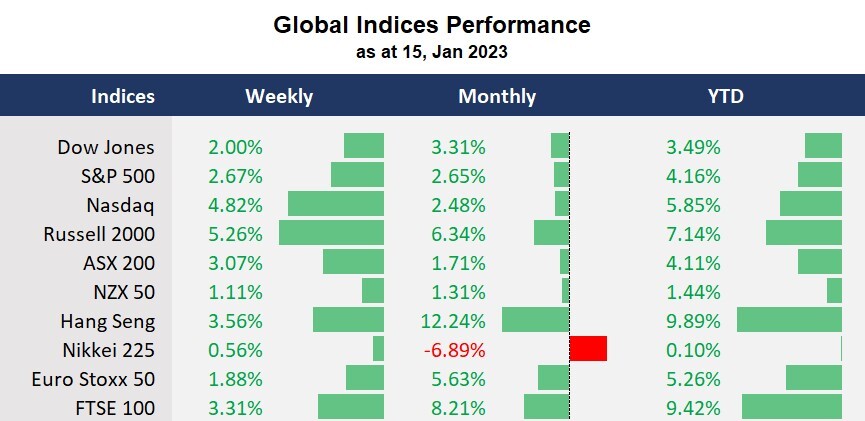

Global equity markets extended gains for the second week, thanks to a further cooling in US inflation, making a sooner-than-anticipated rate-pivot more by the US Federal Reserve more likely. Notably, high multiples have outperformed US equity markets, with the tech-heavy Nasdaq up nearly 4.8 %, and the small-cap index, Russell 2000, up 5.2% for the week.

At the same time, China’s reopening story is playing a major role in gauging the global economic trajectory, with a further jump in commodity prices at the back of an improved demand outlook.

Following a stronger-than-expected US banks' Q4 performance, US big tech earnings kicks off with Netflix, which may further steer current market bulls. The Bank of Japan’s policy meeting will be also a focus, since the central bank unveiled a policy twist in early December.

What are we watching?

- The US dollar weakens: Cooler inflation has sent the king dollar lower, with the dollar index dropping to the lowest seen in June 2022, supporting a sharp rebound in the other major currencies, especially in the Japanese yen and the Chinese yuan. Both USD/JPY and USD/CNH tumbled to the lowest since mid-2022.

- Gold surges: The decline in US bond yields and a softened USD continued to support the sharp rally in gold prices, with gold prices jumping above the key resistance of 1,900, to the highest seen in April 2022.

- Crude oil rebounds: Crude oil prices rose amid China’s reopening optimism and a softened US dollar. The recession fear-induced sell-off in oil faded as cooler inflation and bets for a sooner Fed pivot improved the demand outlook.

- Cryptocurrencies spike: The broad rally in risk assets has also boosted sentiment in cryptocurrencies, with bitcoin surging above 21,000 and ethereum jumping above 1,550, the highest since November 2022.

Economic calendar (16-20 January)

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.