The euro and the British pound followed the alternative, bearish paths we outlined two weeks ago. They then put in retracement bounces. We would like to see additional bounces in both currencies during the upcoming week, but we cannot rule out a quicker resumption of the downward trends. In this post, we present near-term bullish and bearish scenarios for both currencies versus the US dollar.

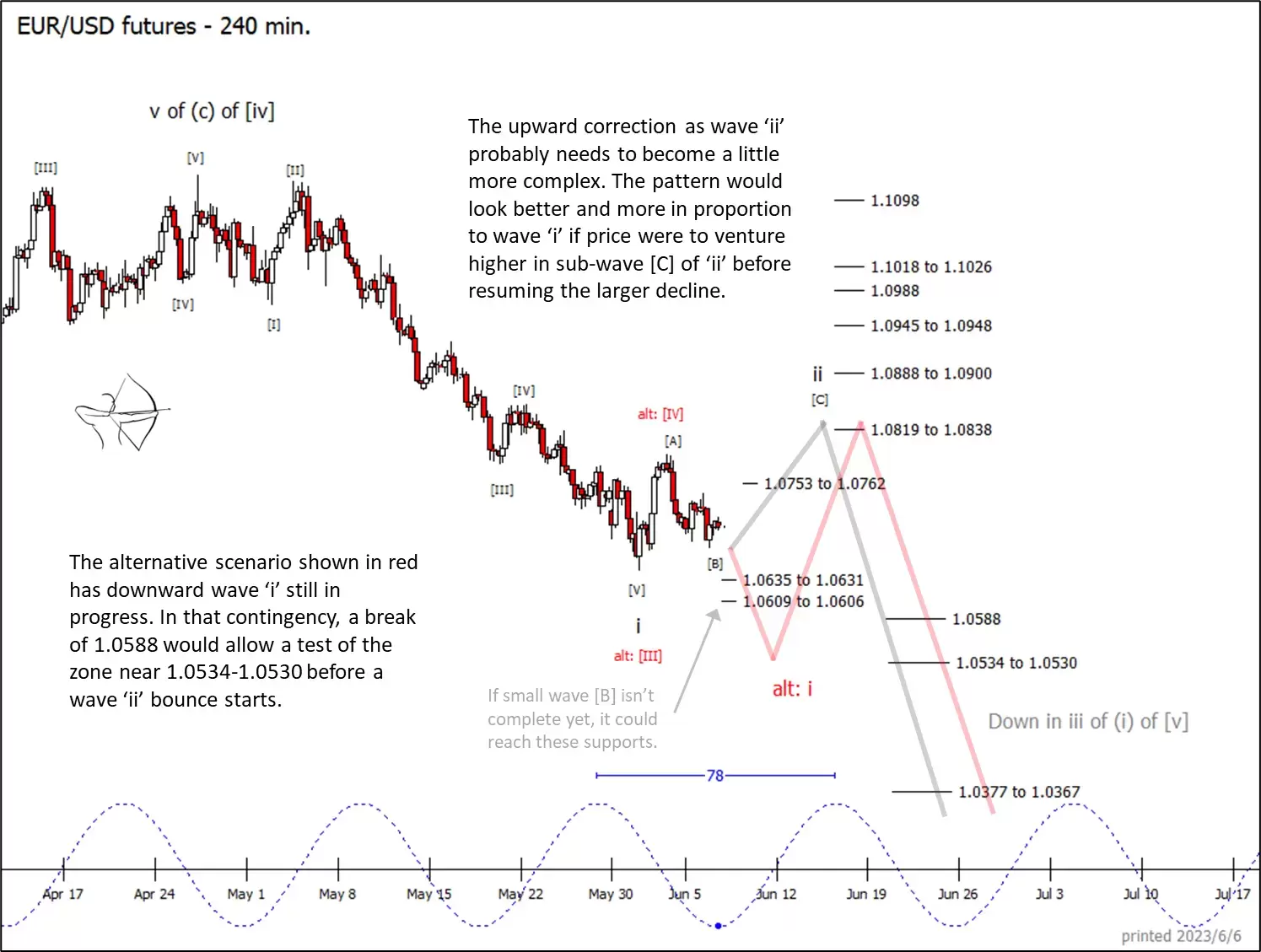

Euro in a consolidation range between $1.0588 and $1.0900

The euro's 31 May low might have represented the completion of downward wave 'i'. In that case the recent bounce looks too brief and shallow to make a satisfying wave 'ii'. Thus our primary scenario projects another modest bounce in sub-wave [C] of 'ii'. The zones near $1.0819 to $1.0838 and $1.0888 to $1.0900 represent the most likely resistance areas to complete the move, although higher levels are possible.

The alternative scenario, drawn in red on the below chart, presents the case that downward wave 'i' might still be ongoing and that the recent bounce represented part or all of an internal fourth wave. That would allow price to wiggle around in the range established since 31 May before trying to complete wave 'i' with a new low. In this alternative scenario, a break of support at $1.0588 would allow for a test of the zone near $1.0534 to $1.0530, where the anticipated wave 'ii' bounce could begin.

