.0770, and possibly even $1.0831, before resuming the larger decline.

This scenario may present an opportunity for nimble intraday traders as key levels could transform from resistance to support. We expect price to wend its way through the targets marked in the chart below, testing them first from below and then from above. The actual path might be a bit more convoluted than the one we’ve drawn on the chart.

Yen trending lower versus the dollar

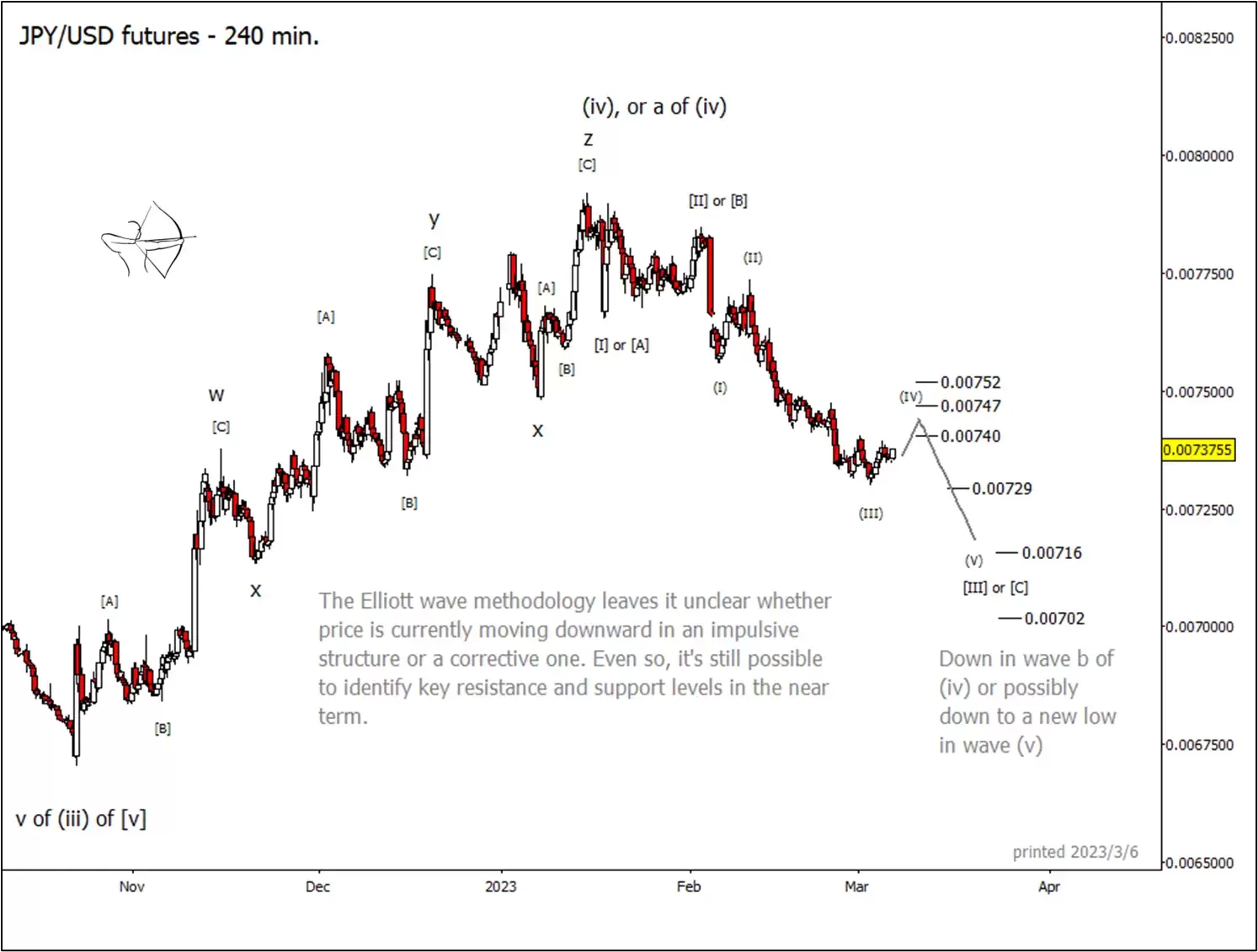

The yen presents a more ambiguous Elliott wave count than the euro, but it might still offer a tradable scenario in the near term. We expect the yen to dip below its 2022 low, but the market may be able to delay that moment until late this year or even sometime next year. Alternatively, price could take a more direct downward path and reach a new low within a few months.

Regardless of which path the market takes, traders may find potential plays in the downward impulsive structure that began in early February at the lower high marked as wave [II] or [B] on the chart below.

Over the next few days, we'll be watching for price to recognize resistance near $0.00740, $0.00747 or $0.00752. A reversal near one of those levels will probably mark the culmination of small wave (IV) of the impulse, regardless of whether the impulse is part of larger wave [III] or wave [C].

Preliminary targets for the next downward phase in the yen wait at $0.00729, $0.00716, and $0.00702. These are based on standard Fibonacci ratios among the waves that have printed since January.

For more technical analysis from Trading On The Mark, follow them on Twitter. Trading On The Mark's views and findings are their own, and should not be relied upon as the basis of a trading or investment decision. Pricing is indicative. Past performance is not a reliable indicator of future results.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.