While European markets started the month on a positive note, and look set to continue that vibe this morning, US markets lost their early momentum, finishing the session lower, after the latest job openings numbers, and ISM manufacturing report, showed that the US economy remained in decent shape, despite concerns over an economic slowdown.

We could see further evidence of a robust labour market later today with the October ADP employment report, which is expected to show 178k new jobs added, a modest slowdown from September’s 208k, as the Federal Reserve gets set to announce its latest rate decision, after European markets close today.

Before that we get the latest updates to the recent flash PMIs from Germany, France, Italy, and Spain, all of which are expected to slip back further into contraction territory, with readings of 45.7, 47.4, 46.9 and 47.6, respectively.

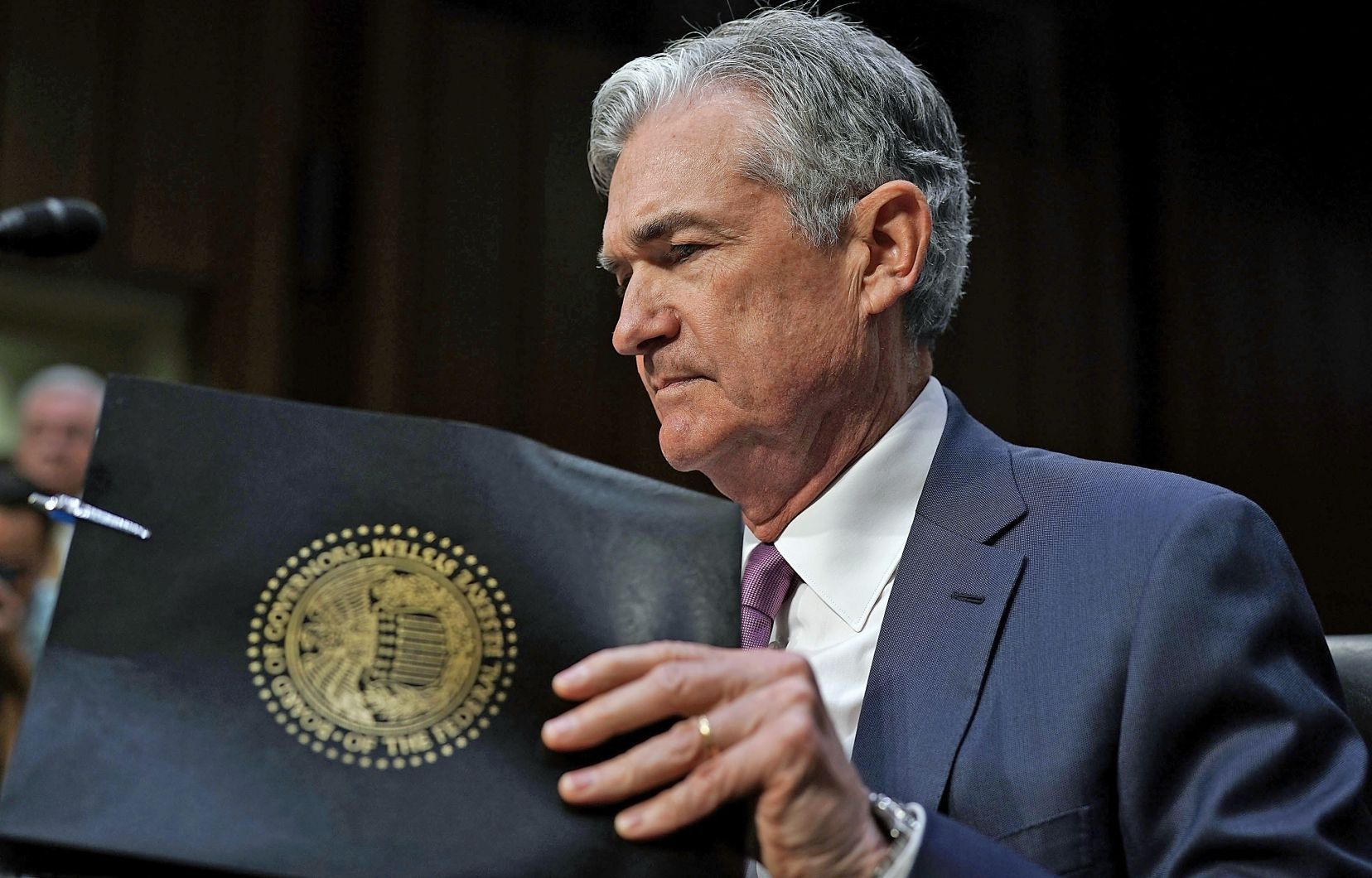

The Fed isn’t expected to surprise today when it is expected to raise the Fed Funds rate by another 75bps, pushing it up to 4%, following on from three similar moves in June, July and September.

The main focus of attention has shifted in the past few days towards what might be coming in December, as markets increasingly price the prospect of a policy pivot, pause or slowdown, as we head into year end.

With the mid-term elections coming in a few days’ time, it’s hard to see how Powell will be able to draw a line between today’s press conference and the December meeting when there will be two CPI reports, as well as two jobs reports between now and then. If as the Fed says it is driven by the data then he will have to keep the prospect of a 75bps rate rise on the table if he is serious as he said back on September, that the FOMC were “strongly committed” to driving inflation lower.

His insistence that there was no painless way to drive inflation lower, is equally as valid now as it was then and while we have seen some central banks slow the pace of their own tightening cycles in the form of the RBA and the Bank of Canada, this is mainly down to concern over their housing markets.

It is true that the US housing market is struggling, but is it struggling enough to warrant a softening of tone?

The Fed’s change of tone in September was also markedly different, with the Fed downgrading its annual GDP target to 0.2% in 2022, with Powell admitting that a recession might be possible.

