After several false starts, the euro and the British pound may finally have embarked on their journeys towards the lows we expect them to post near the end of this year.

In this article we highlight downward, five-wave sequences in both markets that could presage a downtrend over the coming months. This week and heading in to next week, though, we anticipate a minor bounce for both currencies against the US dollar.

For the euro, a rise could come before a fall

The euro has fallen from the late-April consolidation zone. A shallow upward retracement (wave ii) could be capped near $1.0890 or $1.0929. A test of $1.0966 would lift the euro towards the lower edge of the prior consolidation zone, but price is more likely to fall away sooner than that.

Although the downward move may appear encouraging for bears, the Elliott Wave structure is unclear. Our primary count marks wave 'i' as complete, but an alternative count has it extending a bit lower. A failure to overcome resistance at $1.0821, followed by a convincing break of support at $1.0759, would suggest that the downward pattern might continue. In that case we would watch supports at $1.0658, $1.0570 and $1.0530.

The pound could also bounce in the near term

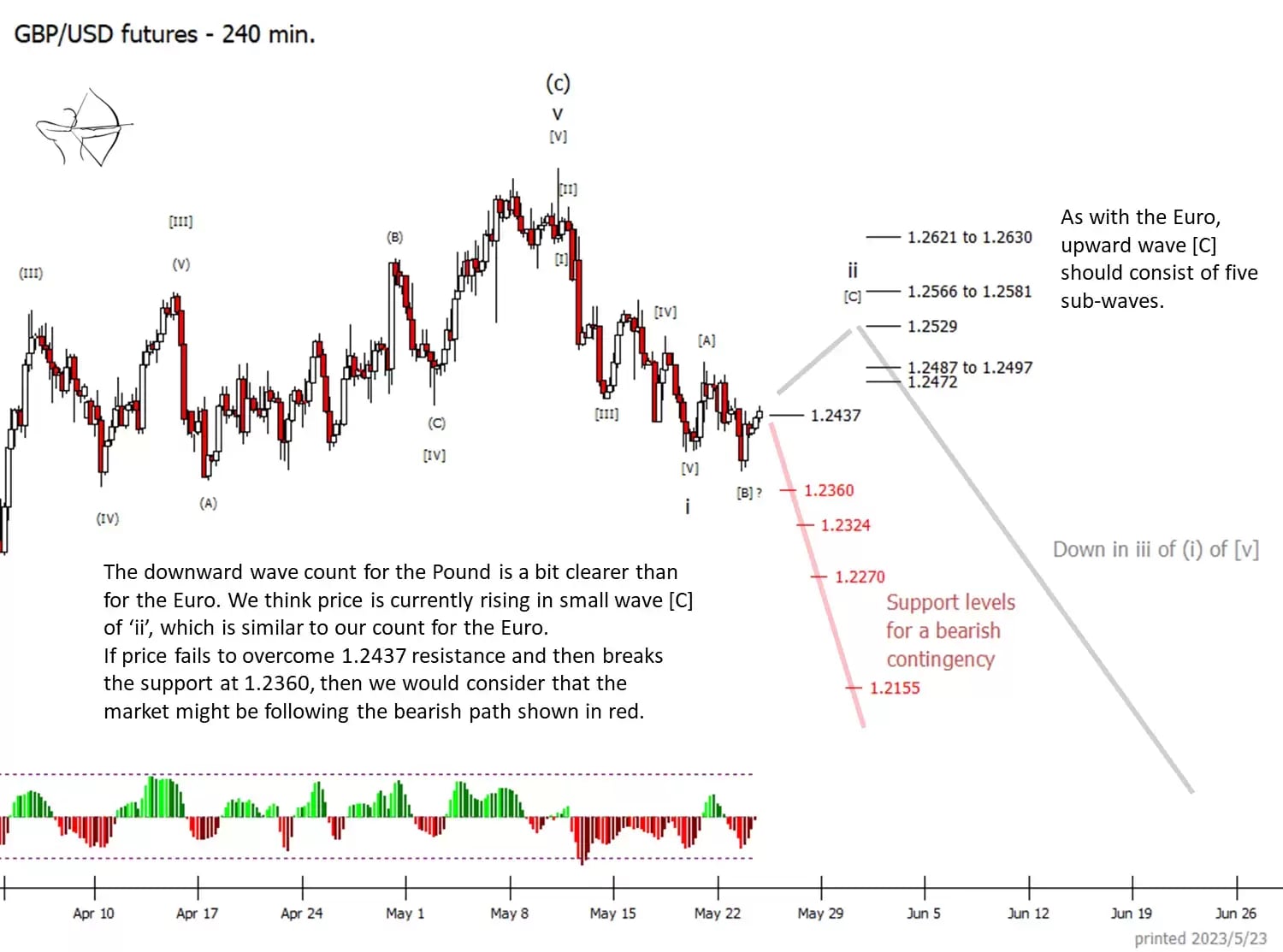

The pound presents scenarios similar to the euro, although the wave count from the early-May high is a little cleaner. If price is currently bouncing in sub-wave [C] of 'ii', then the main areas of resistance to watch should be near $1.2529, $1.2566 and $1.2621.

With the near-term bearish alternative shown in red, a break of $1.2360 could lead to tests of $1.2324 or $1.2270.

For more technical analysis from Trading On The Mark, follow them on . Trading On The Mark's views and findings are their own, and should not be relied upon as the basis of a trading or investment decision. Pricing is indicative. Past performance is not a reliable indicator of future results.

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.