The omicron variant-induced selloff didn’t last long, as US stocks rebounded for the third straight day, with the S&P 500 only 1% away from its record high. The White House said on Monday that the new variant omicron is less of a concern than what people initially thought, according to the preliminary data. Investors certainly found a good reason to buy the dips again as the US stock market is on its longest bull-run since 2009.

It might be a 'done deal' for Fed to accelerate tapering

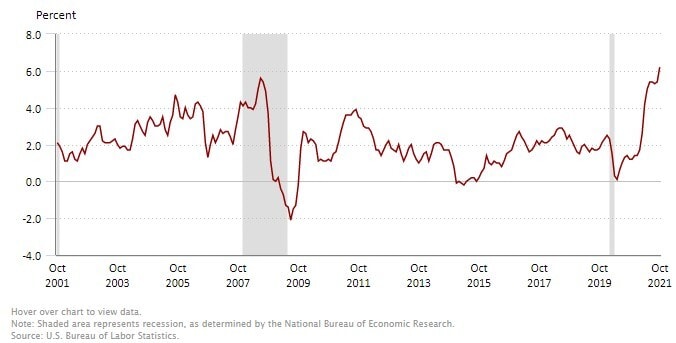

The US November consumer price index (CPI) is to be released on Friday, which is a key economic gauge for the Fed to decide on monetary policy. According to a Bloomberg survey, the US consumer price will increase 0.7% monthly and 6.7% from a year ago, which will be the highest since 1982. Fed chair Jerome Powell has thrown a bomb a week earlier that he would consider accelerating tapering on the bond-buying size and the decision will be put into a discussion at the next meeting on 14-15 December.

Even though the November job data showed a substantial slowdown in the labour markets from last week, it will not deter the Fed to accelerate the stimulus withdrawal. And the relief from the omicron impact also strengthens the expectation. The CME FedWatch Tool shows a 43.7% chance for a rate hike of 25 basis points in June 2022. The odds have increased 74% from one month ago.

12-month percentage change in US CPI

A potential ongoing bulls run in the stock markets

But it looks like investors are fearless of the burning inflation this time. Part of the reason is that the omicron updates overshadowed the Fed effect. People focus more on the optimism towards economic reopening, the airlines and cruises stocks rebounded sharply this week, while the crude oil prices recovered losses by 8% this week. The meanwhile, quality technology companies are in favour of investors who seek safe-haven assets. Apple’s share price hit a new fresh high at $175.06 on Wednesday. The iPhone maker reached a market cap of $3 trillion for the first time. The tech heavily weighted index, Nasdaq 100, rose as much as 3% on Tuesday and outperformed S&P and Dow on Wednesday. The US stocks turned on its risk-on mode since omicron could not be much of a concern anymore.

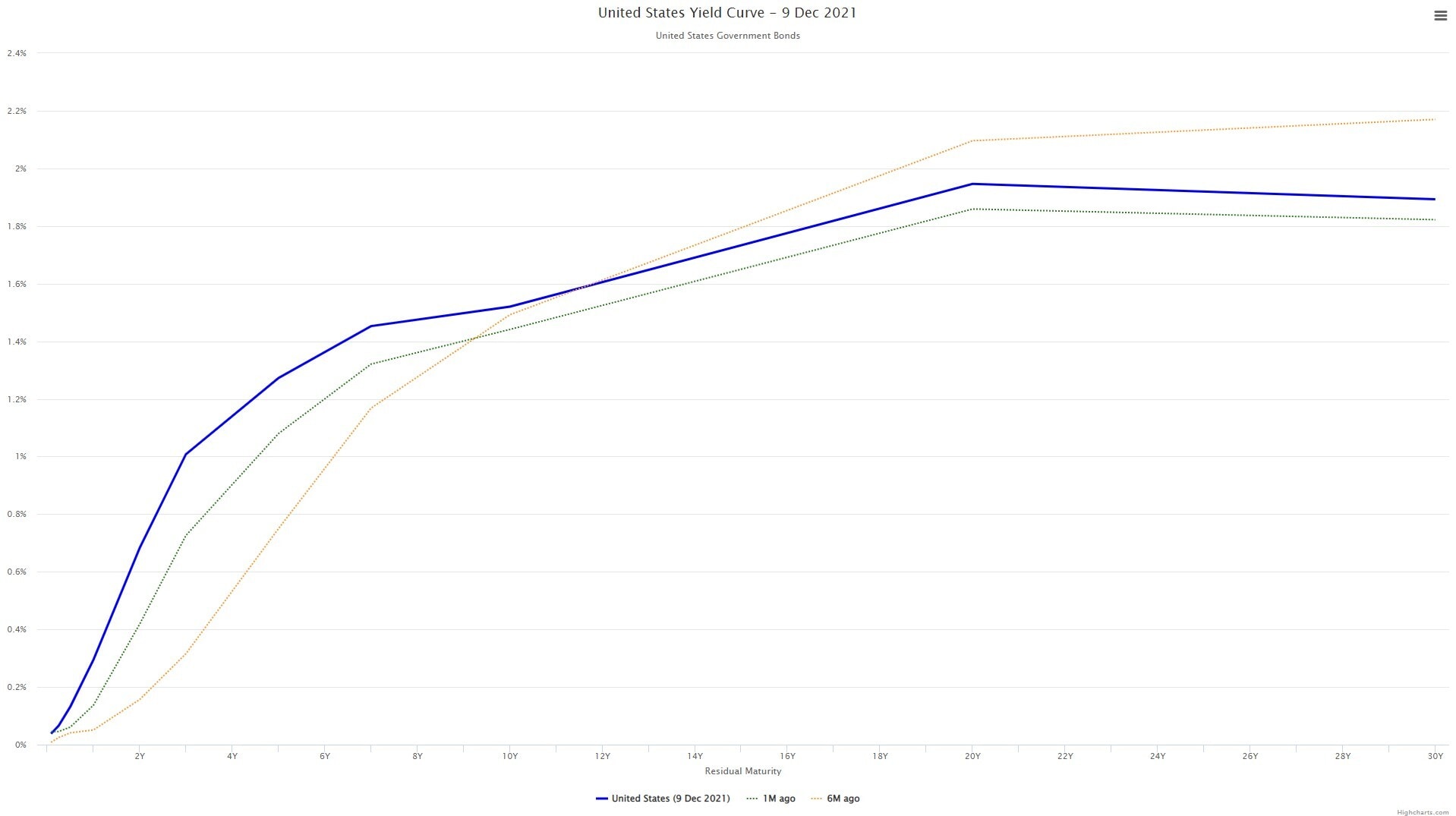

Don’t forget the yields curve

The US Treasury yields continued the flattening run in December, which indicates the yields for the shorter-dated securities increased more than the yields for the longer-dated bonds, as it is widely expected the Fed will wind down its bond purchase. It also shows signs of economic slowdown in a long run from the historically low yields for the long-dated bond. Most of the companies indicated concerns of the supply issue would stretch the profit margin in the third-quarter earnings report. Investors need to be mindful of the stocks market valuation at the start of the tightening monetary policy cycle

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.