From a trader's perspective, the wave count is less important than recognizing the consolidation range that we think price currently inhabits. The lower end of the range is at $1.0588, and the resistance zones up to $1.0900 represent the upper end. Many traders will probably be on the lookout for opportunities at the edges of this range, or after price breaks beyond one of the edges.

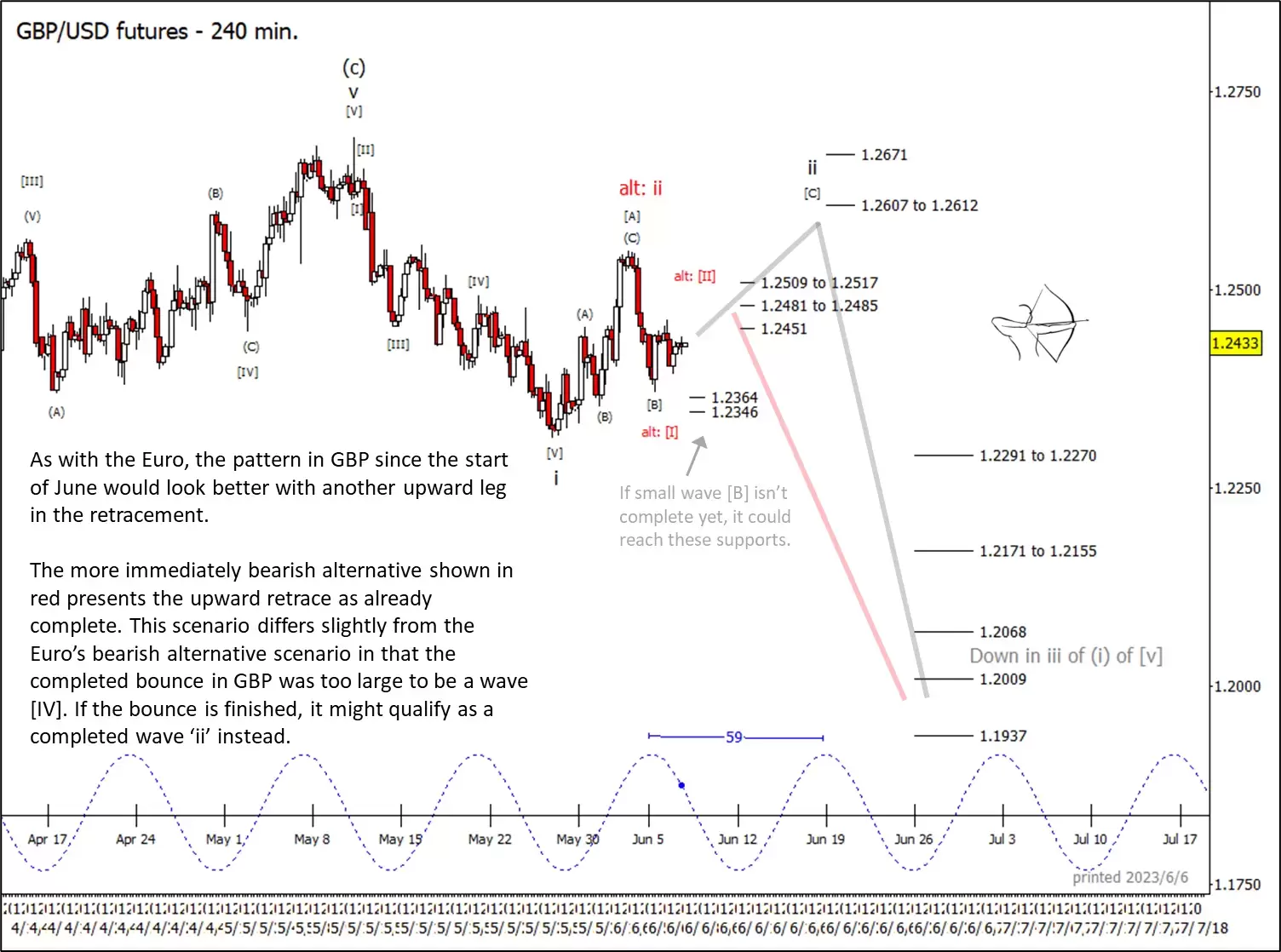

Pound faces resistance above $1.26

The British pound presents a situation similar to that of the euro, even though sterling’s early June bounce was relatively stronger. The bounce was too large to be an internal fourth wave as we have depicted in the alternative scenario for the euro, but it could represent part or all of the wave 'ii' retrace that would be a counterpart to downward wave 'i'.

As with the euro, the pound is probably working within a consolidation range. Resistance zones near $1.2607 to $1.2612 and $1.2671 represent our preferred targets for completion of sideways or upward wave 'ii', but we cannot rule out a small dip lower to test supports at $1.2364 and $1.2346 in the very near term.

If price fails to climb beyond the middle set of resistance levels between $1.2451 and $1.2517, then traders are likely to be mindful of the possibility that the larger correction may be complete. A failure to break beyond those levels could see a steep decline become the path of least resistance.

For more technical analysis from Trading On The Mark, follow them on Twitter. Trading On The Mark's views and findings are their own, and should not be relied upon as the basis of a trading or investment decision. Pricing is indicative. Past performance is not a reliable indicator of future results.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.