Traders are unwinding bets on a big European Central Bank (ECB) stimulus move to be decided on Thursday, which led to a surge in Germany and US treasury yields.

Bond prices declined globally. As longer-term bond yields rose faster than their short-term peers, the yield curve has become less inverted from a week ago.

The euro remains weak despite a mild rebound led by surging bond yields overnight. Thursday’s ECB meeting is going to set the tone for euro trading for the rest of the week. Although the market is trimming expectations for a big stimulus package, it still foresees Mario Draghi delivering a very dovish forward guidance. The futures market is pricing in a 100% probability of a rate cut, rendering the euro susceptible to a big upside gain if the ECB fails to meet market expectations.

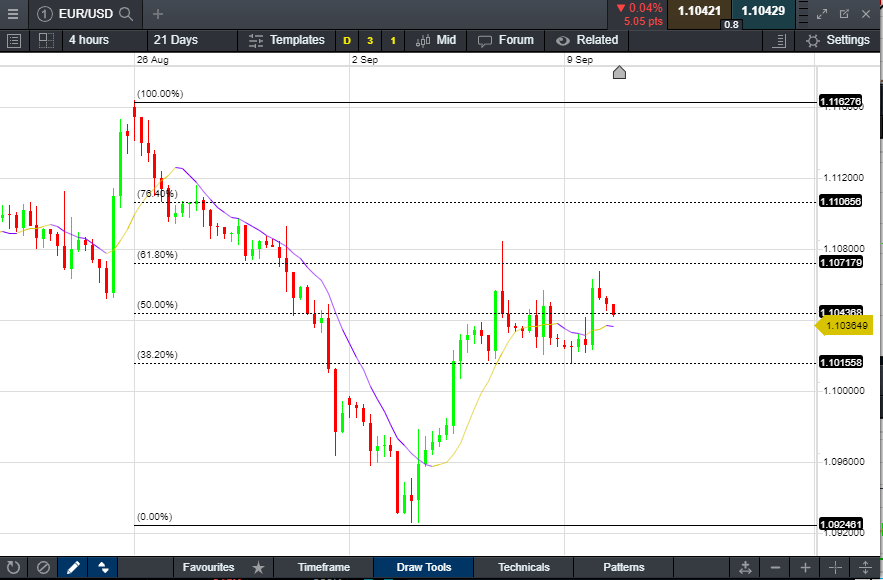

EUR/USD is trading at 1.104 area this morning, with immediate support and resistance found at around 1.101 (38.2% Fibonacci retracement) and 1.107 (61.8%) respectively.

With a lack of positive news, the US equity indices closed mixed, with little changes on Monday. Sector wise, energy (-1.86%) and financials (+1.54%) were leading whereas healthcare (-0.92%), real estate (-0.87%) and information technology (-0.72%) were lagging.

Crude oil prices climbed for a fifth consecutive trading session on hopes that Saudi Arabia’s new energy minister will carry out measures to support oil prices. The energy sector is likely to outperform in the Asian session following the US’s lead. Technically, the Brent crude price has entered into bullish trend as its SuperTrend (10,2) and 10-day SMA have both flipped upwards. Immediate resistance level can be found at $63.5 followed by $65.2.

In Singapore, the Straits Times Index opened 0.6% higher, driven by offshore & marine (SembCorp), banking (UOB), and real estate (Capitaland). REITs are mostly trading lower due to surging treasury yields and lower ECB stimulus expectation.

USD/CNH retraced to 7.107 area ahead of China’s inflation data today.

EUR/USD chart

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.