Wall Street finished mixed to start the new month as earnings results continued to rattle the stock markets and bond yields spiked, pressuring risk sentiment. The S&P 500 and Nasdaq ended in the red, while the Dow extended gains, buoyed by Caterpillar’s (NYSE: CAT). The construction equipment manufacturer’s shares jumped 8.8% to an all-time high following the strong earnings report. At the same time, Uber’s shares slid 6% due to a revenue miss, despite the first operating profit, dragging on other ride-hailing companies, such as Lyft. The AI chipmaker, AMD’s shares rose 4% in after-hours trading amid better-than-expected earnings results.

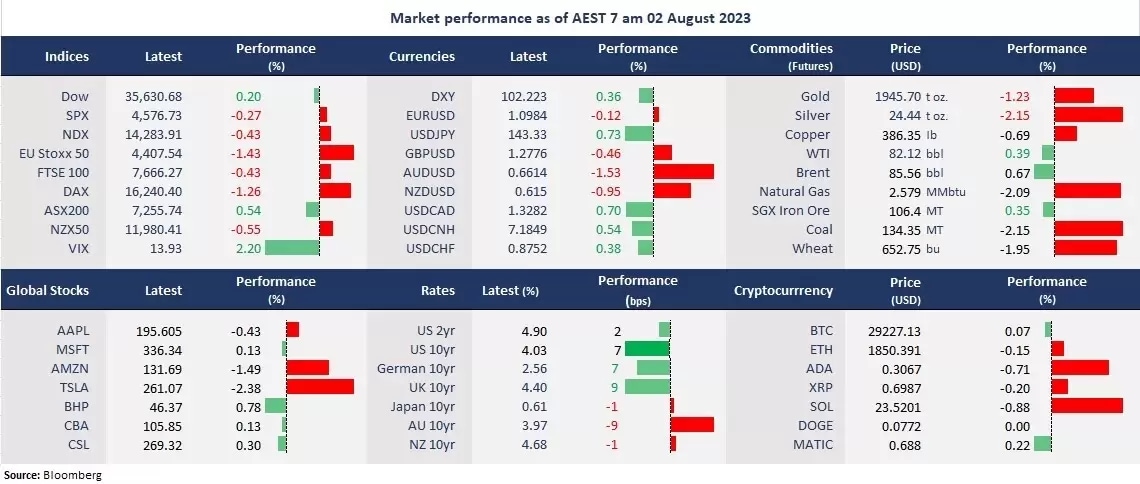

Overall, the broad-based selloff in the S&P 500 and Nasdaq was primarily due to a surge in the US bond yields, suggesting markets priced in higher for longer rates by the Fed. The US 10-year Treasury yield jumped 8 basis points to 4.04% at a one-month high, sending the US dollar to strengthen broadly against the other G-10 currencies, particularly in the Asian peers. The Australian dollar was slashed by the RBA’s dovish rate hike pause, down 1.5% against the king dollar.

On the economic front, the US job openings declined for the third consecutive month to 9.58 million in June. The US ISM manufacturing PMI contracted for the ninth straight month in July. The data suggest that inflation may continue its decline as employment slows down and the factory gate price pressure eases further.

In Asia, the Chinese stock market’s rally took a breather after another contraction month in its manufacturing sector, but ASX was lifted by RBA’s unexpected hiking pause on Tuesday. However, futures are pointing to a lower open across the region. The ASX 200 futures were down 0.55%, Hang Seng Index futures slid 0.68%, and Nikkei 225 futures fell 0.66%.

Price movers:

- 9 out of 11 sectors finished lower in the S&P 500, with Consumer Discretionary and Utilities, leading losses, down 1.15% and 1.26%, respectively. Travel stocks, such as Norwegian Cruise Lines’ shares, slumped 12% due to a miss on earnings expectations. Industrials and Technology were the only two sectors that ended in the green, up 0.32% and 0.09%, respectively.

- AMD’s shares rose 4.5% in after-hours trading amid an earnings beat. The chipmaker reported earnings per share as US$0.58, topping an estimated US$0.57. Its revenue came to US$5.36 billion, beating US$5.32 billion expected but down from US$6.55 billion a year ago. CEO Lisa Su expressed optimism about the company’s AI chip demands.

- Uber’s shares slid 6% following the second-quarter earnings report as the company warned rival, Lyft’s competitive price may lead to price cuts. The ride-hailing company had its first-ever quarterly operating profit, but revenue rose 14% to US$9.23 billion, shy of estimates of US$9.33 billion.

- BP reported a 70% year-on-year drop in profits due to weak oil prices in the second quarter, and its shares were flat following the earnings report. BP’s quarterly revenue came to US$4.96 billion, compared with US$8.5 billion a year ago.

- USD/JPY rose for the third straight trading day to above 143 after the BOJ’s policy tweak last week. Despite signs of monetary policy normalization by the BOJ, the Japanese Yen weakened broadly due to the divergent moves in its government bond yields.

ASX and NZX announcements/news:

- NZME (NZX/ASX: NZM) will release its 2023 half-year results on 25 August.

Today’s agenda:

- New Zealand Employment Change for Q2

- US ADP Non-Farm Employment Change for July

Maximize your potential gains! Take immediate action and seize the investment opportunities that await you. Login to the platform now!

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.