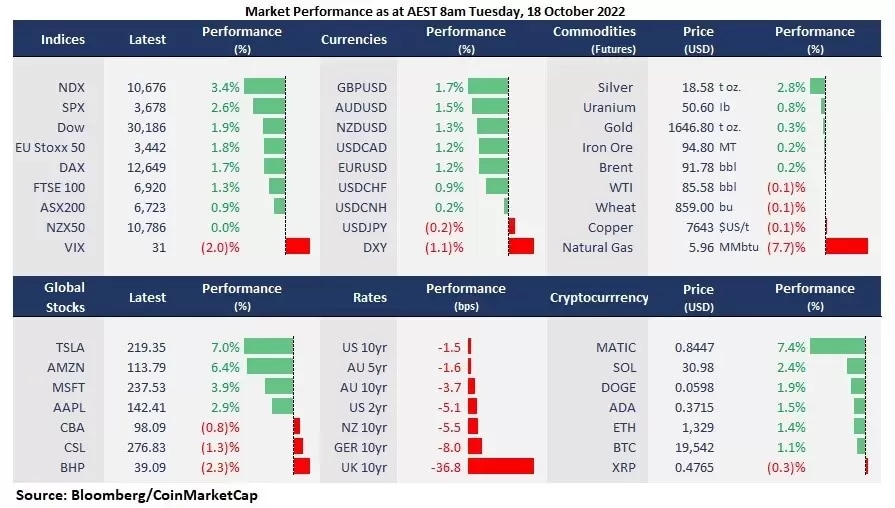

US stocks rebounded strongly amid a tech-fuelled rally after a drop last Friday. There is a combination of reasons why stock markets continued the rebounding momentum since hotter-than-expected US CPI data was released last week. Firstly, rates eased surging after the UK’s new finance minister Jeremy Hunt made a U-turn of the previously proposed tax-cutting plan. The UK 10-year gilt yield fell to 3.96% from 4.32% a day ago, boosting the British Pound to jump 1% against the US dollar. Secondly, a bunch of US big banks’ earnings came in stronger than expected, leading earnings optimism into the second half of October. Netflix and Tesla’s shares jumped 6.6% and 7%, respectively, ahead of their third-quarter earnings reports on Wednesday and Thursday. Third, major US indices are at key technical support levels, algorithmic trading may have caused short covering in positions.

- S&P 200 rebounds at the 200 weekly moving average, with the pivotal support around 3,500. All 11 sectors in the S&P 500 finished higher, with consumer discretionary leading gains, up 4.23%. The other two growth sectors, including technology and communication services, were also up more than 3%. And Real Estate jumped 3.9% amid banks’ earnings optimism.

- Goldman Sachs is reportedly planning to merge trading and investment banking, making its four main divisions into three, one day ahead of the third quarter earnings reports, which is the third reorganization since 2018. The bank will also split the money-losing consumer banking between two new divisions. Apparently, the bank is under pressure due to a downgrade in valuation by analysts.

- Credit Suisse considers selling its US asset management business, CSAM, amid its billions of dollars in losses. The unit may draw interest from private equity firms, while the bank is also in process of selling its securitized products, according to Bloomberg.

- USD/JPY tops 149, the highest since September 1990 after the BOJ confirmed to keep its ultra-loss monetary policy last week, while the US dollar index fell due to a slide in global bond yields, with most major currencies jumping about 1% against the greenback.

- Asian markets are set to open higher following a strong close on Wall Street. ASX futures were up 0.92%. Nikkei 225 futures jumped 1.42% and Hang Seng Index futures rose 1.81%.

- Crude oil was flat on mixed signals that the Chinese Party Congress offered over the weekend. President Xi’s speech shows that the country’s zero Covid policy will remain while continue supporting property and technology with stimulus measures. A softened US dollar also helped ease falls in the prices on Monday.

- Gold futures finished higher after paring early gains. The precious metal may continue to be under pressure of rising rates and a strong dollar, with a key resistance level around the 20-day MA at 1,677.

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.