Core inflation is forecast to decline to 4.5% this year, before falling to 2.1% by 2025. Since then, there has been little evidence of that and since then we’ve had a succession of Fed Presidents talking up the prospects of even more aggressive tightening, with the prospect that we might see another 150bps by year end which would put the Fed Funds rate at 4 75% by year end.

In the last few weeks, we have seen some chatter that some Fed officials were becoming uneasy at the pace of the current hiking cycle.

That would seem eminently sensible but for the fact that apart from Fed vice chair Lael Brainard, and San Francisco Fed President Mary Daly there has been precious little articulation of that line from any Fed officials in recent public speeches.

It’s especially noteworthy when you have the likes of Neel Kashkari of the Minneapolis Fed who has traditionally been one of the more dovish members of the FOMC, showing little sign of the need for a pause or a pivot at this point. This might suggest that for all the market optimism the smart money is on the bar being set very high for the Fed to consider a slowdown in the pace of rate rises, if core inflation is still rising.

Nonetheless the first evidence that splits might be starting to open up could be interesting in the context of when we might start to see the beginnings of a discussion of the need for a stepping down in the pace of rate hikes, starting next month. It’s still a big ask when there are 2 CPI prints between now and December.

Thus, the Powell press conference is likely to be just as important in the context of whether he comes across as hawkish, as he did in September.

EUR/USD – continues to slip back with the prospect of a move towards the 0.9750 area and trend line support from the recent lows. While above this line we could still see a return to the parity area. Resistance currently at the 0.9970 area.

GBP/USD – continues to slip lower with the prospect of a retest of the 1.1370 area and 50-day SMA, after failing at trend line resistance from the highs this year. A move below 1.1360 opens a retest of the 1.1100 area.

EUR/GBP – edging back towards the 0.8650 area but needs to break above to re-target the 50-day SMA. A move below the 0.8570 area could well see further weakness towards the 200-day SMA and the 0.8500 area.

USD/JPY – still looks well supported after last week’s dip to 145.10. A move through the 149.20 area retargets the 150.00 area.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.